Choosing a Card Processing Company Without the Headache

Navigating the World of Payment Processing

A card processing company is a financial service provider that enables businesses to accept credit and debit card payments from customers, handling the complex transaction flow between merchants, banks, and card networks.

What is a card processing company?

Definition: Financial service provider that facilitates electronic payment transactions

Core function: Securely transfers funds from customer accounts to merchant accounts

Key services: Payment authorization, authentication, settlement, and funding

Hardware/software: Provides terminals, card readers, payment gateways, and virtual solutions

Pricing models: Typically charges interchange-plus, flat-rate, or tiered fee structures

Today's consumers expect the convenience of cashless payments everywhere they shop. According to industry data, businesses that accept credit cards can increase sales by 40-50% compared to cash-only operations. Yet many small business owners find themselves overwhelmed by confusing terminology, hidden fees, and complex contracts when selecting a payment processor.

The right card processing company should simplify your payment operations, not complicate them. Whether you're opening your first store, expanding to online sales, or just tired of your current provider's high fees and poor service, finding a transparent partner with fair pricing can make all the difference to your bottom line.

I'm Lydia Valberg, co-owner of Merchant Payment Services with over 35 years of family experience working with businesses to implement reliable card processing company solutions that prioritize transparency and customer relationships above all else.

What You'll Learn

In this comprehensive guide, we'll walk you through everything you need to know about choosing the right card processing company for your business:

The fundamentals of how card payment processing actually works

Different types of payment solutions available for various business models

How to understand and compare pricing models (without the headache)

Essential security and compliance requirements you can't afford to ignore

Step-by-step guidance for selecting a processor that fits your needs

How to switch providers smoothly if you're unhappy with your current solution

By the end, you'll have the knowledge to make an informed decision that saves you money, time, and frustration.

How Card Payment Processing Works

Ever wonder what happens in those few seconds between your customer swiping their card and the "approved" message appearing? It's actually a fascinating behind-the-scenes process that's worth understanding before you partner with a card processing company.

Think of payment processing as a digital relay race where your customer's payment information passes through several hands before reaching the finish line.

When your customer pulls out their plastic to pay, here's what unfolds:

The merchant (that's you!) captures their card information through your terminal, mobile reader, or online checkout

The payment processor securely routes this data to the right networks

The acquiring bank (your merchant bank) receives and processes the request

The card network (Visa, Mastercard, etc.) transfers everything to the customer's bank

The issuing bank (where your customer holds their account) checks funds and approves or declines

The approval message travels back through the same channels

The settlement happens later when the money actually moves to your account

Though the approval happens almost instantly, you'll typically see the funds deposited in your account within 1-3 business days, depending on your card processing company's policies.

Step-by-Step Journey of a Transaction

Let's walk through what happens when your customer pays with a card:

Your customer hands over their card at checkout. Whether they're swiping, dipping an EMV chip, or tapping to pay, your terminal captures their information and immediately encrypts it—keeping their sensitive data safe from the start.

Your card processing company packages this encrypted information and sends an authorization request to your acquiring bank, which routes it through the appropriate card network (Visa, Mastercard, Find, American Express).

"Most people don't realize there's an entire digital highway system working behind that little card reader," says Tom, a restaurant owner who recently switched to Merchant Payment Services. "And it all happens while I'm asking if they want their receipt."

The customer's bank then performs several checks: Do they have enough money? Has the card been reported stolen? Does this purchase fit their normal spending pattern? Based on these checks, they send back either an approval or decline.

Once approved, your terminal displays the good news, and your customer gets their receipt. But the journey isn't over yet!

At the end of your business day, your system "batches" all transactions together and sends them for settlement. The card networks then coordinate moving funds from various issuing banks to your acquiring bank. Finally, your card processing company deposits the batch total (minus their processing fees) into your business bank account.

The whole electronic authorization typically takes just 2-3 seconds, but that final funding step usually happens overnight or within a couple of business days. For more detailed information about this process, you can learn more about Credit Card Payment Processing on our website.

