Swipe Right on Merchant Accounts for Small Businesses

Why Small Businesses Can't Afford to Skip Merchant Accounts

Merchant accounts for small businesses are the backbone of modern payment processing, enabling you to accept credit cards, debit cards, and digital wallet payments from customers. Without one, you're essentially turning away the 80% of customers who prefer cashless transactions.

Here's what you need to know:

• What it is: A special bank account that holds funds from card transactions before transferring them to your business account

• Why you need it: Accepting cards can increase sales by up to 40% compared to cash-only businesses

• How it works: Customers swipe/tap → funds authorize → money reaches your account in 1-3 days

• What it costs: Typically 1.5-3.5% per transaction plus small fixed fees

• Setup time: Can be approved within hours to a few days for most businesses

The payment landscape has shifted dramatically. Cash transactions continue declining while card and digital payments dominate. Small businesses that don't accept cards risk losing customers to competitors who offer convenient payment options.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've helped thousands of small businesses steer merchant accounts for small businesses over the past decade. My experience has shown me that the right payment setup can transform a business's cash flow and customer satisfaction.

What You'll Learn

In this comprehensive guide, we'll walk you through everything you need to know about merchant accounts. You'll find the step-by-step setup process, understand the complete fee breakdown, and learn how to choose the right provider for your business needs. By the end, you'll have the knowledge to make an informed decision that could significantly impact your revenue and customer satisfaction.

Merchant Accounts for Small Businesses: The Essentials

Think of a merchant account for small businesses as your payment processing headquarters. It's a specialized bank account that temporarily holds money from credit and debit card sales before transferring those funds to your regular business bank account.

Here's what makes it different from your everyday business checking account: When customers swipe their cards, the money doesn't zip straight to your bank account. Instead, it takes a quick pit stop in your merchant account, where it gets processed and verified before landing in your business account within 1-3 business days.

You'll encounter two main flavors of merchant accounts. Dedicated merchant accounts are custom-built for your specific business. You'll go through a thorough application process, but you get an account custom to your business model and risk profile. This gives you more control and typically better rates if you process higher volumes.

Aggregated accounts work differently—multiple businesses share one master merchant account. While setup happens faster, you sacrifice some control and might face unexpected account holds or limitations.

The numbers tell an impressive story. Businesses that accept cards see sales increases of up to 40% compared to cash-only operations. With over 80% of consumers preferring card or digital wallet payments, having a merchant account isn't just convenient—it's essential for capturing sales.

To qualify, you'll need to operate as a legal business entity with an Employer Identification Number (EIN). This requirement protects everyone involved and ensures compliance with banking regulations.

More info about Payment Systems

Why Small Businesses Need Merchant Accounts

Beyond the obvious revenue boost, merchant accounts solve several business challenges you might not have considered.

Trust building happens automatically when customers see you accept cards. Cash-only businesses can seem outdated or even suspicious. Card acceptance signals legitimacy and professionalism.

Impulse purchases become your friend when customers aren't limited by the cash in their wallets. They're more likely to add that extra item or upgrade their purchase when payment feels effortless. This psychological factor can significantly bump up your average sale amount.

Omnichannel capabilities meet modern customer expectations. Whether someone shops in your store, browses your website, or calls to place an order, they want consistent payment options. Merchant accounts make this seamless experience possible across all channels.

Future-proofing keeps you ready for whatever payment innovation comes next. From contactless taps to digital wallets to technologies we haven't imagined yet, having a merchant account foundation lets you adapt quickly.

Types of Merchant Services Available

Modern merchant services have evolved far beyond basic card swiping into a complete payment ecosystem.

In-person POS systems range from simple card readers to sophisticated terminals that manage inventory, track detailed sales analytics, and sync with your accounting software. These systems turn every transaction into valuable business data.

E-commerce gateways handle the complex world of online payments, managing everything from fraud detection to international currency conversion. They work behind the scenes to make online checkout smooth and secure for your customers.

Mobile readers perfect the art of payment flexibility. Whether you're running a food truck, selling at farmers markets, or providing home services, these compact devices transform your smartphone into a full payment terminal.

