Merchant Processing Companies That Won't Swipe Your Profits

Why Choosing the Right Payment Processor Matters for Your Business

Merchant processing companies handle the complex system that moves money from your customer's card to your bank account. Here are the key types of processors and what they offer:

Top Merchant Processing Company Categories:

- All-in-One Providers - Simple flat-rate pricing, free hardware

- Interchange-Plus Processors - Transparent wholesale rates + markup

- High-Risk Specialists - Custom solutions for challenging industries

- Membership Models - Monthly fee for wholesale rates

- Bank Processors - Integrated with your existing banking

The payment processing industry has over 5,000 registered companies in North America alone. This creates confusion for business owners who just want to accept cards without losing profits to hidden fees.

The real problem? Many processors bury their true costs in complex contracts. Small businesses often pay 3-4% per transaction when they could pay closer to 2.5% with the right provider.

Research shows that businesses can save thousands monthly by switching to transparent processors. In 2024, payment consultants helped merchants save over $100 million by identifying unnecessary fees and finding better rates.

The key is understanding how different pricing models work and matching them to your business volume and needs.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've spent over a decade helping small businesses steer merchant processing companies and find transparent, fair-priced solutions. My experience comes from working directly with hundreds of merchants to eliminate hidden fees and streamline their payment operations.

How Credit Card Processing Really Works

Every time someone taps their card at your register, you're witnessing a pretty amazing dance between banks, networks, and technology. Understanding this process helps you make smarter choices when evaluating merchant processing companies.

Here's what actually happens: Three main players work together to move money from your customer's account to yours. The issuing bank (where your customer has their account) needs to approve the purchase. Your acquiring bank (where your business account lives) wants to collect the funds. And the processor acts like a translator between everyone, making sure the conversation happens smoothly.

The fees you pay reflect each player's role in this process. Interchange fees - which average around 1.81% plus 10 cents per transaction - go straight to your customer's bank as their reward for taking the risk. Assessment fees of about 0.14% go to card networks for maintaining their systems. The merchant processing companies add their markup on top to cover their services and make a profit.

Most transactions settle within one to three business days, though many processors now offer same-day or next-day funding if you qualify. The timing depends on when you close your daily batch and your specific processor's funding schedule.

Security remains a top priority throughout this process. Scientific research on EMV security confirms that chip card technology has dramatically reduced counterfeit fraud. This is exactly why PCI DSS compliance isn't optional - it protects both your business and your customers from costly data breaches.

Authorization to Settlement: The 3-Step Journey

The entire payment journey unfolds in three distinct phases that happen faster than you can blink:

Authorization happens first. Your terminal sends the transaction details through secure networks directly to your customer's bank. The issuing bank quickly checks account validity, available funds, and runs the transaction through fraud detection systems before deciding to approve or decline.

Verification comes next. Card networks verify all the transaction details and route the approval back to your terminal. Modern systems use tokenization during this step - they replace sensitive card data with secure tokens, which means actual card numbers never stick around on your systems.

Settlement wraps things up. At the end of each business day, you close your batch of transactions. Your acquiring bank then collects funds from all the issuing banks and deposits the money into your merchant account, minus the processing fees.

Data routing happens through encrypted channels every step of the way. Tokenization ensures that even if someone intercepted the data, they couldn't use it fraudulently.

Typical Fees Businesses Pay

Most merchants deal with a combination of transaction fees and monthly costs. Transaction fees typically range from 2.5% to 3.5% depending on which processor you choose and what pricing model they offer. Monthly fees can be anywhere from zero dollars to $99 or more for basic service packages.

Chargeback fees usually cost $15 to $25 per dispute, regardless of whether you win or lose the case. PCI compliance fees range from $5 to $20 monthly, though some processors roll this into their base pricing to keep things simple.

You might also encounter statement fees of $5 to $15 monthly, batch fees of 10 to 25 cents per day, and early termination fees that can reach $200 to $500 if you need to break a long-term contract.

We've worked with merchants who were paying over $500 monthly in hidden fees alone - fees they didn't even know existed until they got their first statement. That's exactly why transparent pricing matters so much.

Merchant Processing Companies: Pricing Models Compared

When you're shopping around for merchant processing companies, you'll quickly find that not all pricing models are created equal. Understanding these different approaches can save your business thousands of dollars each year.

Flat-rate pricing is the simplest option you'll encounter. Companies using this model charge you something like 2.6% + $0.10 for every in-person transaction, regardless of what type of card your customer uses. Whether they pay with a basic debit card or a premium rewards credit card, you pay the same rate. This predictability makes budgeting a breeze, especially if you're new to accepting cards or processing less than $10,000 monthly.