Types of Payment Solutions for Small Businesses

The world of payment processing has evolved dramatically, and today's card processing companies offer a variety of solutions custom to how you do business. Whether you're ringing up customers at a store counter or collecting payments while on the road, there's a perfect fit for your needs.

In-Person Payment Solutions

Remember the clunky credit card imprinters from decades past? Thankfully, those days are gone! Modern in-store payment options now include sleek countertop terminals that connect through ethernet or cellular networks, giving you reliable service even when internet connectivity isn't perfect.

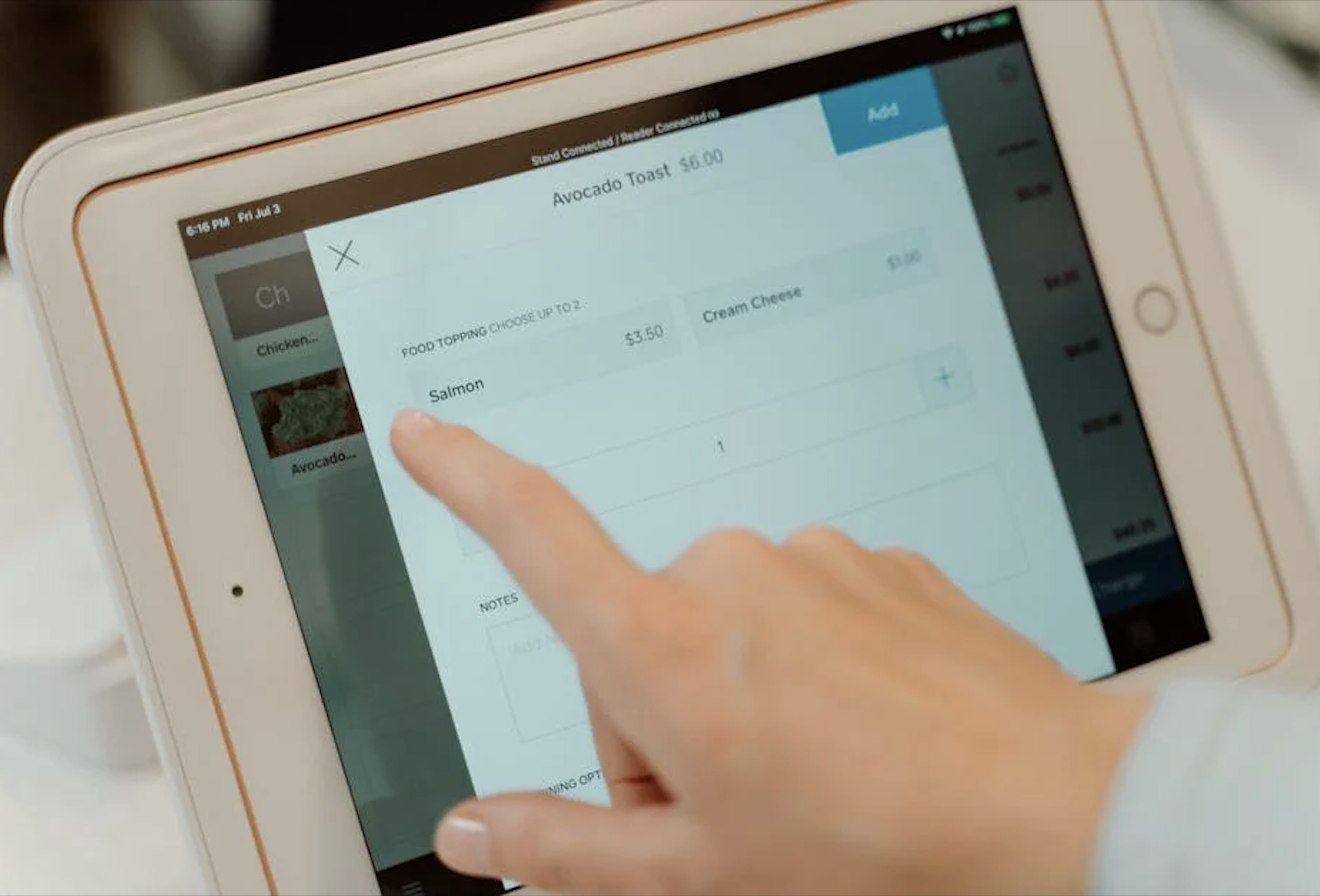

Many of our merchants are switching to smart terminals – those all-in-one devices with bright touchscreens and built-in receipt printers that look more like tablets than traditional payment machines. These not only process payments but can also help with inventory tracking and customer management.

"We upgraded to a smart terminal last year, and it's been a game-changer for our boutique," shares Sarah, a clothing store owner in Columbus. "Our checkout process is faster, and customers love the modern experience."

For businesses that need more comprehensive solutions, full Point-of-Sale (POS) systems combine payment processing with robust business management tools. And if you're often away from a physical location, mobile card readers that connect to smartphones or tablets can turn any location into a checkout counter.

Online Payment Solutions

The digital storefront needs digital payment tools. Payment gateways serve as virtual terminals for online transactions, securely processing payments on your website. If you're using popular platforms like Shopify or WooCommerce, pre-built shopping cart integrations make setup nearly effortless.

For businesses with unique needs, developer APIs provide flexibility for custom integration. And sometimes the simplest solution works best – payment links that can be texted, emailed, or shared on social media allow customers to complete purchases with minimal friction.

At Merchant Payment Services, we provide all these options with risk-free, month-to-month agreements – no startup fees or hidden charges. Our merchants particularly appreciate our free terminal program, eliminating the need to purchase or lease expensive equipment.

Hybrid Solutions

Many businesses operate in both physical and digital worlds, requiring flexible payment options. Virtual terminals allow you to manually enter card information for phone orders. Invoicing systems with integrated payment links streamline billing. Recurring billing automates subscription management, while QR code payments offer a touchless option that bridges physical and digital experiences.

