Credit Card Approval Without the Hassle: Your Easy Acceptance Guide

Why Easy Credit Card Acceptance Opens Doors for Everyone

Easy credit card acceptance means getting approved for a credit card without jumping through endless hoops or meeting sky-high credit requirements. Whether you're building credit from scratch, recovering from past mistakes, or simply want a straightforward approval process, these cards are designed to say "yes" when others say "no."

Quick Answer for Easy Credit Card Acceptance:

Secured cards - Start with $200+ deposit, 89%+ approval rates

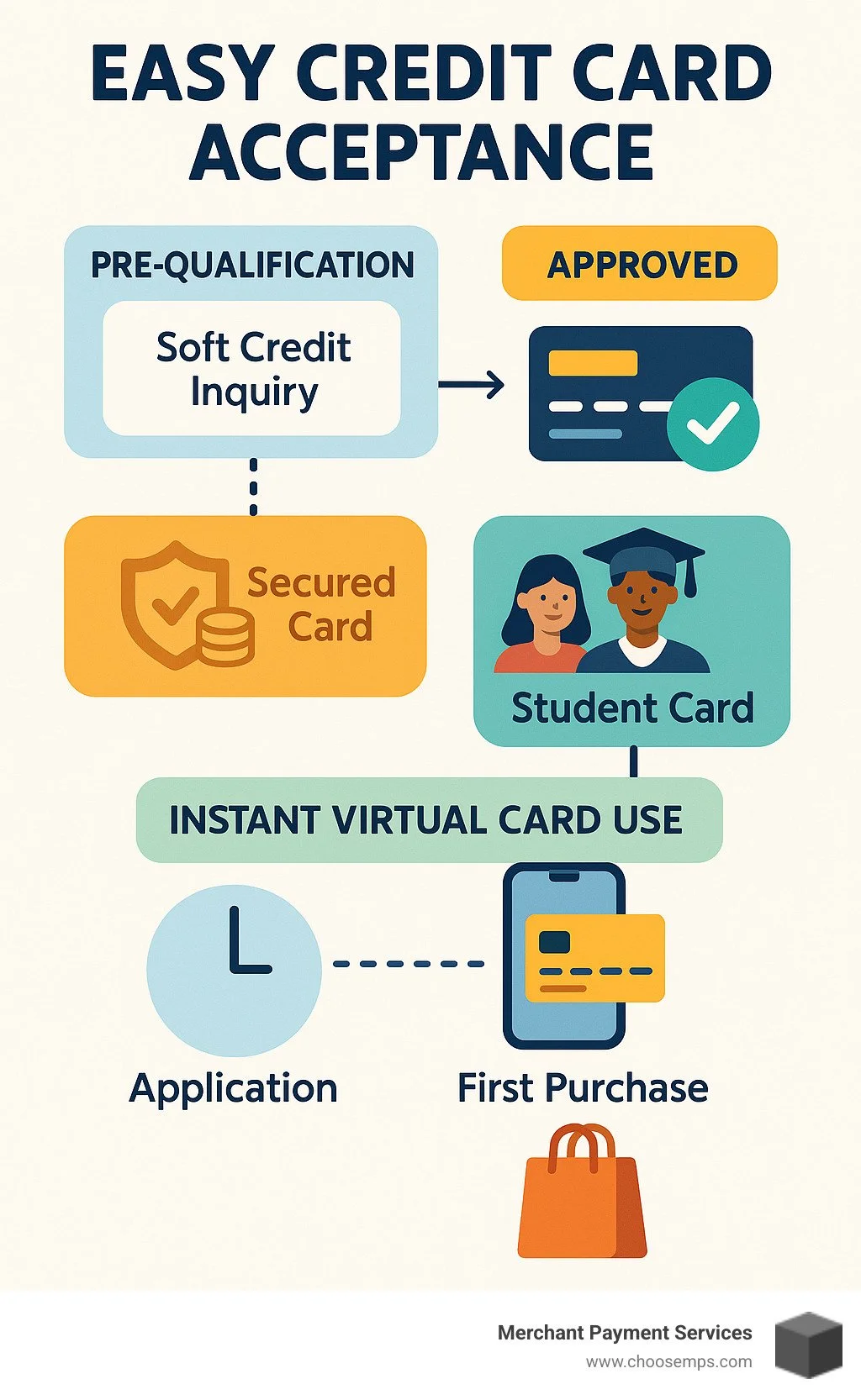

Pre-qualification tools - Check eligibility without hard credit pulls

Student cards - Designed for limited credit history

Store cards - Easier approval for fair credit applicants

Instant virtual numbers - Use your card immediately after approval

No credit check options - Income-based approval without credit history

The days of waiting weeks for a credit decision are over. As one industry expert notes, "Credit card processing doesn't need to be complicated, it can be simple." Modern card issuers now offer pre-qualification processes that use soft credit checks, instant approval decisions, and virtual card numbers you can use before your physical card arrives.