ACH processing opens the door to bank-to-bank transfers, which can slash transaction costs by up to 80% compared to credit card networks. This makes ACH ideal for recurring payments, larger transactions, or customers who prefer direct bank transfers.

How Merchant Accounts Work: From Swipe to Settlement

When your customer taps their card and sees that satisfying "approved" message, there's actually a sophisticated dance happening behind the scenes. Understanding this process helps you make smarter decisions about providers and gives you confidence in how merchant accounts for small businesses actually function.

The journey starts with authorization. The moment your customer's card touches the reader, their payment information zooms through secure networks to their bank. The bank quickly checks whether they have enough money or available credit, then sends back either a thumbs up or thumbs down. This entire conversation happens in just a few seconds.

But approval is just the beginning. Throughout the day, your payment terminal collects all these approved transactions like a digital piggy bank. At the end of your business day—usually around 8 PM—everything gets bundled together in what's called clearing or "batching." Think of it as your daily deposit slip heading to the bank.

The final step is settlement, where the real money movement happens. The card networks facilitate transferring funds from your customers' banks to your merchant account. You'll typically see this money hit your business bank account within 1-3 business days—though some processors now offer faster funding options.

Throughout this entire process, multiple layers of security work overtime to protect everyone involved. Tokenization replaces your customer's actual card number with a unique code that's useless to hackers. Meanwhile, end-to-end encryption wraps all the data in an unbreakable digital envelope during transmission.

There's one part of this process that every business owner should understand: the chargeback cycle. Sometimes customers dispute charges—maybe they don't recognize the transaction or they're unhappy with their purchase. When this happens, the funds get temporarily pulled from your account while everyone investigates. It's like putting money in escrow until the dispute gets resolved. This is why excellent customer service and clear return policies aren't just nice to have—they're essential for protecting your cash flow.

The good news? Modern payment processing has become incredibly reliable. Scientific research on EMV security shows that chip card technology has dramatically reduced fraud rates, making the entire system safer for both you and your customers.

Payment Security & Fraud Prevention

Security might sound like technical mumbo-jumbo, but it's actually your business's best friend. When payments are secure, you sleep better at night knowing you're protected from fraud, data breaches, and the headaches that come with both.

PCI DSS compliance forms the foundation of payment security. These standards aren't just bureaucratic red tape—they're your shield against liability if something goes wrong. The beauty of modern payment systems is that much of this compliance happens automatically when you use certified equipment and processors.

Point-to-point encryption works like a secure tunnel for your customer's card data. From the moment they insert their chip or tap their card, the information gets scrambled into an unreadable code that stays protected until it reaches the secure processing center. Even if someone somehow intercepted the data, they'd just see digital gibberish.

Token vaults are particularly clever. Instead of storing actual card numbers, the system creates unique tokens for each customer. This means you can offer convenient features like saved payment methods for repeat customers without the security risks of storing sensitive data.

Address Verification Service adds another layer of protection by checking whether the billing address your customer provides matches what their bank has on file. It's like having a digital bouncer checking IDs at the door.

The EMV liability shift changed the game significantly. If you're still using old swipe-only terminals and a fraudulent chip card transaction happens, you could end up holding the bag financially. Upgrading to chip-capable equipment isn't just about staying current—it's about protecting your bottom line.

Accessing Your Funds Quickly

Cash flow keeps your business breathing, so knowing exactly when your money arrives matters. Most processors work on a batch cutoff system—typically around 8 PM local time. Process a transaction at 9 PM? It goes into tomorrow's batch instead of today's.

Same-day funding has become increasingly popular, especially for businesses that need quick access to their money. While this service usually comes with a small additional fee, it can be a lifesaver when you need to restock inventory or cover unexpected expenses.

Some processors now offer weekend deposits, breaking away from the old "business days only" model. This means your Saturday sales could be in your account by Sunday, instead of waiting until Tuesday.

Reserve accounts are something newer businesses often encounter. Think of them as a security deposit—the processor holds back a small percentage of your sales to cover potential chargebacks or refunds. It's not permanent money loss, just a temporary safety net that typically decreases as you build a positive processing history.

The key is finding a processor who understands that small businesses need predictable, fast access to their funds. After all, the whole point of accepting cards is to improve your cash flow, not complicate it.