Matching Solutions to Business Models

Different businesses have unique payment processing needs based on how they operate and serve customers:

Retail Storefronts need reliable, fast transactions with inventory integration and loyalty programs. Many are adding contactless options to speed up checkout lines and meet customer expectations for touchless payments.

Restaurants & Food Service businesses benefit from table-side payment capabilities and tip adjustment features. Split check functionality improves the dining experience, while online ordering integration helps manage takeout and delivery orders seamlessly.

Professional Services firms often rely on virtual terminals for phone payments and sophisticated invoicing with integrated payment links. Recurring billing simplifies retainer client relationships, while mobile solutions support on-site service calls.

E-commerce Businesses require secure payment gateways with robust fraud protection. The ability to accept multiple payment methods (credit/debit cards, digital wallets) is essential, as is subscription management for recurring products.

Mobile Businesses & Field Services depend on cellular-connected mobile card readers with all-day battery life. Offline processing capabilities ensure you can accept payments even in areas with poor connectivity.

"When we started our food truck business, we had no idea how important having the right payment system would be," shares a Columbus-based client. "Having a mobile solution that works reliably even at crowded festivals with spotty cell service has literally saved our business on multiple occasions."

The best card processing company for your business will offer solutions that adapt to your specific operational needs, not force you to change how you work to accommodate their technology.

Understanding Fees & Pricing Models

Perhaps the most confusing aspect of choosing a card processing company is understanding the various fee structures and pricing models. Let's break down the most common approaches:

Interchange-Plus Pricing

Interchange-plus (sometimes called "cost-plus") is generally considered the most transparent pricing model. It has two components:

Interchange fees: The non-negotiable fees set by card networks (Visa, Mastercard, etc.) that go to the card-issuing banks

Processor markup: The processor's fee for their services, typically expressed as a percentage plus a per-transaction fee (e.g., 0.30% + $0.10)

With interchange-plus, you can see exactly what the processor is charging above the mandatory network fees. This transparency makes it easier to compare different providers.

