Payment Gateway Providers That Won't Let You Down

Choosing a Payment Gateway Provider You Can Trust

Payment gateway service providers are the essential bridge between your business and successful online transactions. If you're looking for reliable payment gateway providers, here's a quick overview of top options:

| Provider | Best For | Key Features | Pricing |

|---|---|---|---|

| Provider A | Businesses of all sizes | Global payments, 135+ currencies, API-driven | 2.9% + $0.30 per transaction |

| Provider B | Small businesses | Easy setup, widespread consumer trust | 2.99% + $0.49 per transaction |

| Provider C | Omnichannel retail | In-person and online payments, POS integration | 2.6% + $0.10 per transaction |

| Provider D | Established businesses | Award-winning API, 24/7 support | 2.9% + $0.30 per transaction |

| Provider E | Scalable businesses | 200+ processor connections, white-label options | Custom pricing |

Choosing the right payment gateway is crucial for your business's success. The wrong choice can lead to lost sales, frustrated customers, and unnecessary fees eating into your profits.

A payment gateway does more than just process credit cards. It's the technology that securely captures card data, encrypts it, and sends it to the right places for authorization and settlement. Without a reliable gateway, you simply can't accept online payments.

The best providers offer more than basic transaction processing. They provide robust security features, smooth checkout experiences, and tools to help you grow your business. According to research, advanced AI-powered optimizations result in an average 2.2% revenue increase and 38% lower fraud for users.

I'm Lydia Valberg, co-owner of Merchant Payment Services with over 35 years of family experience helping businesses steer the complex world of payment gateway service providers to find solutions that truly meet their needs.

What You'll Learn

In this comprehensive guide, we'll walk you through everything you need to know about payment gateway service providers, including:

- The benefits of using a reliable payment gateway

- Different types of gateways and which might be right for your business

- How pricing and fee structures work (and hidden costs to watch for)

- Essential features that can make or break your payment experience

- Security and compliance requirements

- Integration options for your website, app, or POS system

- Strategies to leverage your payment gateway for business growth

How Payment Gateways Work & Why You Need One

Ever wonder what happens in those few seconds between hitting "Buy Now" and seeing "Order Confirmed"? That's where payment gateway service providers work their magic, serving as the digital handshake between your business and your customer's money.

Picture a payment gateway as the online version of the card reader at your local coffee shop – except it's handling sensitive financial data behind a fortress of security protocols. Let's break down how this actually works:

When your customer clicks "Purchase," their payment journey begins. First comes authorization, where their card details zip through your gateway's encrypted tunnel to their bank, asking "Is this card valid? Do they have enough funds?" This happens in milliseconds, giving that near-instant approval we've all come to expect.

Instead of processing each transaction immediately, your gateway smartly groups them into batches, typically submitted at the end of your business day. Then comes settlement, where the money actually moves from your customer's account into your merchant account, minus the processing fees.

For your customer, it's a seamless experience. Behind the scenes, it's a carefully choreographed dance between your gateway, payment processor, card networks, and banks.

But why invest in a quality gateway when there seem to be so many options?

Security is the top reason. Modern gateways use advanced encryption and tokenization to protect card data, dramatically reducing your PCI compliance headache. According to scientific research on PCI compliance, businesses handling card data directly face significantly higher regulatory burdens and potential liability.

Your cash flow benefits too. With same-day or next-day funding options, you're not waiting weeks to access your revenue. And let's talk about the customer experience – a clunky checkout process is the fastest way to lose a sale. Research shows that optimized payment flows can boost conversion rates by 35% or more.

Finally, the right gateway gives you flexibility to accept whatever payment methods your customers prefer – from traditional credit cards to digital wallets, ACH transfers, and even buy-now-pay-later options.

The Role of Payment Processors vs. Gateways

Many business owners ask us: "Aren't payment gateways and processors the same thing?" Not quite – they're partners in the payment dance, but with different roles:

Your payment gateway works on the front-end, capturing payment data from your website or app, securing it through encryption, and routing it to the right places. Think of it as the doorway that payment information passes through.