Cost & Fee Breakdown: Avoiding Hidden Surprises

Let's be honest—payment processing fees can feel like alphabet soup at first glance. But understanding these costs is absolutely essential for protecting your bottom line and making smart decisions about merchant accounts for small businesses.

The good news? Once you know what to look for, the fee structure becomes much clearer. Think of it like learning to read a restaurant menu in a foreign language—confusing at first, but once you know the key terms, you can order exactly what you want.

Interchange fees are the foundation of all payment processing costs. These are set by the card networks like Visa and Mastercard and paid directly to the banks that issue customer cards. You'll typically see these range from 1.4% to 2.6% plus a small fixed fee per transaction. Here's the key point: these fees are completely non-negotiable, no matter which processor you choose.

Assessment fees are another network-set cost, usually around 0.13% to 0.15% of each transaction. Think of these as the "membership dues" that fund the card network operations that make electronic payments possible.

Processor markup is where things get interesting—and where you actually have some control. This is how your payment processor makes money, and it can range from 0.1% to 1.5% depending on your transaction volume and the pricing model you choose. This is the area where shopping around and negotiating really pays off.

Beyond the percentage-based fees, you'll encounter several fixed monthly costs. Statement fees typically run $5-$25 per month for account maintenance. PCI compliance fees usually add another $5-$15 monthly, though some processors roll this into their base pricing to keep things simple.

When disputes happen, chargeback fees typically cost $15-$25 per incident, regardless of whether you win or lose the dispute. Some processors also impose monthly minimums—like a $25 floor—regardless of your actual transaction volume.

Calculating True Effective Rate

Here's where many business owners get tripped up: focusing only on the advertised rate instead of calculating their true effective rate. To find your real cost, divide your total monthly fees by your total processing volume. This simple calculation gives you an apples-to-apples comparison between different processors.

Interchange-plus pricing offers the most transparency because you can see exactly what goes to the card networks versus what your processor charges. While flat-rate pricing might seem simpler, interchange-plus typically becomes more cost-effective as your business grows and processes more transactions.

Volume discounts are one of the best-kept secrets in payment processing. As your monthly volume increases, many processors will reduce their markup, leading to substantial savings. This is especially true with interchange-plus pricing models, where the processor markup becomes a smaller percentage as you grow.

Red Flags to Watch For

After helping thousands of businesses with their payment processing, I've seen every trick in the book. Here are the warning signs that should make you think twice about a processor.

Long-term contracts are often a sign that a processor knows they're not offering competitive value. At Merchant Payment Services, we believe in earning your business every month through great service, not trapping you with multi-year commitments. If a processor is confident in their service, they shouldn't need to lock you in.

Tiered pricing sounds simple but often costs more than advertised. This model sorts transactions into "qualified," "mid-qualified," and "non-qualified" categories with different rates for each. The problem? Many transactions end up in higher-cost tiers, and the rules for qualification can be confusing and constantly changing.

Cancellation penalties can cost hundreds of dollars and create a huge barrier to switching if you're unhappy with service. Look for processors offering month-to-month agreements that let you leave if expectations aren't met.

Surcharging rules are incredibly complex, and not all processors handle them correctly. If you're considering passing processing costs to customers, make sure your processor truly understands the intricate federal and state regulations governing this practice.

The bottom line? Transparent pricing and month-to-month terms are signs of a processor that's confident in their value proposition. Hidden fees and long contracts are often signs to look elsewhere.

More info about Low Cost Processing

Setting Up & Scaling Your Merchant Account

Getting your merchant accounts for small businesses up and running doesn't have to be a headache. The whole process has gotten much smoother over the years, but a little preparation goes a long way toward quick approval and better terms.

Think of your application packet as your business's first impression. You'll want to gather recent bank statements that show healthy cash flow, create a realistic sales forecast showing your expected monthly volume, and collect any compliance documentation specific to your industry. The more accurate and complete your information is upfront, the faster you'll get through underwriting.

The underwriting process itself usually takes anywhere from a few hours to three business days. It really depends on your business type and how the processor views your risk profile. Some industries face longer review periods, but most standard retail and service businesses move through quickly.