Interchange-plus pricing takes a more transparent approach. Instead of hiding the actual costs, these processors show you exactly what you're paying. You'll see the wholesale cost (called interchange) plus the processor's markup listed separately. A typical setup might look like interchange + 0.4% + $0.08 per transaction. This transparency usually translates to real savings once you're processing more than $5,000 monthly.

Membership pricing flips the traditional model on its head. Rather than marking up each transaction, you pay a monthly membership fee (typically $99-199) and get access to wholesale interchange rates. Think of it like a warehouse membership for payment processing - you pay upfront to access better prices.

Cash discount programs offer an interesting alternative that can eliminate your processing costs entirely. You add a small service fee for card payments while offering a discount for customers who pay cash. When implemented correctly, this shifts processing costs to customers who choose the convenience of card payments.

Flat-Rate vs. Interchange-Plus—Which Merchant Processing Companies Fit?

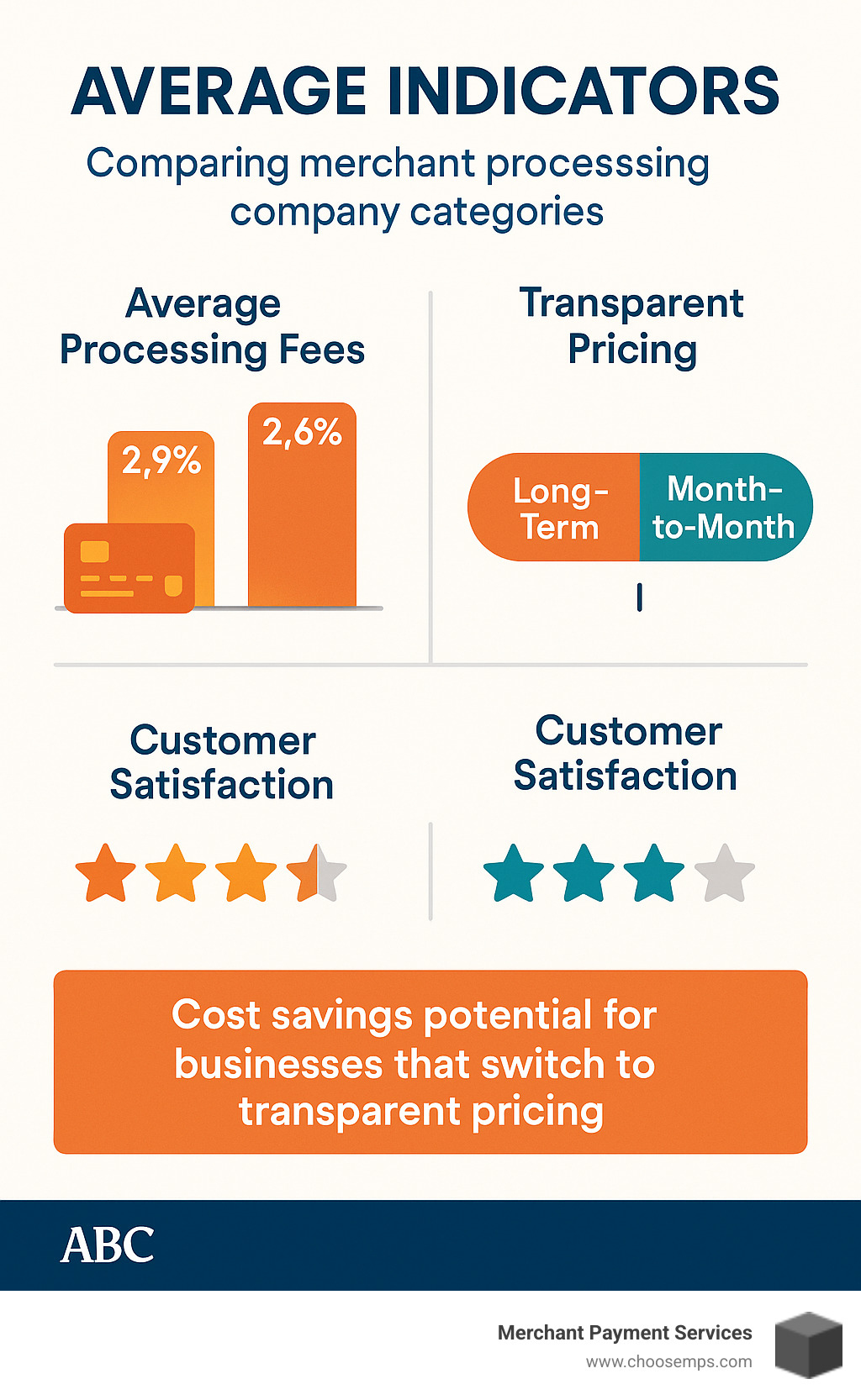

The choice between flat-rate and interchange-plus pricing often comes down to your monthly processing volume and how much you value predictability versus savings.