Your payment processor handles the back-end communication with card networks and banks to authorize and settle transactions. It's like the messenger running between financial institutions.

At Merchant Payment Services, we often see businesses overpaying because they don't understand this distinction. Some providers bundle both services, while others specialize in one or the other.

The technology powering modern gateways has evolved dramatically in recent years. Tokenization replaces sensitive card numbers with secure tokens for future transactions, improving both security and convenience. End-to-end encryption ensures data is protected from the moment it's entered until it reaches its destination. And risk scoring uses artificial intelligence to flag suspicious transactions before they become costly chargebacks.

All this happens in the background while your customers enjoy a smooth, secure shopping experience – exactly as it should be.

Main Types of Payment Gateway Service Providers

Shopping for a payment gateway service provider can feel a bit like walking into a restaurant with a 10-page menu. So many options! Let me simplify things by walking you through the main types you'll encounter in your search.

Think of payment gateways as different roads that all lead to the same destination: getting money from your customer to your business. Each road has its own scenery, speed limits, and driving conditions.

Hosted "All-in-One" Payment Gateway Service Providers

Imagine having a friendly neighbor who handles your mail for you. That's essentially what a hosted gateway does. When customers are ready to pay, they're briefly redirected to the provider's secure payment page, complete their transaction, and then return to your website.

These gateways shine in their simplicity. You'll enjoy minimal PCI compliance headaches since sensitive card data never touches your servers. The setup is typically quick and painless, often requiring zero development work. Plus, the provider takes care of all security updates and maintenance.

The main trade-off? You're handing over some control of the checkout experience. Your customers temporarily leave your website, which might feel disjointed. However, many modern providers now offer white-labeled solutions that can be customized to match your brand's look and feel, creating a more seamless experience.

Hosted solutions are perfect for small to medium businesses that want to start accepting payments yesterday without hiring a development team. They're the "plug-and-play" option of the payment gateway world.

Self-Hosted & Non-Hosted Payment Gateway Service Providers

If hosted gateways are like having a neighbor handle your mail, self-hosted and non-hosted (API-based) gateways are like building your own sophisticated mailroom.

With a self-hosted gateway, you collect payment information on your website, but the actual processing happens off-site. Non-hosted gateways take this a step further, giving you complete control with payment data collected and processed entirely within your environment.

The biggest advantage here is complete control over your checkout experience. Your customers never leave your website, creating a smooth, branded journey from browsing to buying. You'll also enjoy greater flexibility for custom implementations and access to detailed analytics and data.

These benefits come with added responsibility. You'll face higher PCI compliance requirements and need development resources to implement and maintain your solution. Your team will also shoulder more security responsibility – not something to take lightly when handling sensitive payment data.

Self-hosted and API-based solutions typically appeal to larger businesses with technical resources and unique requirements that off-the-shelf solutions can't satisfy. They're the custom-custom suit of payment gateways – more work upfront, but a perfect fit in the end.

Choosing Between Gateway Service Providers

Finding the right payment gateway isn't about picking the "best" one – it's about finding the best fit for your specific business. Here are the key factors to consider:

Your business model matters tremendously. Do you need one-time payments for a retail shop, recurring billing for a subscription service, or both? Some gateways excel at handling subscription billing with features like automated retry logic and dunning management.

Be honest about your technical resources. Do you have developers who can implement and maintain a custom solution? If not, a hosted option might be your best bet.

Consider your customers' preferred payment methods. Beyond credit cards, do you need to accept digital wallets like Apple Pay and Google Pay? What about Buy Now, Pay Later options or alternative payment methods? The right gateway should support all the ways your customers want to pay.

Think about your growth plans. Will you need to scale quickly or expand internationally? Some gateways make it easy to add new payment methods or currencies as you grow.