Here's something that might surprise you: hardware deployment can often happen at the same time as your approval process. At Merchant Payment Services, we frequently ship terminals before final approval to get you up and running as quickly as possible.

Software integrations deserve serious consideration from day one. Whether you're connecting to your existing POS system, e-commerce platform, or accounting software, make sure your processor offers solid integration options. This isn't just about convenience—it's about creating seamless operations that save you time and reduce errors.

Don't forget to think about growth milestones right from the start. As your business scales, you might need features like multiple location support, advanced reporting, or enterprise-level capabilities. It's much easier to plan for growth than to scramble to upgrade later.

Step-by-Step Guide to Open Merchant Accounts for Small Businesses

Let's walk through the actual process of getting your merchant account set up. Each step builds on the previous one, so don't skip ahead.

Register your business as a legal entity in your state first. This foundational step is required for everything that comes next, from business banking to merchant services. Without proper registration, you'll hit roadblocks immediately.

Obtain your EIN (Employer Identification Number) from the IRS next. This number is essential for both business bank accounts and merchant accounts. The good news is you can get this online quickly and for free directly from the IRS.

Open a business bank account before applying for merchant services. You'll need a separate business account for merchant deposits, and this separation is crucial for clean accounting and tax purposes. Most processors require this to be established first.

Choose your provider carefully by researching processors based on your specific needs, expected volume, and industry requirements. Don't get tunnel vision on rates alone—consider support quality, technology offerings, and contract terms. A slightly higher rate with excellent support often pays for itself.

Submit your application with complete and accurate information. Incomplete applications are the biggest cause of delays, so double-check everything before hitting submit. If you're unsure about any part, call and ask rather than guessing.

Connect your hardware once you're approved. Set up your payment terminals, test all systems thoroughly, and train your staff on the new processes. Don't rush this step—proper setup prevents problems later.

Process your first test transaction to make sure everything works correctly before going live with customers. Run a small transaction, verify it processes correctly, and confirm the funds flow to your account as expected.

Hardware & Software Options

Today's payment technology offers incredible flexibility that can transform how you run your business beyond just accepting payments.

Smart POS systems integrate payment processing with inventory management, employee scheduling, customer relationship management, and detailed analytics. These systems can give you insights into your business that you never had before, like which products sell best at what times or which employees are your top performers.

Mobile readers are perfect when you need payment flexibility. Whether you're a contractor visiting job sites, a food truck operator, or a retailer participating in weekend markets, mobile readers ensure you never have to turn away a sale because you can only take cash.

Virtual terminals open up phone and mail order possibilities for your business. This capability is essential if you take orders remotely or need to process payments when customers aren't physically present. Many businesses find this expands their market significantly.

API gateways provide the technical foundation for custom e-commerce solutions. If you're working with developers to create a unique online experience, APIs allow them to build seamless checkout processes custom specifically to your business needs.

Recurring billing tools can be game-changers for businesses with subscription services, membership dues, or regular charges. Automating these payments improves cash flow and dramatically reduces administrative work.

Inventory management integration helps track stock levels, automate reordering, and provide insights into your best-selling products. When your payment system talks to your inventory system, you get a much clearer picture of your business performance.

More info about Business Payment Solutions

eCommerce & Omnichannel Integration

Modern customers expect seamless experiences whether they're shopping in your store, on your website, or calling you directly. Your merchant account should support this expectation across all channels.

Shopping cart plugins integrate with popular e-commerce platforms, providing secure checkout experiences that match your brand. The best integrations feel natural to customers and don't create jarring transitions during checkout.

Hosted checkout pages offer PCI-compliant payment processing that reduces your compliance burden while maintaining high security standards. This means you get enterprise-level security without the enterprise-level complexity.

Tokenized vaults securely store customer payment information for future purchases, enabling one-click checkouts and smooth subscription billing. Customers love the convenience, and you'll see higher conversion rates on repeat purchases.

Same-Day ACH processing has revolutionized bank transfers by providing much faster funding. This is particularly valuable for larger transactions where the lower fees of ACH processing can save significant money.

Curbside and QR payment solutions became essential during the pandemic and have remained popular for their convenience and contactless nature. Many customers now expect these options, especially in restaurants and retail environments.