Flat-rate pricing shines when you're just starting out or have unpredictable sales patterns. You'll typically pay around 2.6-2.9% for most transactions, making it easy to calculate your costs. The trade-off is that you're often overpaying on debit cards and basic credit cards, which have lower actual processing costs.

Interchange-plus pricing becomes your friend as your business grows. The magic number where this model starts saving you money is usually around $5,000-10,000 in monthly processing volume. Once you cross this threshold, you'll typically see real savings because you're paying the actual wholesale costs plus just a small markup.

For businesses processing over $50,000 monthly, the savings can be substantial. We've helped merchants reduce their effective processing rate from 3.2% down to 2.4% simply by switching from flat-rate to interchange-plus pricing.

Membership & Zero-Cost Programs

Membership pricing models work like a payment processing subscription service. Instead of paying markup on every single transaction, you pay a monthly subscription fee (typically $99-199) and get access to wholesale interchange rates.

This approach can be a game-changer for high-volume merchants. If you're processing $50,000 or more monthly, the savings on transaction fees often exceed that monthly membership cost by hundreds of dollars.

More info about Low-Cost Merchant Services dives deeper into how these programs can benefit your specific business situation.

Zero-cost processing programs use a different strategy entirely. Through surcharging or cash discount programs, you can eliminate your processing fees by passing them along to customers who choose to pay with cards. You can typically add up to 3% to credit card transactions in states where it's legally allowed.

The catch with zero-cost programs is in the details. Surcharge rules vary significantly by state and card network, so you must follow specific implementation guidelines and properly disclose any fees.

Hidden Fees to Watch For

This is where many merchant processing companies make their real profit - through fees buried deep in contracts that you might not notice until they start appearing on your statements.

Early termination fees can hit you with $200-500 charges if you decide to switch processors before your contract ends. This is why we always recommend negotiating month-to-month agreements whenever possible.

PCI non-compliance fees range from $20-100 monthly and can be charged if you don't maintain proper security standards. The frustrating part is that some processors charge these fees even when you are compliant, so always verify what's actually included in your base pricing.

Statement fees and batch fees might seem small individually, but they add up quickly. Statement fees typically run $10-25 monthly, while batch fees cost $0.10-0.25 for each day you process transactions.

Equipment lease fees deserve special attention because they're often the most expensive hidden cost. A terminal that costs $300 to purchase might cost $50+ monthly on a lease program. Over a typical three-year lease, you'll end up paying over $1,800 for that same $300 terminal.

Evaluating Merchant Processing Companies for Your Specific Needs

Finding the right payment processor isn't a one-size-fits-all decision. Your merchant processing companies choice depends heavily on what type of business you run, how much you process monthly, and where you sell your products or services.

Industry type plays a huge role in your options. A coffee shop has completely different needs than an online retailer or a home service business. Restaurants need fast terminals that handle tips easily, while e-commerce stores need robust online payment gateways that integrate smoothly with their websites.

Your risk profile matters more than you might think. Some industries face higher chargeback rates or regulatory scrutiny, which affects both your processor options and pricing.

Omnichannel capabilities become essential if you sell through multiple channels. Maybe you have a physical store, an online shop, and do craft fairs on weekends. The best processors offer unified reporting so you can see all your sales in one place.

Next-day funding has become the standard expectation, but same-day deposits might cost extra - usually around 1% of your deposit. If you need money fast to cover expenses or restock inventory, this feature can be worth the cost.

Contract length affects your flexibility significantly. Month-to-month agreements cost slightly more but give you the freedom to switch if you find better terms or if your needs change.

Support quality varies dramatically between processors. When your terminal stops working during your busiest hour, you'll want to reach a real person quickly.

Merchant Processing Companies for High-Risk & Nonprofits

Some businesses face extra challenges when choosing payment processors. High-risk industries like CBD companies, firearms dealers, or debt consolidation services often get declined by standard processors or face much higher rates.

