Worldwide Payments: Leading International Gateway Providers

Expanding Your Business Globally: Understanding International Payment Gateways

When you're ready to take your business beyond U.S. borders, international payment gateway providers opens up exciting possibilities. These clever systems do much more than just process payments—they're your digital bridge to customers around the globe, handling everything from currency conversions to regional payment preferences.

Think of payment gateways as friendly translators for your business, making sure your American online store speaks the financial language of customers in Tokyo, London, or Sydney. They securely authorize electronic payments while navigating the complexities of international commerce.

The market leaders in this space have built impressive global networks. The top providers in the industry serve anywhere from 30 to 200+ countries and support between 25 to 150+ currencies. Some specialize in wide geographic reach, while others focus on supporting the maximum number of payment methods to ensure customers everywhere can pay how they prefer.

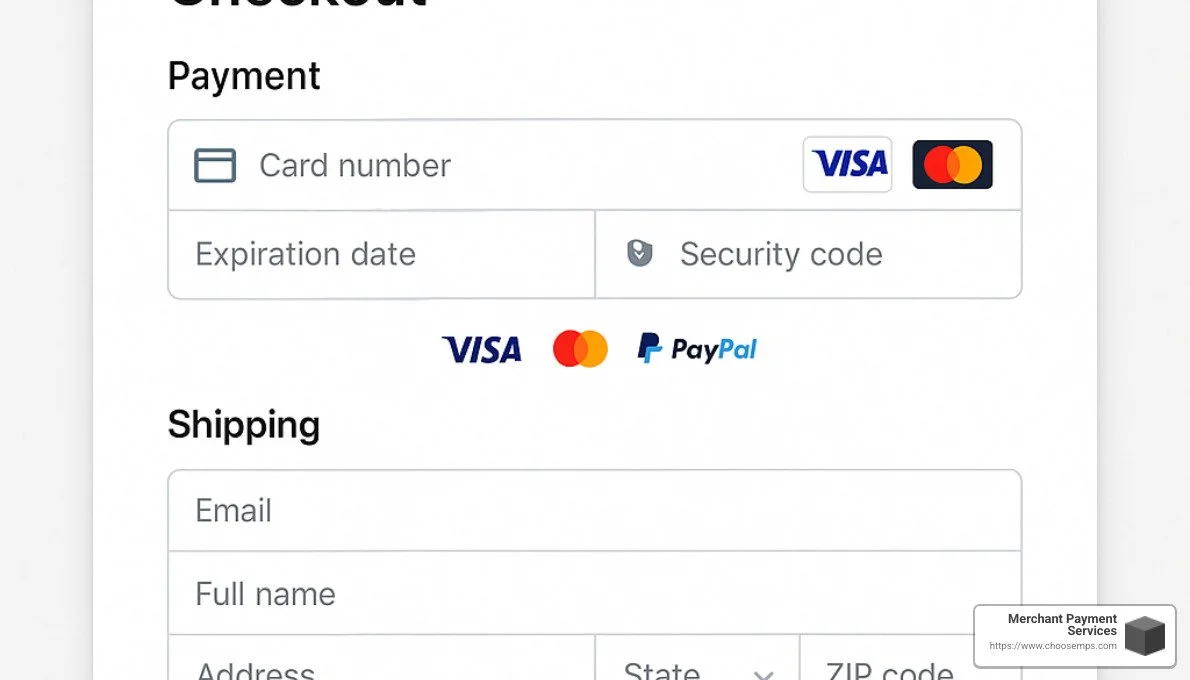

For small retail businesses taking their first international steps, finding the right gateway partner means focusing on what matters most. Multi-currency support eliminates confusion at checkout, while offering local payment methods can dramatically boost your conversion rates—many international shoppers abandon carts when they don't see familiar payment options. Look for transparent fee structures to avoid surprises on your monthly statement, and never compromise on strong security features that protect both you and your customers. Finally, choose a solution with easy integration capabilities that work smoothly with your existing website and systems.

The numbers tell the story: the right international gateway can significantly reduce cart abandonment and lower those frustrating payment failures (which typically hover between 10-15% for cross-border transactions). More completed purchases mean more revenue as you expand into exciting new markets.

I've seen this at Merchant Payment Services, where I've helped hundreds of small businesses implement the right international payment gateway providers. As a co-owner, I've learned that successful global expansion isn't just about reaching new markets—it's about creating seamless experiences that make international customers feel right at home when they shop with you.