Common Pitfalls & Best Practices

Let's be honest—even the smartest business owners can stumble when setting up their first merchant account. I've seen it countless times, and the good news is that most mistakes are easily avoidable once you know what to watch for.

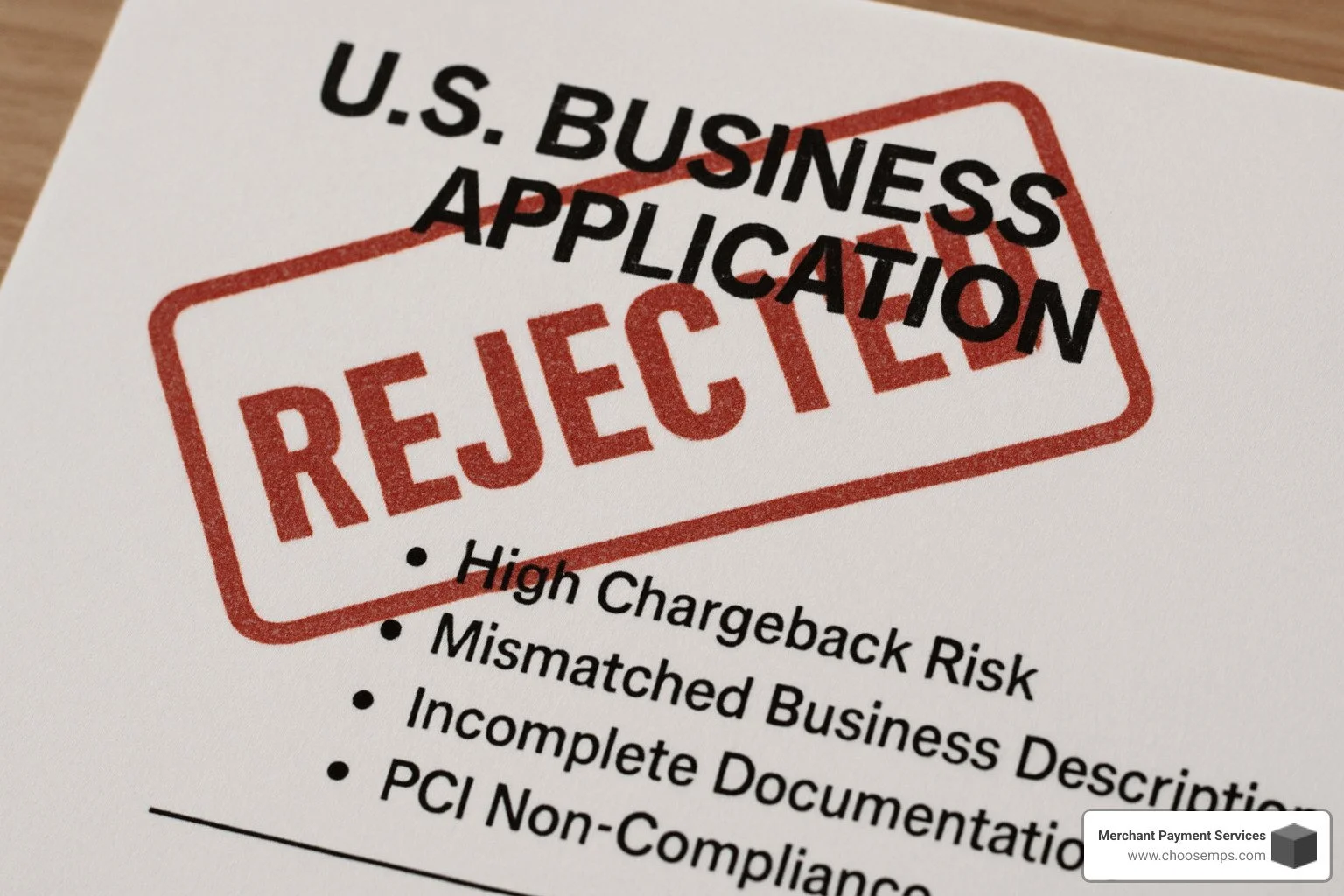

Application mistakes top the list of common problems. The biggest culprit? Getting your processing volume projections wrong. If you tell us you'll process $5,000 monthly but suddenly you're doing $25,000, that's going to trigger a review. Your account isn't in trouble, but we need to make sure everything's legitimate and potentially adjust your pricing tier.