From secured cards with deposits as low as $200 to student cards that consider your potential rather than your past, today's market offers multiple paths to credit access. Some cards even provide instant use through virtual numbers, letting you shop online or add to digital wallets within minutes of approval.

I'm Lydia Valberg, and after 35+ years in the payment processing industry through our family business, I've seen how easy credit card acceptance transforms both personal finances and business operations. My experience helping thousands of merchants process payments has shown me exactly which cards work best for different situations and how to avoid the common pitfalls that trip up new cardholders.

What Does Easy Credit Card Acceptance Mean?

Think of easy credit card acceptance as the difference between knocking on a door that might slam shut versus walking through one that's already wide open. These cards are specifically designed to welcome people who traditional credit cards might turn away.

The magic happens in how these cards evaluate your application. Instead of obsessing over your credit score like a strict teacher grading papers, they look at the bigger picture. Maybe you have steady income from your job, a solid banking relationship, or you're willing to put down a small security deposit. Some cards focus on your current financial situation rather than mistakes you made years ago.

Easy credit card acceptance targets anyone who's tired of hearing "no" from traditional credit cards. If you've got fair credit (that's a FICO score between 580-669), limited credit history, or you're rebuilding after some financial bumps in the road, these cards are designed with you in mind.

Here's what makes the process genuinely "easy": most of these cards let you check your approval odds using a soft credit pull. That means you can window shop for credit cards without worrying about dinging your credit score. It's like being able to try on clothes without buying them first.

Many cards also offer instant decisions and virtual card numbers you can use right away. No more twiddling your thumbs for weeks wondering if you'll get approved, then waiting even longer for your plastic to arrive in the mail. Your new credit line can start helping your cash flow within hours instead of weeks.

All legitimate cards report your payment history to the three major US credit bureaus—TransUnion, Equifax, and Experian. This means every on-time payment you make is building your credit foundation for the future. Plus, modern cards follow EMV standards to keep your transactions secure whether you're shopping online or tapping to pay at your favorite coffee shop.

Who Benefits from Easy Credit Card Acceptance?

Students are probably the biggest winners when it comes to easy credit card acceptance. Think about it—you're 19 years old, working part-time at the campus bookstore, and you've never had a credit card before. Traditional cards take one look at your thin credit file and wave goodbye. Student cards, on the other hand, see your college enrollment and think "future doctor, lawyer, or engineer" instead of "risky borrower."

Newcomers to the US face a frustrating catch-22 in the American credit system. You might be a successful engineer from Germany or a skilled nurse from the Philippines, but your excellent credit history from back home means absolutely nothing here. You're starting from zero, just like an 18-year-old. Easy acceptance cards often work with Individual Taxpayer Identification Numbers (ITINs) instead of requiring Social Security Numbers, giving immigrants and international students a fighting chance.

Credit rebuilders know the sting of past financial mistakes all too well. Maybe it was a medical bankruptcy, a divorce that wrecked your finances, or just a rough patch where bills piled up faster than paychecks. You've got your life back on track now, but your credit report still tells the old story. These cards give you a chance to write new chapters.

Gig workers and freelancers often have the income to support credit cards but struggle with traditional approval processes that expect W-2s and steady paystubs. If you're driving for rideshare companies, freelancing as a graphic designer, or running your own small business, your income might vary month to month. Easy acceptance cards often look at your total annual earnings and bank account patterns instead of demanding traditional employment verification.

Key Features That Signal "Easy" Acceptance

Low deposit requirements separate the truly accessible secured cards from the ones that just claim to be easy. While some secured cards demand $500 or more upfront, genuinely accessible options often start at just $200. Some innovative cards even let you start with deposits as low as $49 for a $200 credit line.