How International Payment Gateways Work

Understanding how international payment gateway providers function is crucial before selecting one for your business. At its core, an international payment gateway is a service that authorizes and processes payments between your customers and your business across national borders.

Think of payment gateways as digital traffic controllers, guiding your customer's money safely to your bank account. When a customer clicks "buy" on your website, they set in motion an intricate dance of data that happens in mere seconds.

First, the authorization request begins its journey. Your customer's payment details are immediately encrypted (think of it as putting their credit card in a virtual vault) and sent to your acquiring bank. This is your bank – the one that'll eventually receive the funds.

From there, your bank forwards this request through card networks like Visa or Mastercard to reach the customer's bank (the issuing bank). The customer's bank then does some quick detective work – verifying the transaction, checking available funds, and running sophisticated fraud checks.

Within milliseconds, an authorization response travels back through the same channels. If it's a thumbs-up, the settlement process begins, and the money starts making its way to your account, typically arriving in 1-3 business days.

What makes international gateways special is their ability to handle different currencies, steer complex cross-border regulations, and process payment methods that might be popular in Tokyo but unheard of in Toledo.

According to recent market research, this global payment gateway market is booming – expected to reach $106.4 billion by 2030, growing at a CAGR of 16.8%. This growth is fueled by increasing financial literacy and the unstoppable rise of digital commerce worldwide.

Key Steps in the Transaction Journey

Let's break down what happens in those few seconds between your customer clicking "Buy Now" and you getting that sweet "Sale Confirmed" notification:

The journey begins with cart submission – your customer's browser bundles up their payment details and securely sends them to your server, which passes them to the payment gateway.

Next comes the gateway handshake, where your payment processor establishes a secure connection with the financial networks. Think of it as the digital equivalent of a secret handshake that ensures everyone involved is legitimate.

Before any money moves, fraud screening kicks in. International transactions typically get extra scrutiny here – it's like going through a more thorough security check when traveling internationally versus domestically.

Finally, settlement occurs. This is when the money actually moves from your customer's account to yours. For international transactions, this process usually takes longer due to currency conversion and the relationships between banks in different countries.

Here's something mind-blowing: a typical transaction processes in just 336 milliseconds – about the time it takes to blink. In that blink, card details get tokenized for security, the transaction routes to the appropriate processor, fraud checks run, the issuing bank approves or declines, and the response zips back to your store.

Why U.S. Businesses Need International Capability

For U.S. merchants, working with international payment gateway providers isn't just nice-to-have – it's becoming essential for growth.

Market expansion is perhaps the most compelling reason. The U.S. represents only about 4% of the global population. Without international payment capabilities, you're essentially hanging a "Closed" sign on your digital storefront for 96% of potential customers.

The revenue growth potential is substantial. Many of our clients report 20-30% revenue increases after expanding their payment options to accommodate international customers. That's like finding money you didn't know you were leaving on the table.

Building customer trust is another major benefit. When shoppers see payment methods they recognize and use daily, they're more likely to complete purchases. A German customer spotting ELV as a payment option feels the same comfort an American feels seeing Apple Pay.

As one of our clients in Chicago recently told us: "Adding international payment options wasn't just about accepting different currencies—it was about speaking our customers' financial language. Our conversion rates jumped 15% in European markets simply by offering their preferred payment methods."

It's like learning to say "thank you" in different languages – a small effort that shows respect and builds tremendous goodwill with your international customers.

What to Look For in International Payment Gateway Providers

When you're ready to take your business global, choosing the right international payment gateway provider can feel overwhelming. I've helped hundreds of merchants make this decision, and I can tell you that finding the perfect fit comes down to a few key elements.

First, you'll want robust multi-currency support. This goes beyond just accepting Euros or British Pounds – the best providers handle everything from Japanese Yen to Brazilian Real. I recently worked with a boutique clothing retailer who saw their sales in Southeast Asia double simply by offering local currency options at checkout.

Local payment methods are just as crucial as currencies. Did you know that in the Netherlands, over 60% of shoppers prefer using iDEAL instead of credit cards? Or that in China, Alipay and WeChat Pay dominate the market? Offering these familiar options creates instant trust with international customers.

If your business involves subscriptions or regular billing, look for recurring billing capabilities that work across borders. This includes smart retry logic when payments fail and automatic card updater services that refresh expired card details.

