Payment Processing Ohio Style – Smooth Transactions Ahead!

Why Payment Processing Ohio Matters for Your Business Success

Payment Processing Ohio is the plumbing that moves money from your customer’s pocket to your bank account—whether you’re serving coffee in Columbus or shipping parts from Dayton. The faster and safer that flow runs, the healthier your cash-flow, customer satisfaction, and growth potential.

Quick take-aways for Ohio owners: • Accept every major card with EMV / contactless readers

• Add an online gateway for e-commerce and phone orders

• Keep a mobile reader handy for deliveries and events

• Offer ACH for big tickets or recurring invoices

• Follow Ohio’s 3 % surcharge cap (credit only) + PCI rules

• Typical total cost: 1.5 – 3.5 % per swipe

Studies show 28 % of shoppers bail if checkout drags. One clunky terminal can cost real revenue, especially for Main-Street shops that rely on repeat traffic.

Ohio’s economy is powered by small businesses—from Cleveland retailers to Cincinnati food trucks. Each needs a payment stack that scales with busy seasons, controls fees, and works even when Internet coverage is patchy. Get it right and you boost cash-flow, protect margins, and win loyal customers.

I’m Lydia Valberg, co-owner of Merchant Payment Services. After 35 years helping local firms, I’ve learned the secret isn’t a “one-size” machine. It’s matching hardware, pricing, and support to the way you actually sell—whether that’s a family diner in Fairborn or an HVAC crew across Miamisburg.

Why This Guide Matters

Every painless swipe is invisible success; every slowdown is lost trust. We’ve watched clients lift revenue 15 – 20 % just by tightening their payment flow. This guide shows you how.

What Payment Processing Means for Ohio Businesses

Payment processing turns a customer’s “I’ll take it” into cash in your account. It includes:

• In-person EMV & tap-to-pay

• Online checkouts & mobile wallets

• ACH bank transfers for large or repeat bills

• PCI, EMV and fraud tools that keep data safe

How the Payment Rail Works (30-Second Version)

Authorization – terminal pings the bank (≈2 s).

Batching – you (or your POS) close the day.

Settlement – banks settle up overnight.

Funding – money lands next- or same-day.

Unique Ohio Use-Cases

• Main-Street retailers need stand-alone terminals that survive spotty Wi-Fi.

• College-town food trucks need fast mobile readers for 50-order lunch lines.

• County offices must tie card payments to state fee portals.

• Manufacturers love Level III data to cut B2B rates.

• Lake-Erie seasonal firms need month-to-month, not 3-year leases.

Payment Processing Ohio – Solution Roundup & Feature Checklist

Core features most winners share: • EMV + Contactless (baseline)

• Mobile wallet support

• Virtual terminal for phone sales

• Recurring billing if you invoice

• 24/7 live support (not just chat-bots)

System Best For Key Features Cost Countertop Retail / dining EMV, tap, print $0–299 Mobile reader Field work, events Phone-pair, chip/tap $0–99 Gateway Web stores Plug-ins, API $10–30 /mo Full POS Multi-site Inventory, staff mgmt $50–200 /mo Enterprise High volume Custom, Level III $200 + /mo

Card-Present, Online & Mobile—Quick Hits

Card-present: Chip = liability shift; tap saves seconds in rushes.

Online: Use a gateway that tokenizes data and plugs into Shopify, Woo, etc.

Mobile: Choose all-day battery + offline mode for fairs and service calls.

ACH & Invoicing

ACH costs pennies, perfect for $1k+ tickets or taxes via the Ohio Treasurer’s ACH credit system. Pair it with auto-invoices so you stop chasing checks.

Government / Non-Profit

Municipal “bridge” portals let citizens pay fees by card while the convenience fee covers processing—no hit to budgets.

