The Truth About High-Risk Merchant Payment Processing

Why Understanding High-Risk Merchant Payment Processing is Critical for Your Business

High risk merchant payment processing is a specialized payment solution designed for businesses that traditional processors consider too risky due to factors like high chargeback rates, industry type, or regulatory concerns. Here's what you need to know:

Key Features of High-Risk Processing:

- Higher fees: 3-5% vs 2-3% for standard accounts

- Rolling reserves: 5-10% of transactions held for 3-6 months

- Longer settlements: 3-7 days vs next-day funding

- Specialized underwriting: More documentation required

- Improved fraud tools: Advanced security measures included

Common High-Risk Industries:

- CBD and cannabis-related businesses

- Adult entertainment and products

- Travel and hospitality

- Online gaming and gambling

- Nutraceuticals and supplements

- Firearms and ammunition

- Subscription and continuity services

The payment processing landscape has shifted dramatically - only 19% of consumers still prefer cash, making card acceptance essential for business survival. Yet many legitimate businesses find themselves labeled "high-risk" and struggle to secure reliable payment processing.

If your business has been denied by traditional processors or if you're facing sudden account shutdowns and frozen funds, you're likely dealing with high-risk classification. This doesn't reflect poorly on your business ethics - it's simply how the industry categorizes certain sectors and business models.

As Lydia Valberg, co-owner of Merchant Payment Services with over 35 years of family legacy in payment processing, I've helped countless businesses steer the complexities of high risk merchant payment processing and secure stable, transparent solutions. My experience has shown that understanding your options and working with the right partner can transform payment processing from a business obstacle into a competitive advantage.

What Makes a Business "High Risk"?

Being classified as high-risk doesn't mean your business is problematic. It simply means processors view your industry or business model as having higher potential for financial losses. Understanding these factors can help you prepare for the application process and set realistic expectations.

Chargeback ratios are the biggest red flag for processors. If your business sees chargeback rates above 1%, you'll likely face high-risk classification. This happens because when customers dispute charges, the processor often absorbs the cost.

Monthly processing volume also matters significantly. Businesses handling over $20,000 monthly or processing individual transactions above $100 face increased scrutiny. Higher volumes simply mean higher potential losses if something goes wrong.

Your industry classification through Merchant Category Codes can instantly trigger high-risk status. Some industries have earned this reputation through years of liftd dispute rates or regulatory complexity.

Business history plays a crucial role too. New businesses without processing track records, companies with poor credit scores, or those appearing on the MATCH list automatically face high-risk classification.

Payment models featuring subscriptions, recurring billing, or card-not-present transactions carry inherent risks. Customers forget about subscriptions, dispute recurring charges, or claim they never authorized payments.

International sales add complexity through increased fraud risk and regulatory challenges across different countries. While global reach can boost revenue, it also raises red flags for risk assessment.

Common High-Risk Industries

CBD and cannabis-related businesses face unique challenges despite increasing legalization. Federal banking regulations create a complex landscape that makes traditional processors nervous.

Nutraceuticals and supplements deal with high return rates and aggressive marketing claims that often attract regulatory scrutiny from the FDA.

Firearms and ammunition businesses operate under strict federal regulations and liability concerns that automatically place them in high-risk territory.

Travel and hospitality companies face the challenge of long periods between booking and service delivery, leading to disputes and chargebacks.

Online gaming and gambling operations steer complex regulatory requirements while dealing with high dispute rates from customers.

Subscription box services often see customers forget about recurring charges or feel disappointed with contents, leading to disputes rather than proper cancellations.

More info about Credit Card Payment Processing

Key Risk Factors Underwriters Check

Your processing history tells a story. Previous merchant accounts, reasons for any terminations, and historical chargeback patterns provide valuable insight into future performance.

Website compliance demonstrates professionalism and legitimate operations. Underwriters look for clear refund policies, comprehensive terms of service, privacy policies, and overall professional presentation.