Specialized high-risk processors understand these industries and create custom solutions. Yes, you'll typically pay more - usually 2.4% to 3.5% plus $0.10 to $0.25 per transaction instead of standard rates. But having reliable processing is worth the premium when other processors won't even work with you.

More info about High-Risk Merchant Payment Processing explains the specific requirements and options available for challenging industries.

Rolling reserves are common for high-risk merchants. Your processor might hold 5% to 15% of your daily deposits for 30 to 180 days to cover potential chargebacks.

Nonprofits often qualify for special discounted rates. Many processors offer pricing like interchange plus just 0.10% plus $0.08 for qualified charitable organizations.

Hardware, Software & Integrations

The right merchant processing companies offer hardware that matches how you actually do business. POS terminals work great for traditional retail counters, while mobile readers suit businesses that travel to customers like contractors or food trucks.

Virtual terminals let you process phone or mail orders from any computer with internet access. This flexibility helps businesses that take orders remotely or need to process payments from multiple locations.

Modern API gateways enable custom integrations if you have unique software needs. Whether you use industry-specific software or custom-built systems, make sure your processor offers compatible APIs or plugins that work seamlessly.

More info about Best Payment Gateway Solutions covers the technical aspects of online payment processing in detail.

Accounting sync saves you hours of manual data entry every month. Popular integrations automatically import your transactions, reducing errors and simplifying your bookkeeping process.

POS system integration streamlines your entire operation by combining payment processing with inventory management, employee scheduling, and customer relationship management.

Customer Support & Cash-Flow Speed

When payment problems arise, quality customer support becomes your lifeline. Look for processors offering 24/7 phone support with real humans who can actually solve problems, not just chatbots that send you in circles.

Average response times under 60 seconds indicate well-staffed support teams that prioritize customer service. When your terminal stops working during a busy Saturday, those response times matter tremendously.

Same-day funding typically costs 1% to 1.5% of your deposit amount but can dramatically improve cash flow for businesses with tight margins. Next-day funding has become standard and is usually free for qualifying merchants.

Weekend funding availability helps businesses that do significant weekend sales. Some processors deposit funds seven days a week, while others only process Monday through Friday.

Security & Fraud-Prevention Must-Haves

When choosing between merchant processing companies, security capabilities should top your priority list. A single data breach can cost your business thousands in fines, legal fees, and lost customer trust. The good news? Modern payment security has come a long way.

End-to-end encryption acts like an armored truck for your customer data. From the moment someone swipes their card until the transaction reaches the bank, all information stays scrambled and unreadable. Even if hackers intercept the data, they can't use it.

Tokenization takes security one step further by replacing real card numbers with meaningless tokens. Think of it as giving someone a hotel key card instead of your house key - the token only works in specific situations and becomes useless if stolen.

EMV chip technology has been a game-changer for in-person transactions. Since chip cards became standard, counterfeit fraud dropped by over 80% in the US. When you use EMV-enabled terminals, the liability for fraudulent chip transactions shifts away from your business to the card issuer.

Smart chargeback prevention tools work behind the scenes to spot trouble before it hits your account. These systems analyze transaction patterns and can flag suspicious purchases based on factors like unusual purchase amounts, shipping addresses that don't match billing addresses, or multiple rapid-fire transactions.

AI-powered fraud filters learn from your specific business patterns. If you normally sell $50 items locally but suddenly get a $2,000 order shipping internationally, the system flags it for review. The best part? These systems get smarter over time and reduce false positives that could block legitimate customers.

Regular compliance audits keep you on the right side of payment card industry rules. Look for processors that don't just meet PCI DSS requirements but actually help you understand and maintain compliance throughout the year.

Building a Secure Stack with Merchant Processing Companies

Creating a truly secure payment environment requires multiple layers of protection working together. Multi-factor authentication adds a crucial second step when accessing your merchant account - even if someone steals your password, they still can't get in without your phone or authentication app.

Secure APIs matter especially if you run an online store or use custom software integrations. These encrypted connections ensure that data flowing between your website, shopping cart, and payment processor stays protected from prying eyes.

Don't let PCI SAQ assistance intimidate you - it's just annual paperwork proving you follow security best practices. The Self-Assessment Questionnaire sounds scary, but experienced processors walk you through it step by step. Many even provide online tools that make compliance tracking almost automatic.

Your payment systems need regular security updates just like your computer or phone. Choose processors that handle updates automatically and keep you informed about any changes that might affect your business operations.

Fraud monitoring services act like a security guard for your merchant account. These systems watch for unusual patterns - like a sudden spike in international orders or multiple declined cards from the same IP address - and alert you before problems escalate.