FeatureDomestic GatewaysInternational GatewaysCurrenciesUsually USD onlyMultiple currenciesPayment MethodsCredit/debit cards, ACHCards, bank transfers, digital wallets, local methodsFeesUsually simpler structureMore complex with FX fees, cross-border feesComplianceU.S. regulationsGlobal regulations (GDPR, PSD2, etc.)SettlementTypically 1-2 business daysVaries by country (1-7 days)Fraud ProtectionStandardImproved for international transactions

Your gateway's compliance framework might not sound exciting, but it's crucial. The right provider will help you steer PCI DSS requirements and other regulations without giving you a headache. And don't overlook uptime and reliability – your gateway should promise at least 99.99% uptime with redundant systems across global data centers.

Core Features Checklist

Let's talk about what should be non-negotiable when evaluating international payment gateway providers.

Chargeback management tools are worth their weight in gold. International transactions typically see higher dispute rates, and good gateways offer automated systems to help you fight back. One of our clients in Hartford reduced their chargeback losses by 22% after switching to a gateway with better dispute management.

You'll also want real-time analytics that break down performance by currency, payment method, and region. When you can see that your conversion rate in Germany is lagging, you can actually do something about it.

API flexibility matters more than you might think. Your developer will thank you for choosing a gateway with clear documentation, sandbox testing, and pre-built plugins for popular e-commerce platforms.

Since global commerce happens 24/7, round-the-clock support is essential. Nothing's worse than having transactions failing in Australia and having to wait until morning for help.

From our experience at Merchant Payment Services, merchants who carefully evaluate these features before implementation typically save 12-18% on transaction costs while enjoying approval rates 8-10% higher than those who don't.

Compliance & Tax for U.S. Merchants

For U.S. businesses going global, compliance isn't optional – it's mandatory.

PCI DSS compliance requirements exist domestically too, but international transactions often need additional security measures. Your gateway should make compliance straightforward, not a burden.

Don't overlook OFAC sanctions compliance. As a U.S. merchant, you're responsible for ensuring you don't process transactions involving sanctioned countries, entities, or individuals. Quality gateways include screening tools that prevent these prohibited transactions automatically.

Sales tax nexus gets complicated when selling internationally. The best gateways integrate with tax calculation services to automatically apply the correct VAT, GST, or sales tax based on where your customer is located.

If you're selling to Europeans, GDPR considerations matter. Your gateway should handle customer data in ways that support compliance with these strict privacy regulations.

We've helped businesses from Providence to Fresno steer these complexities with our online payment processing solutions that include built-in compliance tools and expert guidance.

Top 6 Categories of International Gateway Providers

1. Hosted All-in-One Platforms

If you're just dipping your toes into international waters, hosted all-in-one platforms offer the smoothest sailing experience. These international payment gateway providers take the complexity out of global commerce by handling the entire payment process from start to finish.

Think of these platforms as your "business-in-a-box" solution for global payments. The beauty of these systems lies in their simplicity. With plug-and-play integration, you can typically get up and running in hours rather than weeks. Most small business owners I've worked with are pleasantly surprised at how painless the setup process can be.

"We were intimidated by international expansion, but the hosted platform made it painless," shared one of our clients, a specialty food retailer from Chicago. "Within two weeks, we were processing orders from Canada, the UK, and Australia with zero payment issues."

What makes these platforms special is their balanced approach to customization and convenience. While you maintain a branded checkout experience that matches your store's look and feel, the payment provider handles all the behind-the-scenes complexity. This means you can present a consistent brand experience while the technical heavy lifting happens invisibly.

For business owners without dedicated IT teams, the minimal coding requirement is often the deciding factor. You won't need to hire developers or divert existing resources to maintain these systems. Most integrate through simple plugins with popular e-commerce platforms, making them perfect for busy entrepreneurs who'd rather focus on growing their business than debugging payment code.

The slightly higher fees these platforms charge (compared to developer-focused solutions) are often offset by the comprehensive support they provide. When questions arise—and they always do with international commerce—having a responsive support team can make all the difference between a smooth operation and a stressful one.

In my experience working with small businesses across the country, these hosted solutions make the most sense for companies processing under $50,000 monthly in international transactions. Beyond that threshold, the economics might favor more customized solutions, but for most small to medium businesses just expanding globally, the convenience and peace of mind are well worth the modest premium.