Finally, evaluate your integration requirements. How will the gateway connect with your existing systems like your e-commerce platform, accounting software, or inventory management?

Here in Dayton, Cincinnati, and Columbus, we at Merchant Payment Services sit down with business owners every day to help them steer these choices. Our month-to-month agreements ensure you're never trapped in a relationship with a gateway that isn't meeting your needs. We believe payment processing should work for you, not the other way around.

Evaluating Features, Pricing & Hidden Fees

Let's talk money – because when it comes to payment gateway service providers, what you see isn't always what you get. Think of gateway pricing like an iceberg: the advertised rate is just the tip floating above water, while a whole lot more might be lurking beneath the surface.

Common Pricing Models

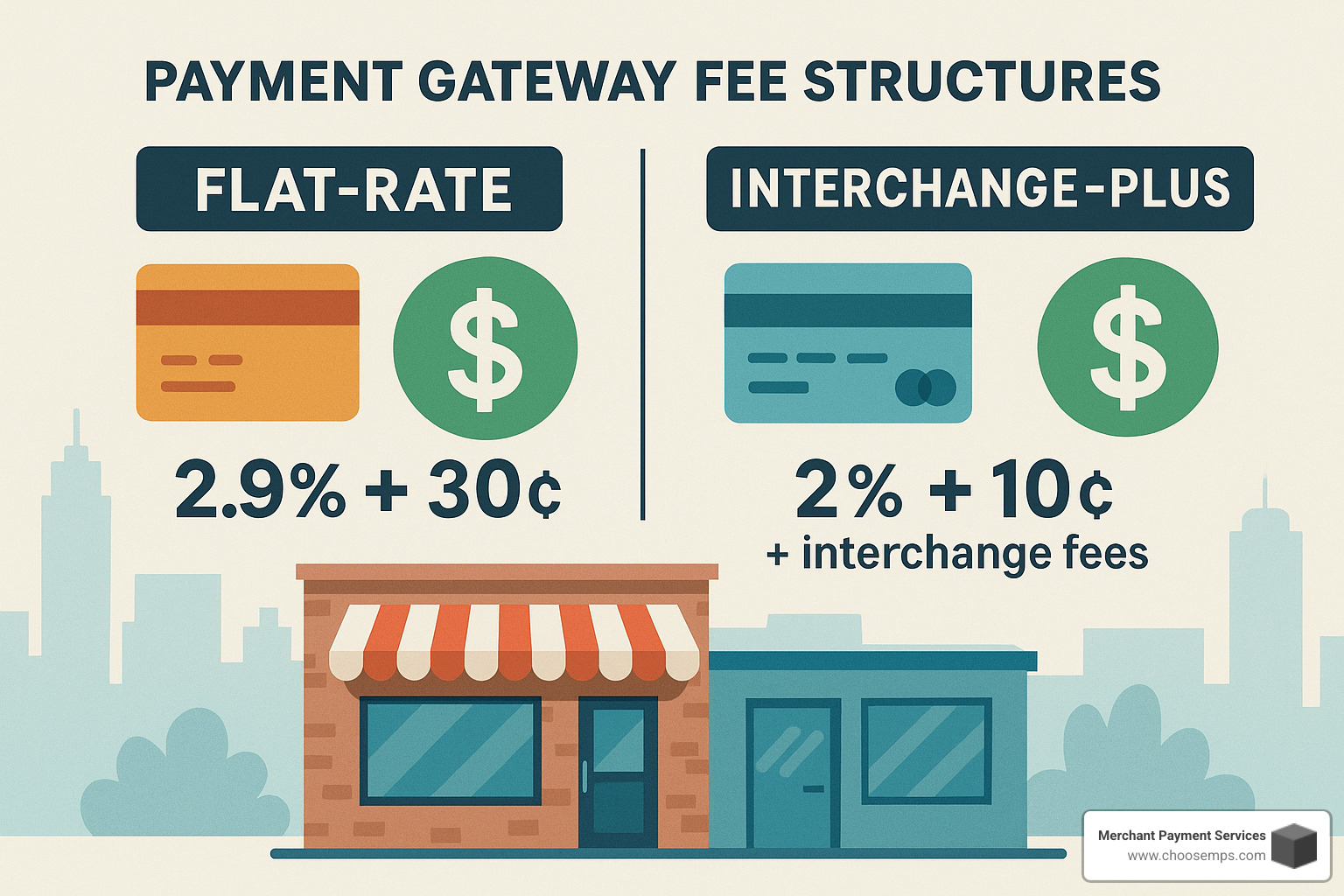

You'll typically encounter three main pricing structures when shopping for a payment gateway.

Flat-rate pricing is exactly what it sounds like – a simple fixed percentage plus a set fee for each transaction (something like 2.9% + $0.30). It's refreshingly straightforward, especially for smaller businesses just getting started. You know exactly what you're paying. The downside? Once your business grows, you might be leaving money on the table compared to other models.

Interchange-plus pricing breaks things down more transparently. You pay the actual interchange cost (set by card networks like Visa and Mastercard) plus a markup (maybe interchange + 0.3% + $0.10). This model often saves money for businesses with higher volumes, and you can clearly see what's going to the card networks versus your provider.

The subscription model flips the script with a monthly fee plus smaller per-transaction fees, often eliminating percentage-based markups entirely. For high-volume merchants, this can mean significant savings.

Hidden Fees to Watch For

Here's where things get tricky. Beyond the headline rates, many providers tuck away extra costs in the fine print.

Watch out for monthly minimums that charge you extra if your business doesn't process enough volume. PCI compliance fees might appear annually or quarterly for security standards you need to follow anyway. Every time a customer disputes a charge, you could face chargeback fees of $15-25 per incident.

Some providers charge setup fees just to open your account, while others lock you in with early termination fees if you want to leave. Planning to sell internationally? Be prepared for currency conversion fees. And perhaps most frustrating of all, some providers keep their transaction fees even when you issue refunds to customers.