Ohio Fees, Surcharges & Compliance Demystified

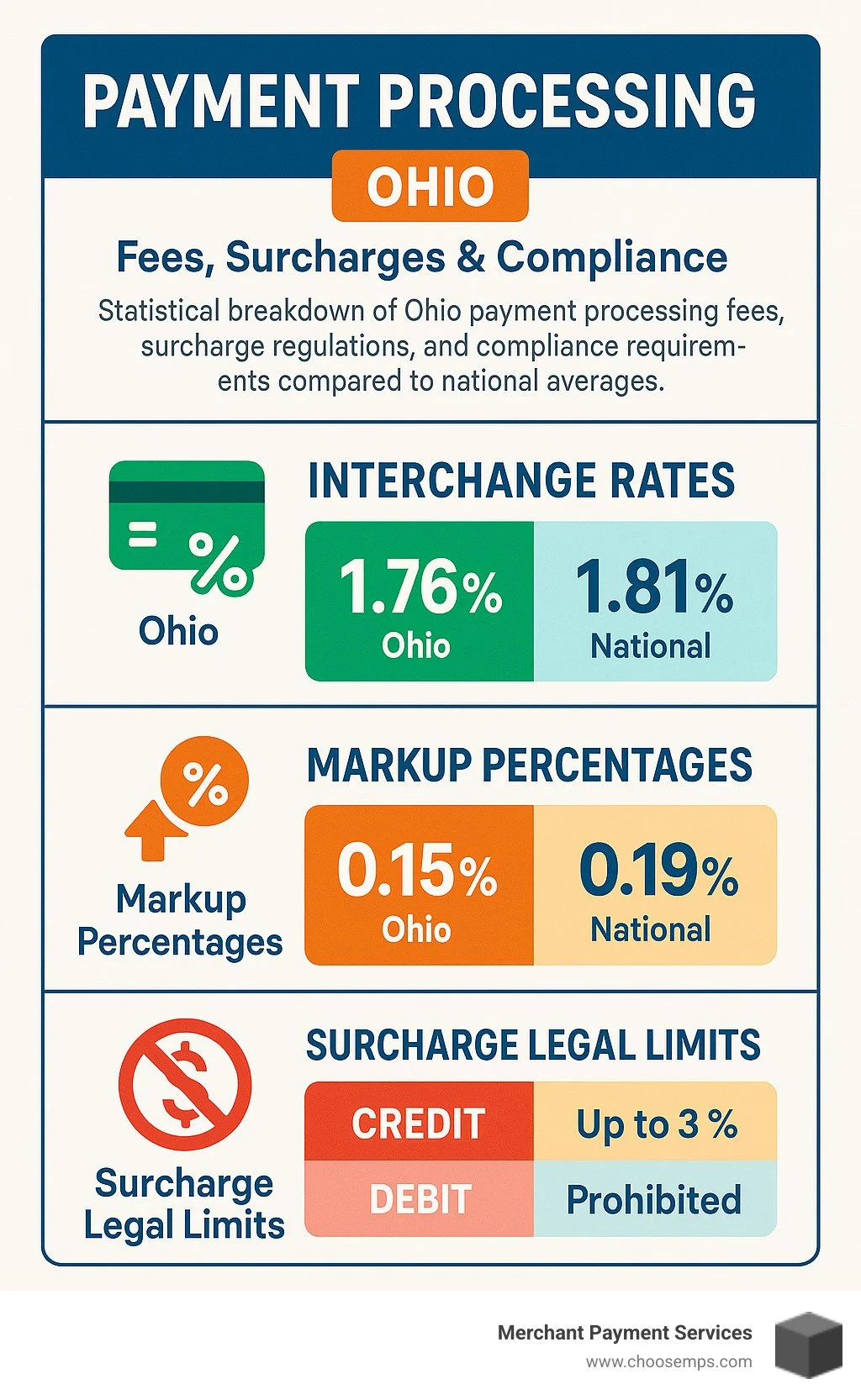

Good news: Ohio keeps rules simple. Key points:

• Credit-card surcharge max = 3 % (Visa/MC rule).

• Debit surcharges are never allowed (federal).

• Cash-discount programs avoid surcharge rules entirely.

Pricing Models in Plain English

Interchange-plus = wholesale + markup (best transparency).

Flat-rate = one % for all cards (good < $3k/mo).

Tiered = simple on paper, pricey in reality.

Subscription = low per-swipe + monthly fee (great high volume).

Cost-Control Tips

• Auto-batch inside 24 h to avoid downgrades.

• Use Level III data for B2B savings.

• Review statements quarterly—rates creep up quietly.

More on consumer rights: https://www.ohioattorneygeneral.gov/Individuals-and-Families/Consumers

Integrations, Security & Cutting Costs

Integrating payments with the software you already use is like hiring an unseen assistant: sales feed QuickBooks, inventory updates automatically, loyalty points post themselves.

Plug-and-Play Accounting Links

QuickBooks or GL exports mean deposits reconcile while you sleep. Miss-matches get flagged instantly.

Inventory & Loyalty

Real-time stock counts + auto re-orders stop overselling. Built-in loyalty ups repeat visits—71 % of shoppers spend more when rewards kick in.