2. API-First Developer Platforms

For businesses with technical resources and specific customization needs, API-first platforms offer maximum flexibility and control over the payment experience.

When you're ready to take your international payment strategy to the next level, API-first platforms become your best friend. These international payment gateway providers put you in the driver's seat, giving your development team the tools to craft exactly what your business needs.

Think of these platforms as building blocks rather than pre-built houses. With REST APIs, your developers can create seamless payment experiences that feel like a natural extension of your brand. The documentation is typically comprehensive, making it easier for your team to implement even complex payment flows across different countries.

One of the most valuable features is webhooks functionality. These real-time notifications are like having a payment assistant who immediately taps you on the shoulder when something important happens – a payment is completed, a subscription renews, or a transaction fails. This enables you to automate customer communications and back-office processes, saving countless hours of manual work.

Before launching internationally, you'll want to test thoroughly. The sandbox testing environments these platforms provide are invaluable, allowing your team to simulate transactions from different countries without risking real money. You can test edge cases like currency conversions, foreign card validations, and regional payment methods before going live.

The level of customization possible with API-first platforms is what truly sets them apart. You can design checkout experiences that adapt to cultural preferences in different markets – showing local payment methods first in Germany or optimizing for mobile wallets in Asia.

A software company we work with in Fresno made the switch to an API-first solution and shared their experience: "The ability to customize every aspect of our payment flow for different countries increased our conversion rate by 22% in Japan and 17% in Germany. The development investment paid for itself within three months."

While these platforms do require more technical resources upfront, they typically offer better long-term value for growing businesses. Your development team can iterate and optimize the payment experience over time, continually improving conversion rates as you learn more about each market's unique preferences.

3. High-Risk Industry Specialists

Some businesses operate in industries considered "high-risk" by traditional payment processors due to liftd chargeback rates, regulatory concerns, or other factors. Specialized international payment gateway providers cater to these industries with custom solutions.

Key Characteristics:

Fraud Scoring: Advanced algorithms specifically designed for high-risk verticals to distinguish legitimate transactions from fraudulent ones.

Dynamic Routing: Intelligent systems that route transactions through the optimal processing channels based on risk profile, improving approval rates.

Rolling Reserve: Managed reserve accounts that protect both merchants and processors from chargeback exposure.

Industry-Specific Compliance: Built-in tools to help maintain compliance with regulations specific to industries like gaming, CBD, or adult content.

According to payment industry experts, "Routing payments through sector-optimized gateways can lift approval rates by up to 20% for high-risk merchants operating internationally."

These specialized gateways typically charge higher fees than standard processors but deliver value through higher approval rates and reduced compliance risks.

4. Subscription & Recurring Billing Gateways

For businesses with subscription models, membership programs, or recurring services, specialized recurring billing gateways offer features designed to maximize customer lifetime value and minimize payment failures.

Key Characteristics:

Token Vaults: Secure storage of payment credentials that facilitates rebilling without requiring customers to re-enter information.

Dunning Management: Automated retry logic and customer communication when payments fail, reducing involuntary churn.

Metered Billing: Support for usage-based billing models with variable amounts.

Subscription Analytics: Detailed reporting on metrics like Monthly Recurring Revenue (MRR), churn, and lifetime value across different markets.

A Providence-based software company we work with implemented a subscription-focused gateway and saw their payment success rate increase from 83% to 94% on international recurring transactions, representing a significant revenue improvement.

These platforms excel at reducing the "leaky bucket" problem where subscribers are lost due to payment issues rather than intentional cancellations. For subscription businesses, this capability often translates directly to improved profitability.

5. Multi-Currency FX-Optimized Gateways

Currency conversion and foreign exchange (FX) rates can significantly impact margins when selling internationally. FX-optimized gateways help businesses maximize revenue while offering customers transparent pricing in their local currency.

Key Characteristics:

Smart FX: Intelligent currency conversion that optimizes for both competitive rates and timing.

Automatic Conversion: Real-time currency conversion at checkout based on current market rates.

Margin Control: Tools to set and manage FX margins to balance competitiveness with profitability.

Settlement Options: Flexibility to settle in your preferred currency or maintain balances in multiple currencies.

Research shows that offering local currency pricing can increase conversion rates by 12-30% depending on the market. Customers strongly prefer seeing prices in their native currency and often abandon purchases when forced to calculate conversions themselves.