At Merchant Payment Services, we believe in straightforward pricing with no surprises. Our month-to-month agreements mean you're never trapped in a bad relationship with your payment provider. If we're not making you happy, you can walk away anytime.

Must-Have Features in Payment Gateway Service Providers

A great payment gateway does far more than just move money. Here are the features worth paying for:

Strong security isn't optional – it's essential. Look for PCI-DSS compliance, tokenization (replacing card data with secure tokens), and robust fraud prevention tools that protect both you and your customers.

The days of "credit or debit" as the only options are long gone. Your gateway should support multiple payment methods including all major cards, digital wallets like Apple Pay and Google Pay, ACH transfers, and even newer options that your customers might prefer.

If your business model includes subscriptions or memberships, recurring billing functionality will save you countless hours of manual work and reduce failed payments. Similarly, customer management tools that securely store payment information make repeat purchases smooth and simple.

Good reporting and analytics help you understand your business better – who's buying, when, and how. For the technically-minded, comprehensive developer tools with clear documentation make integration painless. And when things go sideways (and they sometimes will), reliable support available 24/7 is priceless.

Some advanced features can truly set providers apart. AI-powered fraud detection systems like Stripe's can reduce fraud rates by 38%. Adaptive acceptance technology intelligently routes transactions to improve approval rates. For subscription businesses, smart retries automatically attempt failed payments at optimal times. One-click checkout options dramatically boost conversion rates, while omnichannel capabilities give you unified reporting across in-store and online sales.

You can learn more about the best gateway solutions at our blog post on payment gateway solutions.

Red Flags & Pitfalls to Avoid

Not all payment gateway service providers are created equal. Here are the warning signs that should make you think twice:

Long-term contracts with hefty cancellation fees suggest a provider that needs to trap customers rather than earn their loyalty. If you see unclear or complicated pricing structures, ask yourself what they might be hiding.