No annual fees make a huge difference when you're building credit on a budget. Every dollar counts when you're starting out, and the last thing you need is a $99 annual fee eating into your grocery money. Fee-free cards let you focus on building good payment habits without worrying about additional costs.

Pre-qualification tools might be the most valuable feature of all. These let you peek behind the curtain and see your approval odds before you officially apply. You'll typically just need basic information like your name, address, and the last four digits of your Social Security Number. Since they only use soft credit pulls, you can shop around without leaving footprints on your credit report.

Virtual card numbers for instant use represent the newest frontier in easy acceptance. Within minutes of approval, you get your actual 15-digit card number, expiration date, and security code. You can start shopping online or add the card to Apple Pay or Google Pay before your physical card even leaves the mail room. Your plastic arrives in 5-7 business days, but your credit building starts immediately.

7 Simple Paths to Easy Credit Card Acceptance in 2025

The credit card world has gotten a lot friendlier in 2025. Gone are the days when you needed perfect credit just to get your foot in the door. Today's card issuers have figured out that there's good business in saying "yes" to more people, and they've created multiple pathways to make that happen.

Think of these seven paths as different routes up the same mountain. Some are gentler slopes perfect for beginners, others are express lanes for people in a hurry, and a few are designed specifically for folks who've stumbled before but are ready to try again. The trick isn't finding the "best" path—it's finding the one that fits where you are right now.

What makes 2025 different is how much faster and smarter the approval process has become. Most of these options give you an answer within minutes, not weeks. Many let you start using your new credit immediately through virtual card numbers. And the best part? You can often check your approval odds without any impact on your credit score.

The secret sauce is matching your situation to the right strategy. A college student's best bet looks very different from someone rebuilding after bankruptcy or a gig worker with irregular income. Let's walk through each path so you can spot the one with your name on it.

Easy Credit Card Acceptance: Secured Starter Cards

Secured cards are the closest thing to a guaranteed yes in the credit card world. With approval rates hitting 89% for cards like the OpenSky® Secured Visa®, these cards remove most of the guesswork from getting approved.

Here's how they work: you put down a refundable deposit—usually between $200 and $500—and that becomes your credit limit. Think of it as giving the card company a security blanket. Your deposit sits safely in an account earning interest while your card works exactly like any other credit card.

The beautiful thing about secured cards is they don't stay secured forever. Modern cards like the Find it® Secured automatically review your account after seven months of good behavior. If you've been paying on time and keeping your balance reasonable, they'll graduate you to an unsecured card and mail you a check for your deposit.

What really makes secured cards shine is how they build good habits. Since your credit limit equals your deposit, you naturally think twice before maxing out the card. This built-in training helps you develop the kind of responsible usage patterns that boost credit scores fast.

Small deposits mean big opportunities. Even a $200 deposit gets you started on the path to building real credit history that reports to all three major credit bureaus every month.

Easy Credit Card Acceptance: No-Credit-Check & Fintech Options

The financial technology revolution has created some fascinating alternatives to traditional credit cards. Cards like the Petal® 2 'Cash Back, No Fees' Visa® have thrown out the old rulebook entirely, focusing on your income and banking patterns instead of your credit score.

These cards use some pretty smart technology to make approval decisions. Instead of just looking at whether you've borrowed money before, they analyze your bank account to see how money flows in and out. Steady deposits, responsible spending patterns, and account stability can matter more than a traditional credit score.

The approval process feels almost magical. You connect your bank account, the system crunches the numbers, and you get a decision in minutes. No waiting around wondering if you'll be approved—you know right away.

Virtual card numbers are where these options really shine. Get approved, and you can start shopping online or add your card to Apple Pay before you finish your coffee. Your physical card shows up in the mail later, but you don't have to wait to start building credit.

The income-based approach opens doors for people who've been shut out of traditional credit. Whether you're new to the country, recovering from past mistakes, or just starting your financial journey, these cards look at your current ability to pay rather than your credit history.

Easy Credit Card Acceptance: Student & Store Alternatives

College students have their own special pathway to credit, and it's surprisingly straightforward. Student cards care more about your enrollment status and which school you attend than your credit history. After all, card companies know that today's broke college student could be tomorrow's high-earning professional.

These cards often come with perks that actually make sense for student life—cash back on streaming services, bonus rewards for dining, and no annual fees. The credit limits start modest, but they grow as you prove you can handle the responsibility.