A Chicago-based e-commerce retailer implemented an FX-optimized gateway and reported: "By displaying prices in local currencies and optimizing our FX strategy, we reduced cart abandonment by 17% and improved our margins by 2.3% on international sales."

6. Cryptocurrency-Friendly Gateways

The world of digital currencies is no longer just for tech enthusiasts. Today, forward-thinking international payment gateway providers are embracing cryptocurrencies alongside traditional payment methods, opening new doors for U.S. businesses looking to expand globally.

I remember when a client from Boston called me, puzzled about whether to add Bitcoin to their payment options. "Is this just a fad?" they asked. Six months after implementation, crypto payments accounted for 8% of their international revenue—mostly from tech-savvy customers who appreciated the option.

Blockchain Settlements are perhaps the most attractive feature of these gateways. Unlike traditional bank transfers that can take days to clear, especially across borders, blockchain technology enables near-instant settlement. This means you can receive funds in minutes rather than waiting the typical 2-5 business days for international transactions.

Instant Payouts are a game-changer for cash flow management. One of our clients in Seattle who sells digital products internationally shared: "Before adding crypto options, we'd wait up to a week to access funds from certain countries. Now we can reinvest that money almost immediately."

Volatility Protection is built into quality crypto gateways, addressing the common concern about cryptocurrency price fluctuations. Most modern solutions instantly convert the crypto payment to USD at the moment of transaction, shielding your business from market swings. You get the stability of traditional currency with the speed of crypto.

Multiple Coin Support extends beyond just Bitcoin. Today's leading crypto gateways accept Ethereum, Litecoin, USD-pegged stablecoins, and numerous other cryptocurrencies. This variety gives your customers more flexibility while simplifying your accounting—as most platforms will convert everything to USD before settlement to your bank account.

While crypto payments still represent a relatively small slice of global commerce (around 3-5% of online transactions in most markets), they're growing rapidly. They're particularly valuable if you're selling digital products, subscription services, or high-value items to tech-forward audiences.

A furniture retailer in Dallas who implemented crypto payments told me, "We were surprised to see our high-end customers actually prefer paying with crypto for larger purchases. The transaction fees were lower than credit cards, which saved us thousands on big-ticket sales."

For U.S. businesses looking to expand into regions with less stable banking systems or high credit card decline rates, cryptocurrency options can provide a reliable alternative payment route. They can be especially useful in parts of Latin America and Southeast Asia, where traditional banking penetration is lower but smartphone and crypto adoption is rising.

If you're considering adding cryptocurrency to your payment mix, look for providers that make the integration seamless and handle the complexities of blockchain technology behind the scenes. The best solutions require no cryptocurrency knowledge from you or your customers—just a simple checkout experience with an additional payment option.

How U.S. Merchants Integrate International Payment Gateway Providers

So you've decided to expand globally - congratulations! Now comes the fun part: actually setting up those international payment gateway providers to work with your existing systems. Don't worry, it's not as complicated as it might seem at first glance.

At Merchant Payment Services, we've helped hundreds of businesses across the country make this transition smoothly through our payment gateway integration services. Let me walk you through the most common ways you can connect these powerful tools to your business.

Most merchants choose one of these integration approaches:

Plugins and Extensions are the simplest option if you're using platforms like Shopify, WooCommerce, or Magento. Think of these as pre-built bridges that connect your store to payment gateways with minimal technical effort. Just a few clicks, some basic configuration, and you're often good to go!

SDKs (Software Development Kits) are perfect if you have a custom-built website or application. These programming libraries come in various languages like JavaScript, PHP, and Python, giving your developers the building blocks they need without starting from scratch.

Middleware Solutions act like universal translators between your systems and multiple gateways. The beauty here is you only need to integrate once, and the middleware handles connections to multiple payment providers. It's like having one remote that controls all your devices.

ERP Connectors are specialized tools that sync payment data with your Enterprise Resource Planning systems. This ensures your inventory, accounting, and order management all stay in perfect harmony with your payment processing.

The right approach depends on your technical resources, existing systems, and specific business needs. I've seen businesses in Chicago save weeks of development time by choosing the right integration method from the start.

Integration Best Practices

Want your integration to go smoothly? Here are some tried-and-true practices we recommend to our clients:

Use Staging Environments before going live. This sandbox testing helps you catch issues before they affect real customers and real money. Think of it as a dress rehearsal before opening night.