Poor or limited customer support becomes painfully apparent only when you have an urgent problem. Outdated security practices put both your business and customers at risk. If a provider offers only limited payment method support, you may find yourself turning away customers who want to pay in ways you can't accept.

The lack of offline processing capabilities can leave you unable to accept payments during internet outages. And slow settlement times directly impact your cash flow – the lifeblood of any business.

At Merchant Payment Services, we've built our reputation on being the opposite of these red flags. We're upfront about costs, offer responsive support when you need it most, and provide the security and features your business needs – all without locking you into long-term commitments that don't serve your interests.

Security, Compliance & Future-Proofing Your Payments

Let's talk about something that keeps many business owners up at night—payment security. It's not just a nice-to-have feature; it's the foundation of customer trust and business protection.

How Payment Gateway Service Providers Protect Your Data

Today's payment gateway service providers don't mess around when it comes to keeping your information safe. They're like digital fortresses with multiple security layers working together:

Think of tokenization as your transactions wearing a disguise—it replaces sensitive card details with meaningless symbols that would be useless to any hacker who managed to intercept them. Behind the scenes, these providers maintain secure token vaults where your actual data stays protected.

The best gateways use military-grade AES-256 encryption (the same level used by government agencies) to lock down data from the moment a customer enters their card details until the transaction completes. Nothing travels in plain sight.

What's particularly impressive is how modern providers use artificial intelligence to spot suspicious transactions. These systems learn from millions of transactions to identify fraud patterns that human eyes might miss. One merchant told me, "The system flagged a transaction I would have approved—turned out it was fraudulent and saved me a $2,000 chargeback."

For businesses handling in-person payments, device encryption and EMV chip technology provide that crucial extra layer of security that traditional magnetic stripes just can't match.

According to research, businesses using advanced security features like AI-powered fraud prevention typically see fraud rates drop by 38% while maintaining healthy approval rates—a win-win for both your bottom line and your customers' peace of mind.

Supporting Growth & New Revenue Streams

The right payment gateway does much more than just process transactions securely—it becomes your partner in growth.

Subscription models have revolutionized countless businesses, creating predictable revenue streams that make planning and scaling much easier. The best gateways offer tools that handle the complex parts of subscription management: automatic retries when payments fail, proactive card updates when customers get new cards, and flexible billing cycles.

For businesses expanding into marketplace models, you'll need a gateway that can handle split payments and multi-party transactions. This capability lets you receive payments from customers and distribute portions to vendors or service providers automatically—essential for platform businesses.

Going global? Look for a gateway with cross-border readiness that handles multiple currencies without excessive fees. One Ohio retailer I worked with saw their international sales jump 32% after implementing a gateway that offered local payment methods and currency conversion at competitive rates.

Many businesses are also finding success with newer payment options like pay-by-link (sending payment requests via email or text) and even crypto add-ons for customers who prefer alternative currencies. And don't overlook the humble gift card—they're not just for holidays anymore but can be powerful tools for customer acquisition and retention.

Here at Merchant Payment Services, we help businesses throughout Dayton, Cincinnati, and Columbus implement payment solutions that not only meet today's needs but can adapt to tomorrow's opportunities. Our month-to-month agreements mean you're never locked into technology that's not keeping pace with your growth.

Want to learn more about expanding your payment capabilities internationally? Check out our guide on International Payment Gateway Providers.

Integration Roadmap: From Sandbox to Live Transactions

So you've chosen your payment gateway service provider – now what? Don't worry, I've got you covered with a friendly roadmap to turn that decision into real transactions flowing through your business.

Think of payment gateway integration like building a bridge – one that connects your customers' desire to buy with your ability to get paid. Let's break down this journey together.

Step-by-Step Payment Gateway Integration for Ecommerce

Remember setting up your first online account? This process isn't much different! Start by creating a developer account with your chosen gateway provider. This gives you access to their sandbox – essentially a risk-free playground where you can test everything without real money changing hands.