Store cards offer another interesting route, especially if you shop regularly at specific retailers. These cards have more relaxed approval standards because stores want to encourage customer loyalty. Getting approved for a Target or Amazon store card is often easier than qualifying for a general-purpose card.

The instant gratification factor is real with store cards. Apply at checkout, get approved on the spot, and use your new credit line for your current purchase. It's like getting a discount and starting your credit journey at the same time.

Both student and store cards work best when you think of them as stepping stones. They might not be the cards you'll use forever, but they're excellent ways to establish credit history that opens doors to better options down the road.

Secured vs. Unsecured: Picking the Right Tool

Feature Secured Cards Unsecured Cards Deposit Required $200-$500+ refundable None Typical APR 14.24%-36% variable 16%-36% variable Credit Limits Equals deposit amount $400-$3,000+ initial Approval Odds 89%+ with deposit Varies by credit profile Upgrade Potential Auto-graduation available Product changes possible Annual Fees $0-$35 common $0-$250 range Credit Building Reports to all 3 bureaus Reports to all 3 bureaus

Choosing between secured and unsecured cards for easy credit card acceptance feels like picking between training wheels and a regular bike. Both will get you where you're going, but one offers more stability while you're learning the ropes.

Your current credit situation should drive this decision. If your credit score sits below 600, secured cards often represent your most reliable path forward. The deposit requirement might sting initially, but it virtually guarantees approval and gives you control over your credit limit.

For scores hovering between 600-650, you're in that tricky middle ground where unsecured cards might approve you, but secured cards often offer better terms. It's worth checking pre-qualification tools for both options before deciding.

Think about your timeline too. If you need credit access immediately for emergencies, unsecured cards provide instant spending power without tying up cash in deposits. But if you're focused on long-term credit building, secured cards with automatic graduation features create a clearer path to better products.

The cash flow consideration matters more than many people realize. That $300 security deposit for a secured card might be money you need for other expenses. On the flip side, it's money you'll get back, unlike annual fees that disappear forever.