Staying PCI & Data-Safe

Tokenization hides card numbers, end-to-end encryption locks the pipe, and quarterly scans spot weak spots. Many processors bundle breach coverage so one hack doesn’t sink the ship.

Future Trends Shaping Payment Processing Ohio

Contactless is now table-stakes—tap transactions finish in 2–3 s versus 8+ with chip insert. AI quietly filters fraud in the background, approving more good sales and stopping bad ones in milliseconds.

Embedded Finance

Payment tools are melting into the apps you already use: POS systems that handle payroll, booking software that auto-charges when a job closes. Pick providers that play well with others so you’re future-proof.

Frequently Asked Questions about Payment Processing Ohio

What's the average credit-card fee in Ohio?

Payment Processing Ohio fees vary quite a bit depending on your business setup, but most Ohio businesses can expect to pay between 1.5% and 3.5% per transaction, plus monthly fees ranging from $10 to $50. Think of it like this - a $100 sale might cost you anywhere from $1.50 to $3.50 in processing fees.

The exact rate you'll pay depends on several factors that processors evaluate. Your business type matters because a restaurant has different risk factors than a retail store. Average transaction size plays a big role too - businesses with larger transactions often qualify for better rates because the fixed costs get spread across more dollars.

Monthly volume is probably the biggest factor in determining your rates. If you're processing over $5,000 monthly, you'll typically qualify for interchange-plus pricing, which offers the most transparent and often lowest rates. Smaller businesses might find flat-rate pricing more predictable, even if it's not always the cheapest option.

B2B companies often get the best deal because they can take advantage of Level III processing, which provides detailed transaction data that card networks reward with lower interchange rates. Meanwhile, retail businesses can improve their rates by using EMV chip readers and maintaining good fraud prevention practices.

Industry risk factors also influence pricing. High-risk industries like adult entertainment, debt collection, or travel services typically pay higher rates due to increased chargeback risk. Conversely, low-risk businesses like grocery stores or gas stations often qualify for preferential pricing.

Processing history matters too. New businesses without established processing history may start with higher rates that decrease as they prove their reliability. Businesses with high chargeback rates or frequent disputes will face higher pricing regardless of their volume.

Equipment costs vary widely. Some processors offer free terminals in exchange for higher processing rates, while others charge upfront for equipment but offer lower ongoing fees. The best choice depends on your transaction volume and how long you plan to use the equipment.

Can I legally add a surcharge on debit cards?

Here's where things get a bit tricky - debit card surcharges are federally prohibited under the Durbin Amendment, no matter what Ohio state law says. This applies to both PIN debit transactions (where customers enter their PIN) and signature debit transactions (where they sign instead).

The federal law trumps state regulations on this one, so even though Ohio is generally merchant-friendly when it comes to surcharging, you simply cannot add fees to debit card transactions. Violating this rule can result in significant penalties from card networks and federal regulators.

But there's a workaround that many Ohio businesses use successfully - cash discount programs. Instead of adding a fee for card payments, you offer a discount for cash payments. It achieves a similar financial result but stays within legal boundaries. The key difference is how you present it to customers and structure your pricing.

Convenience fees are allowed for debit cards, but only in specific situations. You can charge these when offering an alternative payment channel - like accepting phone payments for a service that's normally paid in person. These must be structured as flat fees rather than percentages and need to comply with card network rules.

Implementation requirements for surcharging include proper disclosure at the point of sale, separate line items on receipts, and registration with card networks at least 30 days before implementation. Many businesses find the administrative requirements more complex than the potential savings justify.

Customer perception is another important consideration. While surcharging is legal for credit cards, it can negatively impact customer satisfaction and loyalty. Many successful businesses prefer to build processing costs into their base pricing rather than adding visible fees.

How long does it take to switch processors?

Most Ohio businesses can complete a processor switch in 7 to 14 business days, though the exact timeline depends on your specific situation. We've helped hundreds of businesses through this process, and while it might seem daunting, it's usually much smoother than people expect.

The process starts with your application and underwriting review, which typically takes 2-3 business days for straightforward businesses. Equipment delivery and setup usually happens within a week, and then you'll need a day or two for testing to make sure everything works properly with your existing systems.

More complex businesses might need additional time. If you have multiple locations, specialized equipment needs, or custom integrations with your existing software, plan for 2-3 weeks instead. The extra time is worth it to ensure everything works perfectly from day one.