Next, pour yourself a cup of coffee and spend some time with the documentation. I know, not the most exciting reading, but understanding the integration requirements upfront saves headaches later.

When it comes to actually implementing your gateway, you've got options. If you're using platforms like Shopify or WooCommerce, you might be pleasantly surprised at how simple it can be – often just installing a plugin and entering your API credentials. For custom websites, you'll need to roll up your sleeves for some direct API work, but most providers offer developer-friendly SDKs to simplify the process.

Testing is where the magic happens. Use those test card numbers to simulate everything from successful payments to declined transactions. Try refunding an order, canceling a payment, or setting up a subscription. It's much better to find any hiccups now rather than when a real customer is trying to check out!

Once your testing shows all systems go, it's time to flip the switch to production mode. But don't just walk away – keep a close eye on those first few transactions to ensure everything's running smoothly. For more detailed guidance, check out our Payment Gateway Integration for Ecommerce Site: Step by Step resource.

Connecting Payment Gateways to POS & Mobile Apps

If your business has both an online and physical presence, connecting your payment gateway to your point-of-sale system creates a seamless experience that customers will appreciate – and makes your life easier too.

Installing the gateway's SDK into your mobile app enables your customers to pay on the go. If you're accepting in-person payments, you'll need to pair your EMV card readers with your system. Modern solutions should offer offline fallback options for those inevitable moments when the internet decides to take a break.

The real beauty of an integrated system is seeing all your sales data in one place. No more jumping between reports or wondering why your online and in-store numbers don't match up. Everything reconciles automatically, giving you a true picture of your business performance.

At Merchant Payment Services, we understand that not everyone speaks tech. That's why we offer free terminals and POS systems that work right out of the box with our payment processing solutions – no degree in computer science required!

Ongoing Optimization Tactics

Once you're up and running, the real fun begins – making your payment process even better. Try conducting A/B checkout experiments to see which designs lead to more completed purchases. Maybe customers prefer a single-page checkout, or perhaps they respond better to a progress bar showing the steps.

Look at your transaction data regularly. Are certain cards being declined more often? Are international customers abandoning their carts? These patterns reveal opportunities to fine-tune your setup.

Consider adding local payment methods based on where your customers live. Someone in the Netherlands might prefer iDEAL, while a German customer might look for SOFORT. These small touches can significantly boost your conversion rates.

The payment world evolves quickly, so stay curious about new options. Today's emerging payment method could be tomorrow's customer expectation. By partnering with a forward-thinking payment gateway service provider, you'll be ready to adapt as the landscape changes.

At Merchant Payment Services, we're always just a phone call away if you need help optimizing your payment setup. Unlike those other companies with their rigid contracts, our month-to-month agreement means we have to earn your business every day through exceptional service – exactly the way it should be.

Frequently Asked Questions about Payment Gateway Service Providers

What fees should I expect besides the headline rate?

When you're shopping for a payment gateway, that eye-catching rate (like 2.9% + $0.30 per transaction) is just the beginning of the story. It's like buying a car and focusing only on the sticker price – there's always more to consider!

Behind that headline rate, you might encounter several other costs that can impact your bottom line. Many providers charge monthly subscription fees just for the privilege of using their service. Some even hit you with setup fees right out of the gate before you process a single dollar.

PCI compliance fees are another common addition – yes, some companies charge you extra to meet the security standards they should be providing anyway! And don't forget about chargeback fees (typically $15-25 each time a customer disputes a transaction), which can really add up if you experience frequent disputes.

Here's where it gets tricky: many providers keep their transaction fees even when you issue refunds, meaning you pay to process the original sale AND the refund. If you sell internationally, watch out for those currency conversion fees that take another bite out of each cross-border sale.