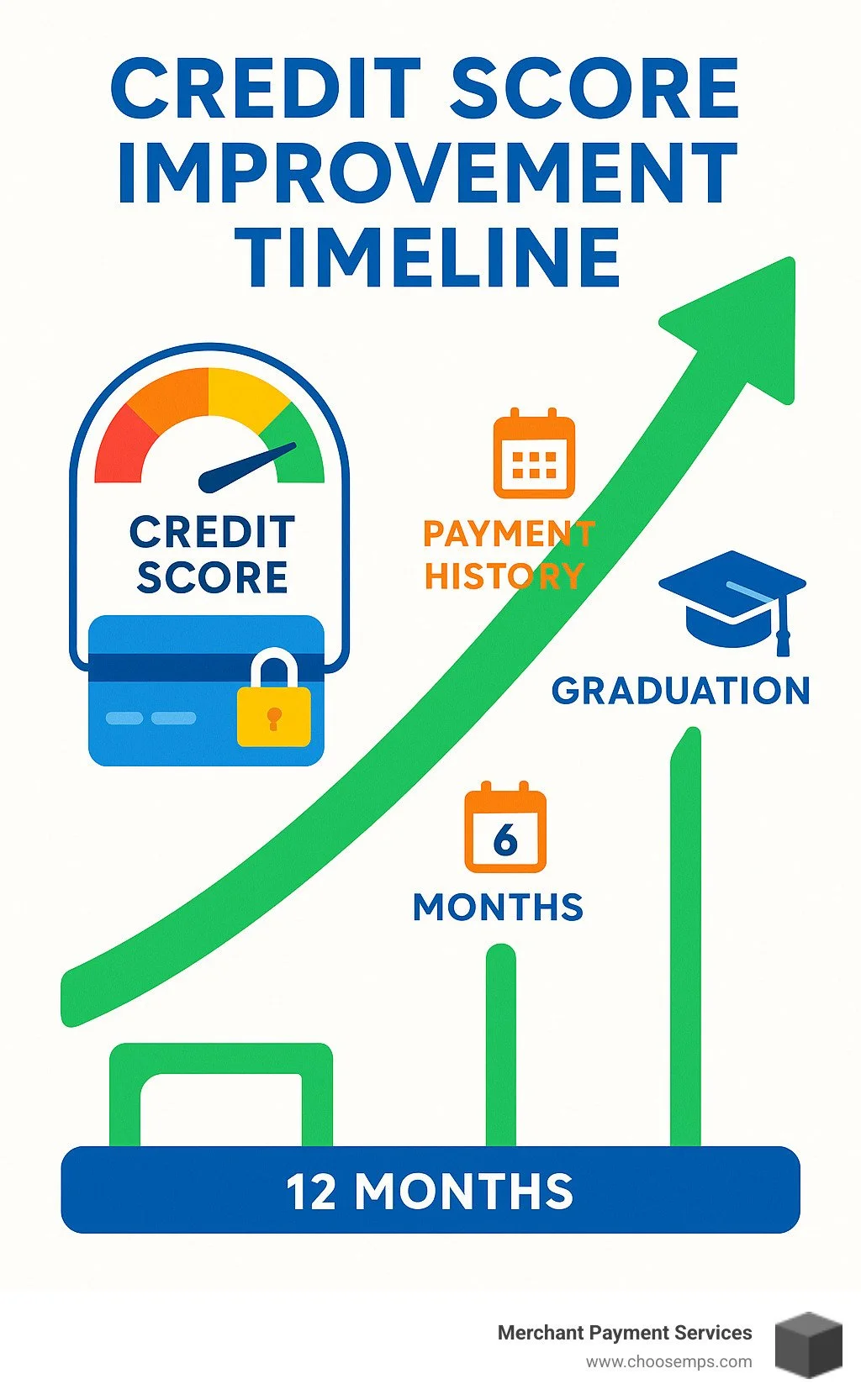

How Secured Cards Accelerate Credit Building

Secured cards work like financial training wheels that actually make you stronger. The deposit requirement isn't just about reducing the bank's risk—it creates natural guardrails that help you develop healthy credit habits from day one.

Payment history makes up 35% of your credit score, and secured cards make it easier to nail this crucial factor. When your credit limit equals your deposit, you're naturally motivated to stay current on payments. Nobody wants to lose their deposit over a missed payment.

The beauty of lower credit limits becomes clear when you're building credit. A $300 secured card limit is much easier to manage responsibly than a $1,500 unsecured card. You can keep that balance under $30 (the magic 10% utilization rate) without breaking a sweat.

Utilization management becomes almost automatic with secured cards. Keeping balances low relative to your limit is one of the fastest ways to boost your credit score, and it's much simpler when you're working with smaller numbers. Plus, you can always increase your limit by adding to your deposit if needed.

Most secured card issuers review accounts after 6-12 months of responsible use. Many offer automatic graduation to unsecured products, returning your deposit and often increasing your credit limit. It's like having a built-in reward system for good behavior.

Pros & Cons of Unsecured "Fair-Credit" Offers

Unsecured cards for fair credit promise immediate access to revolving credit without requiring you to fork over a deposit upfront. This sounds fantastic until you dig into the details and realize why banks are willing to take that extra risk.

The immediate cash flow benefit is real. Instead of tying up $300-500 in a security deposit, you can use that money for other needs while still accessing credit. For people facing financial emergencies, this flexibility can be crucial.

Higher credit limits often come with unsecured cards, typically ranging from $500-1,500 compared to secured cards that match your deposit amount. This extra borrowing power helps with larger purchases and can improve your credit utilization ratios if managed properly.

But here's where things get tricky. Those higher APRs on fair-credit unsecured cards can really bite you. We're talking 25-36% interest rates that make carrying balances expensive fast. Miss a payment, and you're looking at penalty rates that can push past 36%.

Annual fees are almost standard on fair-credit unsecured cards, ranging from $35 to $250. That's money that disappears forever, unlike security deposits that you eventually get back. A $95 annual fee might not sound like much, but it's nearly a third of what you'd deposit for many secured cards.

The approval odds tell the real story. While secured cards approve 89% of applicants who can fund the deposit, unsecured fair-credit cards might approve only 40-60% of applicants. You could end up with a hard credit inquiry and no card to show for it.

The temptation factor with higher limits can derail credit building efforts before they start. It's much easier to overspend with a $1,200 credit line than a $300 one, and the consequences are more severe when you're paying 29% interest on the balance.

Pre-Qualification & Instant Use: How the Process Works

Getting approved for a credit card used to feel like applying for a mortgage—lots of paperwork, long waits, and that sinking feeling when you got rejected. Today's easy credit card acceptance process is completely different, thanks to pre-qualification tools that let you peek behind the curtain before you commit.