Financial stability gets evaluated through bank statements, tax returns, and credit reports. Processors want confidence that you can handle rolling reserves and potential losses.

Business age matters because established companies with proven track records pose less risk than brand-new ventures.

Average ticket size directly correlates to potential loss exposure. Higher transaction amounts mean bigger potential losses from chargebacks or fraud.

Your refund and return policies reveal customer satisfaction expectations. Clear, fair policies reduce dispute likelihood and demonstrate professional operations focused on customer service.

High Risk Merchant Payment Processing Explained

High risk merchant payment processing works differently than regular payment processing. Regular processors are like cautious banks that only lend to people with perfect credit. High-risk processors are specialized lenders who understand that some perfectly legitimate businesses operate in challenging industries.

The key difference is specialized acquirers who actually understand your industry's unique challenges. These processors maintain relationships with banks that specialize in higher-risk merchant categories.

Rolling reserves are probably the biggest shock for new high-risk merchants. Every time you make a sale, the processor keeps 5-10% of that money in a separate account for 3-6 months as insurance against potential chargebacks and disputes.

Multi-currency support and international payment acceptance often come standard with high-risk accounts. Many processors also offer offshore options for businesses that can't secure domestic processing.

PCI DSS compliance isn't optional - it's built into every high-risk solution because processors can't afford security breaches with their liftd risk exposure.