Implement Fallback Logic to handle unexpected hiccups. Even the best gateways have occasional outages, so design your system to gracefully switch to backup providers when needed. Your customers will never know there was a problem.

Conduct Load Testing to ensure your integration can handle peak traffic. The last thing you want is for your payment system to crash during your biggest sale of the year!

Document Thoroughly so your team knows exactly how everything works. Future you (and future team members) will thank present you for this investment.

Implement Comprehensive Logging of transaction details. These logs are pure gold when troubleshooting issues or reconciling accounts. I can't tell you how many times detailed logs have saved the day for our clients.

Plan for Updates because gateway APIs evolve over time. Establish a process to stay current with changes so you're never caught off guard.

One of our clients in Providence followed these practices religiously and told me, "Our meticulous testing process caught several edge cases that would have caused payment failures for international customers. By addressing these before launch, we avoided potential revenue loss and customer frustration." Smart move!

Optimizing Conversion & Reducing Failures

Once your integration is humming along, it's time to fine-tune it for maximum performance. Here's how to squeeze every bit of revenue from your international payments:

Localized Checkout Experiences make customers feel at home. Customize the checkout flow based on location, showing familiar payment methods and formats. When a customer in Germany sees their preferred payment methods displayed, their comfort level (and conversion rate) skyrockets.

Card Updater Services automatically refresh expired or replaced cards, especially crucial for subscription businesses. This simple feature can reduce failed transactions by up to 20% for recurring billing.

Alternative Payment Buttons prominently displayed for each market can dramatically increase conversion. Credit cards aren't king everywhere – in the Netherlands, for example, iDEAL is the preferred payment method.

Smart Retry Logic turns failed transactions into successful ones. Instead of giving up after one declined transaction, implement intelligent retry strategies based on the specific reason for failure.

Address Verification Tuning by country recognizes that address formats vary internationally. What works for U.S. addresses might reject perfectly valid international addresses if not properly configured.

Dynamic 3D Secure applied selectively based on risk factors creates the right balance between security and convenience. Using it for every transaction can hurt conversion, but skipping it entirely increases fraud risk.

By implementing these optimization strategies, our clients typically see a 7-15% improvement in international transaction approval rates and a 5-10% increase in conversion rates. Those numbers translate directly to your bottom line!

At Merchant Payment Services, we're here to help you steer these waters. The right international payment setup isn't just about accepting global payments – it's about creating a seamless experience that makes your international customers feel valued and understood.

Frequently Asked Questions about International Payment Gateway Providers

What fees should U.S. businesses expect when going international?

When you're ready to take your business global, understanding the fee structure of international payment gateway providers is crucial for your bottom line. As someone who's helped hundreds of merchants expand internationally, I can tell you that transparency about costs will save you headaches down the road.

Most businesses are surprised by the layered fee structure that comes with international processing. Your basic processing fees will typically range from 2.5% to 3.5% plus a fixed fee (usually around $0.30) per transaction. International transactions tend to land at the higher end of this spectrum – that's just the reality of cross-border commerce.

Then there are the cross-border fees charged by card networks like Visa and Mastercard. These typically add another 0.8% to 1.2% to transactions where your customer's card was issued in a different country than where your business operates. Think of these as the "passport stamps" for your payments!

If you're accepting payments in euros or yen but want your money in good old American dollars, currency conversion fees will come into play. These generally range from 1% to 3% above the interbank exchange rate. Some gateways are more competitive than others here, which is why we at Merchant Payment Services analyze this carefully for our clients.

Don't forget about the fixed costs – many gateways charge monthly or annual fees specifically for international capabilities, typically ranging from $25 to $100+ monthly. And since international transactions unfortunately see higher dispute rates, budget for chargeback fees between $15 to $25 per incident (on top of the disputed amount itself).

One of our Providence-based retailers saved nearly $7,000 annually just by switching to a gateway with more favorable cross-border fee structures. It pays to shop around!

How do gateways handle multi-currency payouts back to a U.S. bank account?

Managing money across borders can feel like juggling in different languages, but international payment gateway providers offer several approaches to bring your global earnings home.

The simplest option is immediate conversion, where the gateway automatically converts all foreign currency to USD before depositing funds into your U.S. bank account. It's convenient but typically comes with less favorable exchange rates – you're paying for that simplicity.