Flat-Rate Pricing

Flat-rate pricing simplifies processing costs by charging the same rate regardless of card type or transaction method. Popular examples include:

In-person transactions: 2.6% + $0.10 per transaction

Online transactions: 2.9% + $0.30 per transaction

Keyed-in transactions: 3.5% + $0.15 per transaction

While flat-rate pricing is simple to understand, it's often more expensive for businesses with higher transaction volumes or those that process many debit cards (which typically have lower interchange fees).

Tiered Pricing

Tiered pricing bundles interchange fees into simplified categories, typically:

Qualified (lowest rate): For standard consumer credit and debit cards processed with a chip reader

Mid-qualified: For rewards cards or transactions processed with a card swipe

Non-qualified (highest rate): For business/corporate cards or manually keyed transactions

The challenge with tiered pricing is that processors determine which cards fall into which tiers, and they're not always transparent about these classifications. This can lead to unexpected costs when customers use certain card types.

Additional Fee Considerations

Beyond the basic processing rate, card processing companies may charge various other fees:

Monthly fees: Account maintenance, statement fees, PCI compliance fees

Setup fees: Charges to establish your merchant account

Gateway fees: Monthly charges for e-commerce payment gateways

Batch fees: Small charges for daily transaction batching

Chargeback fees: Penalties when customers dispute charges

Early termination fees: Charges for breaking a contract before its term ends

At Merchant Payment Services, we believe in complete transparency. We operate on a month-to-month agreement with no startup fees, no hidden charges, and no early termination penalties. We'll always explain exactly what you're paying and why.

Decoding Your Statement Like a Pro

One of the most valuable skills for any business owner is the ability to read and understand their processing statement. Here's what to look for:

Effective rate: Your total processing fees divided by your total sales volume

Interchange fees: The base costs set by card networks

Assessment fees: Additional fees charged by card networks

Processor markup: What your processor charges above interchange

Monthly fees: Any subscription or service charges

Transaction counts: Number of transactions by card type and entry method

"When I switched to Merchant Payment Services, I was amazed at how much clearer my statement became," says a retail client from Beavercreek. "For the first time, I could actually understand what I was paying for and why. My previous processor's statement might as well have been written in another language."

How a Card Processing Company Structures Pricing

A card processing company typically structures its pricing based on several factors:

Business type and industry: Some industries are considered higher risk than others

Processing volume: Higher volume generally qualifies for better rates

Average transaction size: Very small or very large average tickets may affect pricing

Card acceptance methods: In-person transactions generally cost less than online or keyed-in

Business history: Established businesses may qualify for preferential rates

When evaluating pricing, always ask potential processors:

Are there monthly minimums?

Do rates increase after an introductory period?

What happens if my volume changes significantly?

Are there any fees not disclosed in the initial quote?

Security & Compliance Essentials

Let's face it – security isn't just some technical checkbox when you're handling customer payments. It's absolutely fundamental to your business. A data breach can be devastating for small businesses, hitting you with financial penalties, legal headaches, and worst of all, destroying the trust your customers place in you.

PCI DSS Compliance

Think of the Payment Card Industry Data Security Standard (PCI DSS) as the security rulebook everyone has to follow. If you accept card payments, compliance isn't optional – it's mandatory.

What you need to do depends on how many transactions you process and how you accept payments, but the basics include using validated payment applications, maintaining good firewalls, keeping anti-virus software updated, and restricting data access to only those employees who absolutely need it.

"When I first heard about PCI compliance, it sounded like alphabet soup," laughs Sarah, a boutique owner in Dayton. "But my card processing company walked me through exactly what I needed to do for my small shop. It was much simpler than I feared."

A good card processing company should be your partner in this process, providing the tools and support to help you stay compliant without driving yourself crazy.