Some forward-thinking processors even include data breach insurance as part of their service package. While nobody plans for security incidents, having coverage provides peace of mind and financial protection if the worst happens despite your best efforts.

Frequently Asked Questions about Merchant Processing Companies

What services do merchant processing companies provide?

Merchant processing companies act as the bridge between your business and the banking networks that make card payments possible. Think of them as your payment partner who handles all the technical complexity behind that simple card swipe.

The core service is obviously processing credit and debit cards, but modern processors do much more. They handle ACH transfers for bank-to-bank payments, mobile wallet transactions like Apple Pay, and secure online payment gateways for e-commerce stores.

Most merchant processing companies provide the hardware you need at no upfront cost. This includes countertop terminals, mobile card readers, and complete POS systems that integrate with your business operations. You're not just getting a card reader - you're getting a complete payment ecosystem.

The software side includes virtual terminals for processing phone orders, automated recurring billing for subscription businesses, and detailed reporting that helps you understand your sales patterns. Many processors also throw in fraud prevention tools and chargeback management services.

Beyond payments, many companies offer business financing, cash advances, and integration with popular accounting software like QuickBooks. The goal is to become your one-stop shop for financial services rather than just processing transactions.

How fast can I get my funds?

The speed of getting your money depends on several factors, but next-day funding has become the standard expectation in 2024. Most transactions processed before your daily cutoff time (usually around 6-8 PM) will appear in your bank account the following business day.

If you need money faster, same-day funding is available from many processors for an additional fee of about 1-1.5% of your deposit. This can be a lifesaver for businesses with tight cash flow or unexpected expenses.

Weekend funding varies significantly between merchant processing companies. Some deposit funds seven days a week, while others stick to traditional Monday-through-Friday schedules. If you do significant weekend business, this timing difference can impact your cash flow planning.

Your bank also plays a role in funding speed. Major national banks typically process ACH deposits quickly, while smaller community banks or credit unions might add an extra day to the timeline. It's worth asking your processor about their experience with your specific bank.

Federal holidays throw a wrench into the usual schedule since ACH processing stops on these days. Plan ahead for holidays that fall on weekdays, as they'll delay your deposits regardless of your processor's normal speed.

Are long-term contracts required?

The contract landscape has shifted dramatically in recent years, with more merchant processing companies offering flexible terms. Many processors now provide month-to-month agreements, especially for established businesses with solid credit histories.

Long-term contracts still exist and sometimes come with slightly lower processing rates as an incentive for the commitment. However, those early termination fees can sting - often ranging from $200 to $500 if you need to break free early.

At Merchant Payment Services, we believe you shouldn't be trapped in a relationship that isn't working. Our month-to-month agreements mean we have to earn your business every single month rather than relying on contract clauses to keep you around.

Some situations might require longer commitments, particularly for high-risk businesses or when significant equipment financing is involved. But even then, you should negotiate terms that feel comfortable for your specific situation.

Always read the fine print on contract renewals. Some agreements automatically extend for additional terms unless you provide written notice well in advance - sometimes 30 to 90 days before your current term expires. Nobody wants surprise contract extensions.

Conclusion

Choosing the right payment processor significantly impacts your bottom line. With over 5,000 merchant processing companies in North America, finding transparent, fair-priced solutions requires careful evaluation of pricing models, contract terms, and service quality.

The key is matching your processor to your specific business needs. High-volume merchants benefit from interchange-plus or membership pricing, while smaller businesses might prefer flat-rate simplicity. Industries with unique requirements need specialized processors that understand their challenges.

Security, support quality, and funding speed are equally important considerations. Your processor should protect your business and customers while providing reliable service when you need assistance.

At Merchant Payment Services, we've built our reputation on transparency and flexibility. Our month-to-month agreements, free terminals, and no hidden fees approach reflects our belief that processors should earn your business through service quality, not contract locks.

We serve businesses throughout Ohio, including Dayton, Cincinnati, Columbus, and surrounding communities. Our local presence means you can reach us when you need support, and our industry expertise helps you steer the complex world of payment processing.

Whether you're just starting to accept cards or looking to switch from an expensive processor, we're here to help you find solutions that won't swipe your profits. Our risk-free approach means you can try our services without long-term commitments or hidden costs.

More info about Merchant Payment Processing Solutions provides additional details about finding the right processor for your business needs.

The payment processing industry continues evolving with new technologies and pricing models. By understanding how different processors operate and what they offer, you can make informed decisions that benefit your business for years to come.