On the flip side, wildly overestimating your volume can backfire too. If you project $50,000 monthly to get better rates but only process $2,000, you won't qualify for those volume discounts anyway.

Another sneaky issue is mismatched business descriptions. Your application says "restaurant" but your transactions look like online software sales. This inconsistency raises red flags during underwriting, even if there's a perfectly innocent explanation.

PCI compliance neglect causes serious headaches down the road. Many business owners think their processor handles all the security stuff, but you have ongoing responsibilities too. Skipping your annual PCI questionnaire or ignoring security updates can result in monthly fines that really add up.

Chargeback management requires more attention than most business owners realize. When customers dispute charges, it's not just about the transaction amount—you'll also pay chargeback fees. High chargeback rates can land you in expensive monitoring programs or even lead to account closure.

The best defense? Crystal-clear return policies, responsive customer service, and detailed transaction records. When a customer calls with a problem, resolving it quickly often prevents a chargeback entirely.

Funding holds catch many new merchants off guard. Your processor might temporarily hold funds if transaction patterns suddenly change, chargebacks spike, or something looks unusual. Understanding these triggers helps you avoid surprises and plan your cash flow accordingly.

Scaling Without Headaches — Merchant Accounts for Small Businesses

Growth is exciting, but it can create unexpected payment processing challenges if you're not prepared. The merchant accounts for small businesses that work perfectly at startup might need adjustments as you scale.

Upgrade tiers should be part of your growth conversation from day one. Most processors offer better rates and features as your volume increases. At Merchant Payment Services, we regularly review accounts to ensure you're getting the best pricing for your current volume—no need to ask.

Multi-MID strategies become valuable when your business gets more complex. If you're running both a retail store and an online shop, or if you have multiple locations, separate Merchant Identification Numbers can provide cleaner reporting and better risk management.

Analytics dashboards transform from "nice to have" to "absolutely essential" as your transaction volume grows. Advanced reporting helps you spot trends, identify your most profitable products, and make smarter business decisions based on real payment data.

Here's something many business owners don't consider: your processor choice at $3,000 monthly volume might not be ideal at $30,000 monthly. Look for a payment partner who can grow with you rather than forcing you to switch providers every time you hit a new milestone.

The beauty of month-to-month agreements is that you're never stuck with a provider who can't meet your evolving needs. As your business grows and changes, your payment processing should adapt seamlessly alongside it.

Frequently Asked Questions about Merchant Accounts

What payment types can I accept?

The beauty of modern merchant accounts for small businesses is their flexibility. Gone are the days when you could only accept cash or checks—today's payment landscape offers incredible variety.

Credit and debit cards form the foundation of most payment systems. You'll be able to accept all major networks: Visa, Mastercard, American Express, and Find. Each has slightly different interchange rates, but the differences are usually minimal for most small businesses.

Digital wallets have exploded in popularity, especially since the pandemic accelerated contactless payments. Apple Pay, Google Pay, and Samsung Pay use the same secure technology as chip cards but offer even faster checkout experiences. Many customers now prefer tapping their phone over inserting a card.

ACH payments deserve special attention because they can save you significant money. Bank-to-bank transfers typically cost 80% less than credit card transactions, making them perfect for larger purchases or recurring payments like monthly subscriptions. The trade-off is that ACH payments take a few days to clear, unlike the instant authorization of card payments.

Gift card programs round out your payment options while building customer loyalty. Both physical and digital gift cards encourage repeat business and often lead to customers spending more than the card's value.

The key is working with a processor that supports all these payment types without forcing you to use multiple systems. At Merchant Payment Services, we ensure you can accept whatever payment method your customers prefer.

How long does approval take?

Here's the honest truth about approval times: it depends on how prepared you are and what type of business you're running.

For most straightforward businesses—think retail stores, restaurants, or professional services—approval can happen within hours. I've seen applications approved in under an hour when everything is properly documented and the business model is clear.