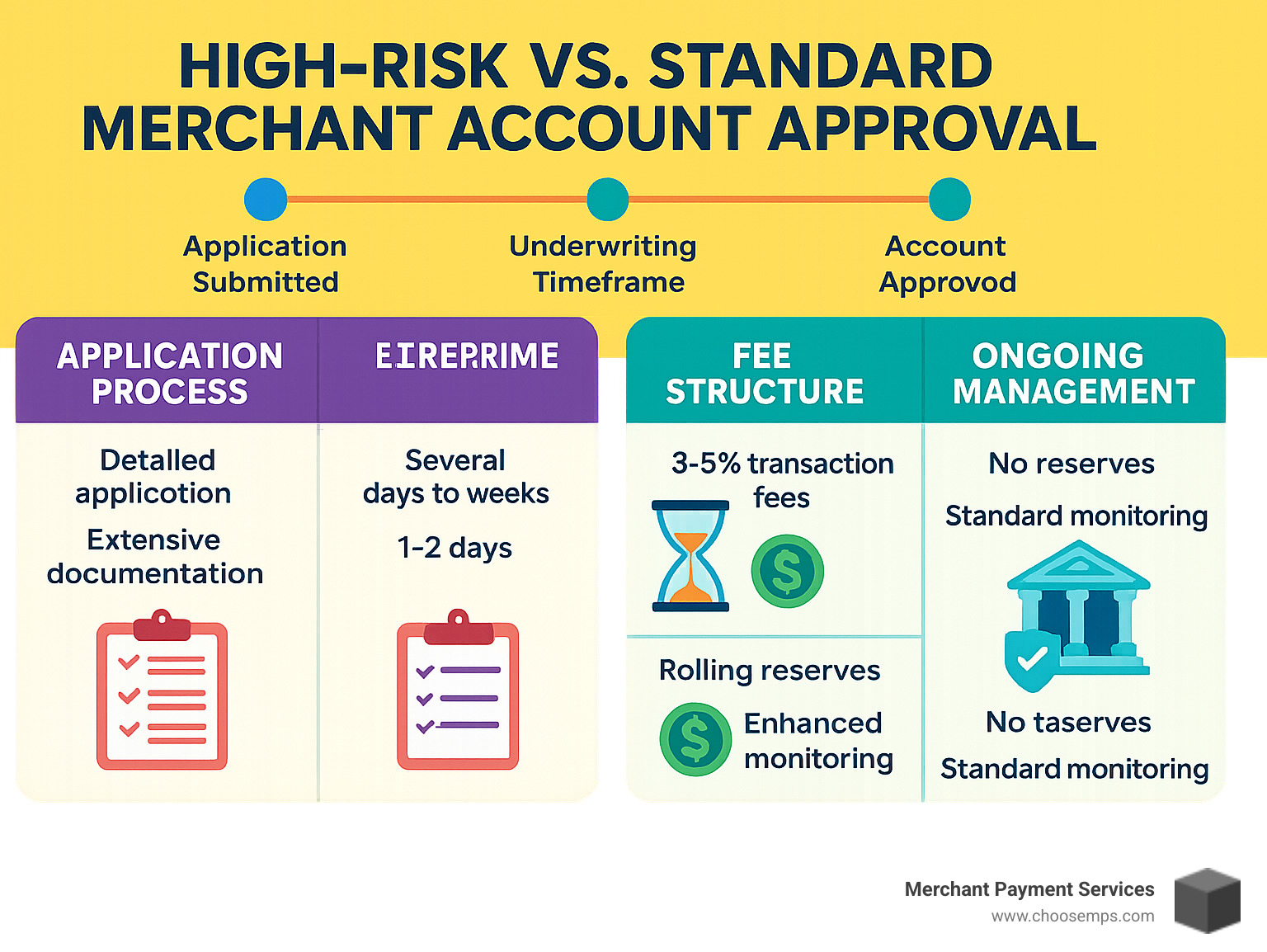

High Risk Merchant Payment Processing vs Standard Accounts

| Feature | Standard Accounts | High-Risk Accounts |

|---|---|---|

| Processing Fees | 2-3% | 3-5% |

| Rolling Reserves | 0-2% | 5-10% |

| Settlement Time | 1-2 days | 3-7 days |

| Application Time | 24-48 hours | 5-10 business days |

| Chargeback Fees | $15-25 | $25-100 |

| Volume Restrictions | Minimal | Often capped |

| Contract Terms | Flexible | Stricter |

Processing fees of 3-5% might sting compared to the 2-3% standard merchants pay, but consider the alternative - no processing at all. Some high-risk accounts can reach 4.3% blended rates, especially for newer businesses.

Reserve requirements hit your cash flow the hardest. When 10% of every transaction sits in limbo for six months, you're essentially giving the processor an interest-free loan. But those reserves protect you too - they're your buffer against chargeback disasters.

Settlement periods stretch to 3-7 days instead of next-day funding, which means your cash flow planning needs to account for this delay.

Advantages & Disadvantages for High-Risk Merchants

The advantages make it worthwhile for most businesses. Global reach opens up international markets that could dramatically expand your customer base. You gain the ability to sell restricted goods that mainstream processors won't touch. The fraud tools included with high-risk accounts often surpass what standard merchants get.

Gateway flexibility means you're not locked into one payment gateway - many high-risk processors support multiple gateways, giving you backup options.

The disadvantages are real and significant. Higher costs affect your profit margins on every transaction. Possible fund holds can happen if your account shows unusual activity. Volume caps might limit your growth until you prove stability over time.

Application & Approval Process

Getting approved for high risk merchant payment processing requires patience and thorough preparation. The online form is just the beginning - expect to provide extensive documentation.

KYC documentation includes your driver's license, business license, articles of incorporation, and sometimes personal financial statements. Six months of bank statements show your business's financial stability and transaction patterns.

If you've processed payments before, processing statements from previous providers are crucial. They show your chargeback history, monthly volumes, and any account issues. A bank letter confirming your account status and a voided check complete the financial documentation.

The site review process involves underwriters examining your website for compliance issues, clear policies, and professional presentation.

Approval typically takes 5-10 business days. This thorough review process protects you - it means your processor understands your business model and is committed to supporting it long-term.

More info about Merchant Accounts for Small Businesses

Costs, Fees, Reserves & Contract Terms

High risk merchant payment processing costs more than standard accounts. Understanding exactly what you're paying for helps you make informed decisions and budget effectively.

The Reality of High-Risk Processing Fees

Your processing costs will typically fall into two main structures. Interchange plus pricing charges the actual interchange rate plus an additional 1.5% or higher. Standard businesses might pay interchange plus just 0.3%.