More sophisticated merchants often prefer currency holding accounts, which are virtual accounts that can hold balances in multiple currencies. This approach gives you the flexibility to convert and withdraw funds when exchange rates are favorable. I've seen this strategy work beautifully for seasonal businesses that can time their conversions strategically.

For businesses with significant international volume, multi-currency merchant accounts allow you to maintain separate balances for each currency. This gives you maximum flexibility in managing your international revenue and can be especially valuable if you have suppliers or expenses in those same foreign currencies.

Many of our clients appreciate payout scheduling features, which allow you to set regular conversions and payouts (weekly, bi-weekly, monthly) to average out exchange rate fluctuations. This "dollar-cost averaging" approach to currency conversion helps smooth out the inevitable ups and downs of foreign exchange markets.

I'll never forget working with a specialty foods exporter in Fresno who saved over $12,000 annually simply by switching from immediate conversion to strategic withdrawals from currency holding accounts. Their CFO called it "the easiest money we never spent!"

Which security certifications are mandatory for international payment gateway providers?

When it comes to processing international payments, security isn't just important—it's everything. The right international payment gateway providers will proudly display their security credentials, and you should absolutely expect nothing less than comprehensive protection.

PCI DSS Compliance is non-negotiable in this industry. All legitimate gateways must maintain at least Level 1 PCI DSS compliance, which is the highest level of protection for cardholder data. This isn't a "nice to have"—it's an absolute requirement.

Look for providers with ISO 27001 certification, which demonstrates they've implemented a robust information security management system. This internationally recognized standard means they take a systematic approach to managing sensitive information.

SOC 1 and SOC 2 audit reports are also crucial indicators of trustworthiness. These verify that the provider has appropriate controls for data security, availability, processing integrity, and confidentiality. When a gateway has these certifications, it means they've opened their doors to independent auditors who've verified their security practices.

For businesses serving European customers, GDPR compliance is essential. This ensures proper data protection measures are in place to meet the EU's stringent privacy requirements. I've seen merchants locked out of European markets because they chose gateways that couldn't support these regulations—don't make that mistake!

While not strictly a certification, support for 3D Secure 2.0 protocols is crucial for strong customer authentication, particularly in Europe under PSD2 regulations. This adds an extra layer of verification to help prevent fraud while maintaining a smooth checkout experience.

Finally, major card networks like Visa and Mastercard have their own security programs that gateways must comply with. These constantly evolving requirements help ensure the entire payment ecosystem remains secure.

At Merchant Payment Services, we carefully vet all our gateway partners to ensure they maintain these critical security certifications. After all, protecting both your business and your customers isn't just good practice—it's good business.

Conclusion

Expanding your business internationally through international payment gateway providers isn't just about accepting foreign currencies—it's about opening doors to entirely new markets and opportunities. With the right payment tools in place, what once seemed like impossible borders can transform into bridges connecting your products with eager customers worldwide.

Throughout this guide, we've walked through the essential elements of successful international expansion. From understanding how cross-border payments actually work behind the scenes to selecting the perfect gateway category for your specific needs, we've covered the critical factors that will determine your global success.

Implementation isn't just about technical integration—it's about strategic alignment with your business goals. At Merchant Payment Services, we've seen how businesses in Chicago, Providence, and Fresno have transformed their growth trajectories by thoughtfully implementing international payment solutions. One client told us, "Going global wasn't just about increasing revenue—it completely changed how we think about our business potential."

Compliance and security aren't optional extras—they're the foundation of customer trust across different markets. The regulatory landscape varies dramatically between countries, and staying on top of these differences is crucial for sustainable growth.

Perhaps most importantly, international expansion works best as a gradual journey rather than an overnight change. Start with the markets showing the highest potential for your specific products, implement the appropriate payment methods for those regions, and expand your reach as you gain confidence and experience.

The world of global payments never stands still. New payment methods emerge constantly, regulations evolve, and consumer preferences shift across different markets. By partnering with a knowledgeable payment expert like Merchant Payment Services, you can stay focused on your core business while we keep you ahead of these changes with our online processing solutions.

International payment gateway providers do more than just process transactions—they help you speak your customers' financial language, wherever they happen to be. When customers see familiar payment options presented in their local currency, it creates an immediate sense of trust and comfort that significantly boosts conversion rates.

Ready to take your business beyond borders? We'd love to help you steer the exciting world of international payments with a personalized consultation custom to your specific expansion goals.

With the right payment strategy in place, your business isn't limited by geography—the entire world becomes your marketplace.