Pre-qualification works like a friendly conversation with the card issuer. You share some basic information—your name, address, birth date, and usually just the last four digits of your Social Security Number. Some companies also ask about your income and whether you rent or own your home. The magic happens when they run this through their system using what's called a "soft credit check."

Here's the beautiful part: soft credit checks don't hurt your credit score at all. It's like window shopping for credit cards—you can look at all the offers without any commitment or consequences. The card company's computer algorithms work behind the scenes, checking your credit profile against their approval criteria and showing you which cards you're likely to get approved for.

The technology has gotten incredibly sophisticated. These systems consider dozens of factors beyond just your credit score—things like how many credit cards you've applied for recently, whether you already have accounts with that bank, and how your income compares to your existing debt. They're essentially trying to predict not just whether you'll get approved, but whether you'll be a profitable customer.

Once you find a card that pre-qualifies you and decide to apply, many issuers now offer instant approval decisions. We're talking minutes, not days or weeks. And here's where it gets really exciting—if you're approved, you might get a virtual card number immediately.

Virtual card numbers are game-changers for easy credit card acceptance. Instead of waiting 7-10 business days for your physical card to arrive in the mail, you get your actual 15-digit card number right on your screen. You can start shopping online immediately or add it to your phone's digital wallet for contactless payments at stores.

The digital wallet integration happens almost instantly. Whether you prefer Apple Pay, Google Pay, Samsung Pay, or even PayPal, you can have your new card loaded and ready to use before you finish your coffee. This means you can tap to pay at millions of locations across the US within minutes of getting approved.

This instant access is particularly helpful if you're applying for a card because of an immediate need—maybe your old card expired, got damaged, or you're traveling and need backup payment options. The days of being stuck without credit access while waiting for mail delivery are essentially over.

How to Accept Credit Card Payments

Easy Credit Card Acceptance Pre-Qual Checklist

Before you start the pre-qualification process, gather some basic information to make everything go smoothly. Think of this as prep work that'll save you time and increase your chances of getting good offers.

Your income information should be accurate and include all legitimate sources. This means your salary from work, but also spousal income if you're married, investment returns, Social Security benefits, or income from side gigs. The key word here is "household income"—you can include money that you have reasonable access to for paying bills.

Keep recent pay stubs handy, or at least know your annual income figure. If you're self-employed or have irregular income, having your tax return information available helps. Some card companies might ask for documentation later, so it's better to be prepared.

Address matching is more important than many people realize. Your current address needs to match what's on file with the credit bureaus. If you've moved recently, this can cause hiccups in the approval process. It's worth checking your credit reports before applying to make sure everything matches up.

Students and military personnel often have special considerations for temporary addresses. Many card companies understand that college students might use their school address or that military families move frequently. Don't let address complications discourage you—just be prepared to explain your situation.

Social Security Numbers versus ITINs matter for the application process. Most cards require a Social Security Number, but some companies specifically work with immigrants and international students who have Individual Taxpayer Identification Numbers instead. If you're new to the US and only have an ITIN, look for cards that specifically mention accepting them.

Marketing preferences might seem like a small detail, but they can affect your offers. When you opt in to receive promotional materials during pre-qualification, some companies provide access to better terms or exclusive offers. The trade-off is getting more marketing emails and possibly phone calls, so decide what you're comfortable with.

Avoiding Common Mistakes in Easy Credit Card Acceptance

Even with easy credit card acceptance, there are ways to accidentally sabotage your own success. The good news is that these mistakes are completely avoidable once you know what to watch for.

Multiple credit applications in a short time period can backfire spectacularly. Each time a company runs a hard credit check on your application, it can ding your credit score by a few points. More importantly, it signals to other lenders that you might be desperate for credit or having financial problems.

This is exactly why pre-qualification tools are so valuable. You can check your odds with multiple companies using soft credit checks that don't hurt your score, then submit actual applications only to the ones most likely to approve you. It's like test-driving cars before you buy instead of walking into every dealership and filling out financing paperwork.

Fee blindness turns many "easy approval" cards into expensive mistakes. Yes, it feels great to get approved, but if that card has a $95 annual fee plus monthly maintenance fees, you're paying nearly $10 per month before you even swipe the card. Always calculate the total cost of ownership, not just the approval odds.