Blended rate pricing simplifies everything into one rate - often around 4.3% per transaction. While this makes budgeting easier, it might cost more depending on your typical transaction types.

Chargeback fees sting the most. Instead of the $15-25 that standard merchants pay, you're looking at $25-$100 per chargeback incident.

Understanding Rolling Reserves

Most high-risk processors will hold 5-10% of your monthly processing volume for about 180 days. Think of it as a security deposit that protects them against potential chargebacks.

If you're processing $100,000 monthly, that means $10,000 of your money is constantly sitting in reserve. It's not gone forever - it's just not available when you might need it most.

Some processors offer capped reserves, where the held amount stops growing once it hits a certain level. This provides relief as your business grows.

The Hidden (and Not-So-Hidden) Fees

Beyond processing rates, you'll encounter various additional costs. Setup fees can range from $0-$500, though we eliminate these entirely at Merchant Payment Services.

Monthly gateway fees typically run $10-$50, while statement fees add another $10-25. You'll also face PCI compliance fees of $100-$200 annually.

The fee that really hurts is early termination - often $200-$500 if you need to leave before your contract ends.

Contract Terms That Actually Matter

High-risk contracts tend to be stricter than standard agreements. Many processors lock you into 2-3 year terms with hefty penalties for early exit. They'll also impose volume limits and detailed compliance requirements.

At Merchant Payment Services, we offer month-to-month agreements even for high-risk merchants, because we believe you should stay with us because you want to, not because you're trapped in a contract.

Making Sense of the Numbers

Yes, high-risk processing costs more. But consider the alternative - not being able to accept credit cards at all means losing customers and revenue. When you factor in the specialized support, advanced fraud tools, and ability to serve restricted markets, the investment often pays for itself.

The key is working with a processor who's transparent about all costs upfront. No hidden fees, no surprise charges, and no contracts that lock you in when better options become available.

More info about Low-Cost Merchant Services

Managing Risk: Chargebacks, Fraud & Compliance

When you're operating a high risk merchant payment processing account, managing chargebacks and fraud isn't just good business practice - it's absolutely critical for keeping your doors open. With most processors pulling the plug when chargeback ratios hit 1-2%, you need to stay ahead of the game.

Chargebacks are the ultimate customer complaint - one that costs you money, time, and potentially your entire payment processing relationship. When customers dispute transactions through their banks instead of calling you directly, you're looking at a 90-120 day resolution process that can cost 2-3 times the original transaction amount.

The most common reasons customers file chargebacks include unrecognizable billing descriptors, delayed deliveries, product dissatisfaction, and friendly fraud where customers dispute legitimate purchases they simply forgot about.

Modern fraud prevention starts with EMV chip technology for in-person transactions, which shifts liability for fraudulent transactions from your business to the card issuer. For online sales, 3-D Secure authentication adds an extra security layer by requiring customers to verify their identity with their bank.

One of the smartest investments you can make is in real-time alert services like Ethoca Alerts. These systems notify you when a customer contacts their bank about a potential dispute, giving you a chance to resolve the issue with a refund before it becomes an official chargeback.

AI-powered fraud detection has become incredibly sophisticated, analyzing transaction patterns in real-time to flag potentially fraudulent activity. Dynamic billing descriptors ensure customers recognize your charges on their statements, preventing confusion-based disputes.

The key to staying compliant involves maintaining PCI DSS standards and keeping detailed records of all transactions and customer communications.

Scientific research on PCI compliance

More info about Ecommerce Fraud Protection Services

Reducing Chargebacks Below 1%

Keeping your chargeback ratio below that critical 1% threshold requires a systematic approach that touches every part of your customer experience.

Shipping and delivery management forms the foundation of chargeback prevention. Always provide tracking numbers immediately after shipment, and for high-value items, require signature confirmation. When possible, use expedited shipping - customers appreciate faster delivery, and it reduces the window for buyer's remorse.