At Merchant Payment Services, we believe your pricing should be as clear as day – no hidden fees, no unpleasant surprises in your monthly statement. Our month-to-month agreements mean you're never trapped in unfavorable terms if something doesn't work for your business.

How do gateways handle refunds and disputes?

Nobody likes dealing with refunds and disputes, but they're an inevitable part of doing business. Fortunately, most payment gateway service providers offer tools to make these situations less painful.

For refunds, the process is usually straightforward. You can typically issue them through your gateway's dashboard with a few clicks or via their API if you prefer automation. Just be aware that many gateways impose time limitations – you might only have 30-90 days after the original transaction to process a refund. Your customers will generally see the refunded amount back in their accounts within 5-7 business days, though this can vary by bank.

Disputes (also called chargebacks) are trickier. These happen when a customer goes directly to their bank to contest a charge instead of contacting you first. Unfortunately, most gateways charge a fee for every dispute (typically $15-25) whether you win or lose the case. The good news is that you can fight invalid claims by submitting evidence through your gateway's dispute management system.

The best payment gateway service providers now offer proactive tools that alert you to potential disputes before they become official chargebacks. This early warning system gives you the chance to reach out to the customer and resolve the issue before it escalates – saving you both the chargeback fee and the headache!

Can I switch providers without disrupting my store?

"We'd love to switch, but we're worried about downtime" – if that sounds familiar, I have good news! Yes, you absolutely can change payment gateways without bringing your business to a screeching halt. The key is careful planning and a methodical approach.

First, work closely with your new provider on data migration. This is especially important if you store customer payment information for recurring billing or one-click checkouts. Good providers will help transfer customer tokens securely so your regular customers don't need to re-enter their payment details.

Consider a parallel processing approach during the transition. This means running both your old and new systems simultaneously for a short period, which provides a safety net if any issues arise. Many businesses find success with a phased approach – perhaps moving your website payments first, then your in-person terminals later.

Thorough testing is non-negotiable. Process test transactions through your new gateway before fully committing, and check that all your payment types work correctly. And don't forget to communicate any relevant changes to your customers – especially if they'll notice differences in how payments appear on their statements.

At Merchant Payment Services, we understand that changing payment providers can feel overwhelming. That's why we handle the technical heavy lifting for businesses throughout Dayton, Cincinnati, Columbus, and all of Ohio. We manage the transition details so you can focus on what you do best – running your business!

Conclusion

Finding a payment gateway service provider you can trust isn't just about processing transactions—it's about building the foundation for your business's financial future. When you choose the right partner, you gain so much more than the ability to accept credit cards.

Think about what truly matters for your business: security that gives you peace of mind, a checkout experience your customers will love, and the flexibility to grow without technology holding you back. These aren't just nice-to-haves—they're essential ingredients for success in today's digital marketplace.

At Merchant Payment Services, we've spent decades helping Ohio businesses steer the complex world of payment processing. We've seen how the right gateway solution can transform a business's operations, from streamlining daily tasks to opening new revenue streams.

What sets a great payment gateway apart? It starts with robust security features that protect both you and your customers from fraud and data breaches. It continues with flexible integration options that work seamlessly with your website, POS system, or mobile app—no technical headaches required.

The best providers offer transparent pricing without those frustrating hidden fees that eat into your profits. They provide reliable support when you need it most (because payment issues never seem to happen during business hours!). They deliver advanced features that help you sell more effectively across all channels. And perhaps most importantly, they offer scalability that grows alongside your business ambitions.

We believe payment processing should be the least stressful part of running your business. That's why we offer risk-free, month-to-month agreements with no startup fees or hidden charges. Whether you're a new startup in Dayton, an established retailer in Cincinnati, or a growing service business in Columbus, we're committed to finding the payment solution that truly fits your unique needs.

Ready to explore payment gateway options that won't let you down? Check out our online processing solutions or contact us today for a friendly, no-pressure consultation custom to your business requirements.

After all, accepting payments should be the easiest part of running your business—not the most complicated.