This is especially important with secured cards. Some charge annual fees on top of requiring deposits, which seems particularly unfair. Look for no-fee options or cards where the benefits clearly outweigh the costs.

Credit limit maximization right after approval is tempting but dangerous. Getting approved for a $500 credit limit doesn't mean you should immediately spend $500. Your credit utilization ratio—how much you owe compared to your limit—affects your credit score significantly.

Try to keep your balance below 30% of your limit, with 10% being even better for your credit score. This means if you get a $500 limit, keeping your balance around $50 shows much better credit management than carrying a $400 balance.

Application rushing causes more rejections than you might expect. Simple errors like typos in your Social Security Number or wrong income figures can trigger automatic denials. Take a few extra minutes to double-check everything before hitting submit.

This is particularly important with income reporting. If you accidentally understate your income, you might get rejected for a card you actually qualify for. If you overstate it significantly, that can cause problems if the company asks for verification later. Accuracy beats speed every time in credit applications.

Boosting Approval Odds & Building Credit Fast

Getting approved is just the beginning of your easy credit card acceptance journey. The real magic happens when you start building credit strategically, turning your new card into a powerful tool for financial growth.

Payment history makes up 35% of your credit score, making it your most powerful weapon for credit improvement. Think of every on-time payment as a small investment in your financial future. Miss just one payment, and you could see your score drop by 60-110 points. That's why smart cardholders set up automatic payments from day one.

Here's something many people don't know: Experian Boost can instantly improve your credit score by adding utility bills, streaming services, and phone payments to your credit report. This free service has helped users increase their scores by an average of 13 points immediately. It's like getting credit for payments you're already making.

Becoming an authorized user on someone else's account can add years of positive credit history to your report overnight. If your parents or spouse have excellent credit, this strategy can boost your score significantly. Just make sure the primary cardholder has spotless payment habits—their mistakes become your mistakes.

Your balance ratios affect your entire credit profile, not just individual cards. Keep your total credit utilization below 30% across all accounts, with 10% being the sweet spot. If you have a $500 limit, try to keep balances under $50. It might feel restrictive, but it maximizes your score improvement.

Diversifying your credit mix shows lenders you can handle different types of credit responsibly. Adding a small personal loan or store card to your secured card creates a more robust credit profile. Think of it as showing off your financial skills in multiple areas.

Mobile Credit Card Payment Options

Day-1 Best Practices After Approval

Set up autopay immediately—before you even make your first purchase. Choose to pay the full statement balance if you can swing it, or at least the minimum amount. Most issuers let you pick your payment date, so align it with your payday to avoid cash flow problems.

Keep utilization under 10% for maximum credit score benefits. Yes, this means using only $50 of a $500 credit limit. It might feel like you're barely using the card, but this restraint pays huge dividends in score improvement. Your future self will thank you when you qualify for premium cards.

Monitor your credit score monthly using the free tools your card issuer provides. Watching your score climb month by month becomes addictive in the best way possible. Many cardholders report that seeing their progress motivates them to stick with good habits.

Set up account alerts for everything—payment due dates, balance thresholds, and unusual activity. These digital nudges prevent costly mistakes and catch fraud early. Think of them as your personal financial assistant working 24/7.

Graduation Strategies Within 12 Months

Request credit limit increases after six months of perfect payments. Many issuers review accounts automatically, but asking can speed things up. Higher limits improve your utilization ratios even if you don't use the extra credit. It's like getting a better credit score for free.

Product change requests can upgrade your card without starting over. After building positive history, call your issuer about upgrading to cards with better rewards or lower fees. This preserves your account age—a valuable asset for your credit score.

Diversify your credit mix by adding different account types. A small installment loan or second card from another issuer shows you can juggle multiple credit products. Just don't go overboard—two or three accounts are plenty for building credit.

Time your payments strategically by making multiple payments per month. Credit card companies report balances on your statement closing date, so paying down balances before this date keeps your reported utilization low. Some savvy cardholders make weekly payments to keep balances near zero.

Frequently Asked Questions About Easy Credit Card Acceptance

Getting approved for a credit card shouldn't feel like solving a puzzle, but many people still have questions about the process. After helping thousands of customers steer payment solutions over the years, I've heard these same concerns repeatedly. Let me clear up the most common confusion around easy credit card acceptance.

Does pre-qualification hurt my credit score?