Here's an important tip from our experience - start the switch process before your current contract expires. Most processors require 30 to 60 days notice for contract cancellation, and you definitely don't want to get stuck with automatic renewal terms while you're trying to switch.

During the transition, you can often run both systems in parallel for a few days. This ensures zero disruption to your business operations while you verify that the new system handles all your transaction types correctly. It's like having a safety net while you make the change.

Documentation requirements can slow down the process if you're not prepared. Have your business license, bank statements, processing statements, and tax returns ready before starting the application. Missing documents are the most common cause of delays.

Training requirements should be factored into your timeline. Even if the new system is similar to your old one, staff need time to learn new procedures and become comfortable with different interfaces. Plan for at least a few days of reduced efficiency as everyone adapts.

Integration testing is crucial for businesses using connected systems. Your payment processor needs to communicate properly with your POS system, accounting software, and any other integrated applications. Thorough testing prevents problems that could disrupt operations after go-live.

What happens if my payment processor goes out of business?

While processor failures are rare, they do happen, and Ohio businesses should understand their protections. Funds in transit are typically protected through reserve accounts and bonding requirements, but the recovery process can take weeks or months.

Merchant accounts are usually transferable to new processors, though you may need to go through underwriting again. Having backup documentation and maintaining good processing history makes transitions smoother.

Equipment ownership matters during processor changes. Leased equipment may need to be returned, while purchased equipment can often be reprogrammed for new processors. Understanding your equipment agreements prevents surprises during transitions.

How do I know if I'm getting a good deal on processing?

The best way to evaluate processing costs is through effective rate analysis - dividing your total monthly fees by your total monthly volume. This gives you a single percentage that accounts for all costs, making it easy to compare different processors.

Statement analysis should include interchange costs, processor markup, monthly fees, and any additional charges. Many businesses focus only on quoted rates while ignoring fees that can significantly impact total costs.

Benchmark comparisons help identify whether your rates are competitive for your industry and transaction profile. Processing costs vary significantly between business types, so comparing your restaurant to a retail store isn't meaningful.

What security measures should I expect from my processor?

Modern processors should provide end-to-end encryption, tokenization, fraud monitoring, and PCI compliance support. These aren't optional extras - they're essential security features that protect both your business and your customers.

Breach response procedures should be clearly documented, including notification requirements, investigation processes, and remediation steps. Understanding these procedures before you need them reduces stress and ensures proper response.

Regular security updates keep your systems protected against new threats. Processors should handle most updates automatically, but businesses need to maintain current software versions and follow security best practices.

Conclusion

Payment Processing Ohio success comes down to choosing solutions that match your business needs, comply with state and federal regulations, and provide room for growth. Whether you're running a family restaurant in Trotwood, an online business in Riverside, or a service company in Vandalia, the right payment processing setup protects your revenue while enhancing customer experience.

Think of payment processing as the invisible foundation that supports everything else your business does. When it works smoothly, customers barely notice it - and that's exactly what you want. When it doesn't work well, it becomes the frustrating bottleneck that drives customers away and keeps you up at night worrying about lost sales.

The landscape continues evolving with contactless payments, AI-powered fraud detection, and embedded finance solutions, but the fundamentals remain the same: reliable processing, transparent pricing, and excellent support. Ohio businesses that prioritize these elements while staying current with technological advances position themselves for long-term success.

What we've learned from working with hundreds of Ohio businesses is that one size definitely doesn't fit all. The payment solution that works perfectly for a busy Columbus coffee shop might be completely wrong for a Dayton manufacturing company or a Cincinnati e-commerce startup. That's why understanding your options - from basic card readers to sophisticated integrated systems - matters so much.

At Merchant Payment Services, we've built our reputation on providing Ohio businesses with honest advice, competitive pricing, and the kind of personal service that comes from being part of the community we serve. Our month-to-month agreements mean you're never locked into a solution that doesn't work for your business, and our local presence across Dayton, Cincinnati, Columbus, and surrounding areas ensures you always have support when you need it.

The beauty of Ohio's business-friendly payment regulations is that you have real choices. You can implement surcharging programs to offset processing costs, offer cash discounts to reduce fees, or find the pricing model that makes the most sense for your specific situation. You're not stuck with whatever your processor decides to charge you.

Ready to optimize your payment processing? The right solution is waiting, and with Ohio's growing economy and supportive business environment, there's never been a better time to ensure your payment systems are working as hard as you are. Every smooth transaction is a small victory that builds customer trust and keeps your business moving forward.