Advanced Security Technologies

Modern payment security relies on some pretty impressive technology:

Tokenization replaces actual card numbers with unique symbols that contain all the essential information without the security risk. Think of it as a clever disguise for card data – your systems never actually store the real card numbers.

End-to-End Encryption (E2EE) keeps card data encrypted from the moment your customer taps, dips or swipes until it reaches the processor. It's like sending the data through an armored car instead of on the back of a postcard.

EMV Chip Technology – those little gold squares on modern cards – creates a unique transaction code every time the card is used. This makes it nearly impossible for fraudsters to create counterfeit cards from stolen data. Scientific research on EMV chip security confirms just how effective this technology has become.

Building a Fortress Around Card Data

Beyond the tech your card processing company provides, there are practical steps every business should take to protect payment data:

Train your employees well – they're your first line of defense against fraud. Keep your payment network separate from your general business WiFi. Physically secure your terminals against tampering (yes, fraudsters will try to install skimming devices when you're not looking). Keep all your software updated with security patches, limit who can access payment systems, and regularly test for security weaknesses.

"We had no idea how vulnerable our old system was until we switched to Merchant Payment Services," shares Tom, who runs a service business in Kettering. "Their team spotted several critical security holes our previous processor had completely missed. That alone was worth making the switch."

Regular security scans are like health check-ups for your payment system – they catch problems before they become disasters. More info about PCI Compliance Support is available if you want to dive deeper into this topic.

Why Your Card Processing Company Matters for Compliance

Your choice of card processing company makes a huge difference in how protected you really are:

While you're ultimately responsible for compliance, a good processor shares the burden by providing the right tools and guidance. They should help simplify the annual validation process (which can otherwise be a real headache). Some processors even offer breach protection programs – basically insurance if something does go wrong.

Advanced card processing companies provide real-time fraud monitoring that can spot suspicious transactions before they're approved. And they should keep your equipment and software updated against new threats, because fraudsters never stop innovating.

At Merchant Payment Services, we take security seriously because we know what's at stake for your business. We provide straightforward PCI compliance support, including simplified self-assessment questionnaires, vulnerability scanning, and breach protection programs. Our approach is designed to protect both your business and the customers who trust you with their payment information.

How to Choose the Right Card Processing Company

With dozens of options vying for your business, finding the right card processing company can feel like searching for a needle in a haystack. Let's break this down into manageable steps so you can make a confident choice.

Step 1: Assess Your Business Needs

Before you start comparing providers, take a moment to understand what your business actually requires:

Do you need to accept payments in-person, online, on-the-go, or all three? A retail store has different needs than a service business that visits customers' homes. Your monthly transaction volume and typical sale amount also matter—processors often structure pricing differently for high-volume businesses versus those with fewer, larger transactions.

Consider your industry too. Restaurants need tip adjustment features, while subscription businesses need recurring billing capabilities. And don't forget about tomorrow—if you're planning to expand soon, you'll want a processor that can grow with you.

"I wish I'd taken more time to think about what I actually needed," shares a Columbus boutique owner. "I ended up with expensive equipment with features I never use, while missing capabilities that would have made my life easier."

Step 2: Research Potential Providers

Once you know what you're looking for, start building a list of potential card processing companies:

Ask fellow business owners who they use and—more importantly—whether they'd recommend their processor. Industry-specific social media groups can be goldmines for honest feedback. Online reviews and Better Business Bureau ratings provide additional perspective, though remember that people are more likely to post when they're unhappy than satisfied.

Don't hesitate to request customer references directly from processors you're considering. Reputable companies like Merchant Payment Services are happy to connect you with existing clients who can share their experiences.

Step 3: Compare Key Features

Now it's time to evaluate your top contenders side-by-side:

Pricing structure matters tremendously—interchange-plus offers transparency, flat-rate provides simplicity, and tiered pricing... well, often benefits the processor more than you. Contract terms are equally important; we believe month-to-month agreements show a processor's confidence in their service quality, while long-term contracts with cancellation penalties suggest they fear you'll want to leave.