Your customer service team becomes your first line of defense against chargebacks. Respond to customer inquiries within 24 hours, make your contact information easy to find, and train your staff to resolve issues quickly and fairly.

Clear communication throughout the purchase process prevents most disputes. Send immediate order confirmations, provide realistic delivery timeframes, and notify customers about any delays.

For subscription-based businesses, send renewal reminders before charging recurring fees, provide easy cancellation processes, and consider offering trial period extensions instead of immediately charging disputed amounts.

Descriptor testing with your payment processor can dramatically reduce chargebacks. Work with them to test different billing descriptors and choose the one that generates the fewest customer inquiries.

Essential Fraud-Prevention Toolset

Building a comprehensive fraud prevention system requires multiple layers of security working together. Each tool catches different types of fraud, creating a robust defense system.

Address Verification Service (AVS) compares the billing address your customer provides with the address on file with their card issuer. CVV/CVV2 verification adds another authentication layer by requiring the security code from the back of the card.

Velocity filtering monitors how frequently cards are used and for what amounts. If someone tries to make multiple large purchases in a short time, the system flags it as suspicious.

Device fingerprinting creates unique identifiers for the devices customers use to make purchases. This technology helps identify suspicious patterns across multiple accounts.

Tokenization replaces sensitive card data with secure tokens, dramatically reducing your risk if there's ever a data breach. It also helps with PCI compliance by reducing the scope of sensitive data you store.

Geographic filtering allows you to block transactions from high-risk countries or regions that don't align with your business model.

Choosing a High-Risk Processor & Best Practices

Finding the right high risk merchant payment processing partner isn't just about getting approved - it's about building a relationship that will support your business growth for years to come. After helping hundreds of high-risk merchants secure reliable processing, I've seen how the right processor can transform a struggling business into a thriving enterprise.

The challenge lies in navigating a marketplace filled with processors making big promises but delivering disappointing results. The key is finding a processor that combines industry expertise with genuine transparency.

Industry expertise matters more than you might think. A processor experienced in CBD regulations understands compliance requirements that a generalist might miss entirely. They know which acquiring banks work best for your vertical and can anticipate potential issues before they become problems.

Transparent pricing should be non-negotiable. If a processor won't provide clear fee schedules upfront or dodges questions about additional charges, consider it a red flag.

Contract flexibility protects your business interests. Month-to-month agreements give you the freedom to leave if service deteriorates or better options become available.

Multiple banking relationships provide crucial backup options. Processors with diverse banking partnerships can quickly move your account if issues arise with your primary acquiring bank.

Watch out for processors who guarantee approval without reviewing your business details, request upfront fees before approval, or pressure you to sign immediately.

More info about Payment Gateway and Processor

The evaluation process doesn't have to be overwhelming. Start by researching three to five processors specializing in your industry. Request detailed quotes including all fees and contract terms - not just the headline processing rate.

Setting Up Multiple MIDs for Continuity

Smart high-risk merchants never put all their eggs in one basket. Setting up multiple merchant identification numbers (MIDs) isn't paranoia - it's sound business planning that protects against unexpected account closures.

Business continuity represents the primary benefit of a multi-MID strategy. If one account faces sudden closure due to chargeback spikes or regulatory changes, your other accounts keep transactions flowing.

Load distribution across multiple accounts provides operational advantages. You can spread transaction volume to stay under individual account limits or use different MIDs for different product lines.

Gateway token vault technology makes multi-MID management practical. Modern payment gateways store customer payment tokens independently of your merchant accounts, allowing you to switch between MIDs without losing stored payment methods.

Traffic load-balancing takes this concept further by automatically routing transactions to the best-performing MID based on success rates, fees, or risk factors.

Integration & Settlement Tips

The technical side of high risk merchant payment processing doesn't have to be complicated, but making smart choices during setup pays dividends in operational efficiency.

API integration versus hosted payment pages represents your first major decision. Direct API integration provides complete control over the customer experience but requires more development resources. Hosted payment pages offer simpler implementation and reduced compliance scope.