Standard approval times typically range from a few hours to three business days. Several factors influence this timeline:

Your business type matters significantly. A neighborhood coffee shop will likely approve faster than an online supplement company. It's not about discrimination—it's about risk assessment based on industry chargeback rates and fraud patterns.

Documentation completeness is crucial. Having your business registration, EIN, bank statements, and processing estimates ready speeds everything up. Incomplete applications are the biggest cause of delays.

Both personal and business credit history are reviewed during underwriting. Don't worry if your credit isn't perfect—processors understand that small business owners sometimes have complex financial situations. However, better credit typically means faster approval.

New businesses might face slightly longer review periods since there's no processing history to evaluate. Established businesses with existing merchant accounts elsewhere often approve more quickly.

The good news? Most delays are communication-related, not actual rejections. Stay responsive to any underwriter questions, and you'll be processing payments before you know it.

What should I look for in a provider?

Choosing a merchant account provider is like choosing a business partner—you want someone reliable, transparent, and genuinely invested in your success.

Transparent pricing should be your first priority. If a provider can't clearly explain their fees in plain English, that's a red flag. At Merchant Payment Services, we believe you should understand exactly what you're paying for. Interchange-plus pricing typically offers the most transparency because you can see the actual card network costs versus the processor's markup.

U.S.-based customer support becomes critical when something goes wrong. Payment issues don't wait for business hours, and you need real people who understand your business, not offshore call centers reading from scripts. When a terminal stops working during your lunch rush, you want immediate help from someone who knows how to solve the problem.

Month-to-month agreements demonstrate a provider's confidence in their service. If a processor insists on long-term contracts, ask yourself why they need to lock you in. Quality service should earn your business every month, not contractual obligations. We've built our entire business model around this principle.

Security and compliance support protects both you and your customers. Your provider should offer robust fraud prevention tools, help with PCI compliance, and use the latest security technologies like tokenization and end-to-end encryption. These aren't optional features—they're essential for protecting your business.

Integration capabilities ensure your payment system works seamlessly with your existing business tools. Whether you're using QuickBooks for accounting, a specific POS system, or an e-commerce platform, your processor should make integration simple, not complicated.

Scalability matters even if you're just starting out. Your payment needs will evolve as your business grows, and switching processors later is a hassle you want to avoid. Look for providers who can offer better pricing and advanced features as your volume increases.

The right provider feels like a true business partner, not just a vendor. They should understand your industry, respond quickly to questions, and proactively help you optimize your payment processing as your business evolves.

Conclusion & Next Steps

Setting up merchant accounts for small businesses isn't just about keeping up with technology—it's about open uping your business's full potential. When you can accept the payment methods your customers prefer, you're not just making their lives easier; you're positioning yourself for serious growth.

The numbers speak for themselves: businesses that accept cards see sales increases of up to 40% compared to cash-only operations. But beyond the revenue boost, you're building trust, enabling impulse purchases, and future-proofing your business for whatever payment innovations come next.

The path forward is clearer than you might think. Focus on transparent pricing where you can see exactly what you're paying for. Choose month-to-month agreements that give you the freedom to make changes as your business evolves. Prioritize excellent support because when payment issues arise, you need real people who understand your business, not endless phone trees.

At Merchant Payment Services, we've seen thousands of small businesses transform their operations with the right payment setup. Our risk-free, month-to-month agreements mean you're never locked into something that doesn't work for you. No startup fees, no hidden charges, no surprises—just straightforward payment processing that grows with your business.

We're proud to serve businesses throughout Ohio, from busy Cincinnati to growing Columbus, and everywhere in between. When you work with us, you're not just getting a payment processor—you're gaining a local partner who understands the unique challenges facing Ohio businesses.

Your next step is simple: gather your business documents, think about your monthly sales volume, and reach out to a provider who shares your values. The right merchant account for small businesses should feel like a natural extension of your operations, not a complicated burden.

Your customers are already reaching for their cards and phones to pay. The question isn't whether you need to accept these payments—it's how quickly you can get set up to capture every sale.

More info about Online Processing

Ready to see how the right payment processing can accelerate your growth? Contact us today and let's build a solution that works as hard as you do.