Absolutely not, and this might be the biggest misconception I encounter. Pre-qualification uses what's called a "soft credit inquiry" that's completely invisible to your credit score. Think of it like window shopping—you're just looking around without making any commitments.

These soft pulls let card issuers peek at your credit profile without leaving any footprints on your credit report. It's the same type of inquiry that happens when you check your own credit score or when companies send you pre-approved offers in the mail.

You can actually use pre-qualification tools from multiple card issuers in the same day without any impact whatsoever. This is exactly what you should do—shop around and compare your options before committing to a formal application. Only when you submit an actual application does a "hard pull" occur, which might temporarily lower your score by a few points.

Most major card issuers offer these pre-qualification tools right on their websites. It's like getting a sneak preview of whether you'll be approved before you actually apply.

Are there cards with zero credit check at all?

Yes, though they're pretty rare. The OpenSky® Secured Visa® Credit Card stands out because it requires absolutely no credit check—not even a soft pull. You just need to provide a security deposit and basic personal information like your name and address. They don't even require a bank account.

This approach makes sense when you think about it. Since you're putting down a deposit that equals your credit limit, the card company has very little risk. Your deposit acts as collateral, so your credit history becomes less important to them.

However, truly no-credit-check cards often come with trade-offs. They might have higher fees, lower credit limits, or fewer features than cards that do some form of credit review. Most cards marketed as having easy credit card acceptance still perform some type of credit check—they just accept lower scores or limited credit history.

The key is understanding that "easy acceptance" doesn't always mean "no credit check." It usually means the issuer is willing to work with people who have fair credit or limited credit history.

How long until I receive and can use my card?

This has changed dramatically in recent years, and it's one of my favorite improvements in the industry. Physical cards still take the traditional 5-7 business days to arrive by mail, but many issuers now provide instant virtual card numbers for immediate use.

With virtual numbers, you can literally start shopping online within minutes of approval. You can also add your new card to digital wallets like Apple Pay or Google Pay and use it for contactless payments at stores before your physical card even ships. It's pretty amazing technology.

For secured cards, the timeline depends on how you fund your deposit. Electronic transfers from your bank account can process within hours, leading to same-day approval and instant virtual card access. If you mail a check for your deposit, you're looking at 7-10 business days before processing begins.

The instant access feature has been a game-changer for people who need credit immediately—whether for an emergency expense or just to start building credit right away. No more waiting around wondering when your card will arrive.

Conclusion

Getting approved for a credit card doesn't have to feel like solving a puzzle with missing pieces. Easy credit card acceptance has opened doors that were previously locked tight, giving millions of Americans a real shot at building or rebuilding their credit history.

The landscape has changed dramatically. Where banks once said "no" to anyone without perfect credit, today's market offers genuine solutions. Secured cards deliver approval rates above 89% for anyone who can fund a deposit. Pre-qualification tools let you window-shop for credit without worrying about damaging your score. Virtual card numbers mean you can start using your new credit within minutes, not weeks.

The secret sauce isn't finding some magic loophole—it's matching your specific situation to the right tool. Students can tap into cards designed for their unique circumstances, while folks rebuilding credit often find secured cards provide the most reliable path forward. If you're new to the US, income-based underwriting can work in your favor, and everyone can benefit from those risk-free pre-qualification checks.

But here's the thing: getting approved is just the opening act. What really matters is how you handle that new credit line. Easy credit card acceptance becomes truly valuable when you use it as a launching pad. Keep those payments on time, watch your utilization ratios like a hawk, and treat these accessible cards as stepping stones to better products down the road.

Most people who play their cards right (pun intended) can graduate to unsecured options with better terms within 6-12 months. It's not magic—it's just consistent, responsible usage that proves you're worth the risk.

Speaking of accepting cards, getting approved for your own credit card is only half the story if you're running a business. You also need a reliable way to accept payments from your customers. At Merchant Payment Services, we make payment processing as straightforward as the easy credit card acceptance you just experienced.

Our month-to-month agreements come without the headaches of long-term contracts or surprise fees. No startup costs, no hidden charges—just honest payment processing that keeps your business running smoothly. Whether you're in Ohio or anywhere else we serve, our free terminals and POS systems are designed to make accepting payments as easy as getting approved for that new card.

Explore our point-of-sale solutions and see how we can help your business accept payments with the same simplicity you experienced getting your credit card approval.