Shopping cart compatibility eliminates integration headaches. Ensure your chosen processor offers plugins for your e-commerce platform, whether that's Shopify, WooCommerce, Magento, or custom solutions.

Batch timing affects your cash flow more than you might realize. Submit transaction batches before your processor's daily cutoff times to avoid delayed settlement.

Same-day funding options can improve cash flow for businesses with tight margins, though they typically come with additional fees.

At Merchant Payment Services, we understand that high risk merchant payment processing success depends on more than just approval - it requires ongoing partnership, transparent pricing, and flexible terms that grow with your business.

Frequently Asked Questions about High-Risk Merchant Payment Processing

How does high-risk merchant payment processing impact my overall fees?

High risk merchant payment processing will cost you more than standard accounts. Understanding exactly how much helps you budget properly and decide if the benefits outweigh the costs.

Your processing fees jump from 2-3% to 3-5% per transaction. A business processing $50,000 monthly could pay an extra $500-1,000 in fees alone.

Chargeback fees hit harder too - expect $25-100 per incident instead of the $15-25 that standard merchants pay.

The rolling reserves hurt your cash flow most. With 5-10% of your monthly volume held for 3-6 months, that same $50,000 monthly business has $2,500-5,000 constantly tied up.

These higher costs often make perfect sense when you consider the alternative. If traditional processors won't touch your business, paying extra for high risk merchant payment processing beats not accepting credit cards at all.

What documents speed up approval for high-risk merchant payment processing?

Getting approved faster comes down to being prepared with complete documentation. Missing paperwork is the biggest cause of approval slowdowns.

Your bank statements matter most - provide six full months showing consistent deposits and healthy balances. Processors want to see you're financially stable and your business generates real revenue.

Previous processing statements tell your story if you've had merchant accounts before. Even if a previous account was terminated, showing your processing history helps underwriters understand your business patterns.

Government-issued photo ID for all owners with 25% or more stake in the business is non-negotiable.

Your business formation documents prove legitimacy. Articles of incorporation, LLC operating agreements, or business licenses show you're operating legally.

Professional website review can make or break your application. Ensure your site has clear terms of service, privacy policies, and refund policies.

What should I do if my high-risk merchant payment processing account is frozen?

Account freezes feel terrifying, but staying calm and acting quickly can minimize the damage.

Contact your processor immediately - not tomorrow, not after you finish other tasks. Call the moment you find the freeze and ask for specific reasons.

Gather documentation fast because every day counts. Recent bank statements, customer service records for disputed transactions, and explanation letters for unusual activity should be your priority.

Activate your backup merchant account if you have one set up. This is why smart high-risk merchants maintain multiple processing relationships.

Communicate honestly with customers about potential payment delays. Customers appreciate transparency and may offer alternative payment methods.

Review your recent transactions for patterns that might have triggered the freeze. Sudden volume spikes, unusual geographic patterns, or chargeback clusters often cause automatic freezes.

The key lesson? Prevention beats reaction every time. Maintain multiple merchant accounts, monitor your chargeback ratios religiously, and keep your processor informed about business changes.

Conclusion

Securing reliable high risk merchant payment processing can seem daunting when traditional banks keep saying no. Yet, the right solution doesn’t have to be expensive or unpredictable.

High-risk accounts do carry higher fees and stricter rules, but they also give you the ability to accept cards and grow when other options are closed. Keep chargebacks below 1%, use layered fraud tools, and communicate clearly with customers—that’s the formula for long-term stability.

Transparency is critical. If a processor hides fees or insists on a long contract, walk away. At Merchant Payment Services we use month-to-month agreements and zero startup fees because we believe partnerships should be earned, not enforced.

Never rely on a single MID. Maintaining backup accounts protects cash flow if your primary line is interrupted.

From Dayton to Cincinnati to Columbus, we’ve helped businesses others considered “too risky” turn payments into a competitive edge. Want to see how transparent, supportive processing feels? We’re ready to help—one transaction at a time.