Consider equipment options carefully. Are you required to purchase or lease terminals (often at inflated prices), or does the processor offer free equipment programs? Will your new payment system play nicely with your existing point-of-sale system, accounting software, and other business tools?

Don't overlook funding speed and customer support. When you have a payment issue, waiting days for help isn't acceptable. At Merchant Payment Services, we pride ourselves on answering calls with real humans who can actually solve problems—no endless phone trees or overseas call centers.

Card Processing Company Comparison Factors

When you're narrowing down your choices, dig deeper into these critical differentiators:

Transparency should be non-negotiable. A quality card processing company will clearly disclose all fees upfront, provide contracts free from gotcha clauses, and deliver statements you can actually understand without a finance degree. If a sales rep dodges direct questions about fees or uses vague language, consider it a red flag.

Hardware flexibility can save you thousands. Can you continue using equipment you've already paid for? Is the hardware proprietary (locking you to that processor) or universal? What happens when equipment breaks down? The best processors offer multiple options and quick replacements when needed.

Integration capabilities often determine whether your payment system makes life easier or creates daily headaches. Your processor should work seamlessly with your business software ecosystem. At Merchant Payment Services, we've invested heavily in developing integrations with popular business platforms so everything works together smoothly.

Support quality becomes obvious only when problems arise. Is help available when you actually need it—like Saturday night when your restaurant is packed? Are you speaking with outsourced agents reading from scripts, or knowledgeable professionals who understand your business? Will you reach a different person every time, or have a dedicated representative who knows your account?

Scalability ensures your payment solution grows with your success. The processor who's perfect for your startup might become problematic as you expand. Look for volume discounts, easy addition of new locations, and the ability to add new payment channels without starting from scratch.

"When we were opening our second location, the ability to easily add another terminal with the same account was crucial," says a restaurant owner from Cincinnati. "Our previous processor wanted to treat it as an entirely new business with separate fees and statements. Merchant Payment Services made it seamless—just another terminal on our existing account."

Switching Your Card Processing Company Smoothly

Already accepting cards but unhappy with your current provider? Here's how to make a painless transition:

First, review your existing contract for potential escape costs—early termination fees can range from a few hundred to several thousand dollars. Equipment leases can be particularly problematic, sometimes requiring buyouts or returns of specific hardware.

Time your switch strategically. The holiday rush probably isn't ideal for implementing new systems. Gather recent processing statements for accurate rate comparisons, and plan for some overlap—keeping your old system running until the new one is proven reliable.

Don't forget about staff training. Even the most intuitive systems require some adjustment, and your team needs to feel confident before facing customers. Update any connected software integrations and thoroughly test everything before fully committing.

At Merchant Payment Services, we've helped thousands of businesses make smooth transitions. We can often reprogram existing terminals rather than requiring new equipment purchases, and our team handles the technical details so you can focus on what you do best—running your business. Our Business Payment Solutions are designed to make switching as painless as possible.

Frequently Asked Questions about Card Processing Companies

What are the typical setup times?

When you're eager to start accepting card payments, waiting around can feel like watching paint dry. The good news is that most card processing companies can get you up and running within 1-3 business days after your application is approved.

"I was pleasantly surprised at how quickly we were able to start taking cards," shares Maria, a boutique owner from Cleveland. "I expected weeks of paperwork and delays, but we were processing our first transaction just two days after signing up."

Your setup timeline can vary depending on a few factors though. If you run a complex business model (like high-risk industries or multi-location operations), it might take a bit longer. Need physical terminals shipped? Add a day or two for delivery. Integrating with your existing POS system or website can also add some time, as can a thorough underwriting process.

At Merchant Payment Services, we've streamlined our setup process to get you accepting payments within 48 hours in most cases. We know that time is money, especially when you're waiting to make sales!

Are month-to-month agreements really contract-free?

The phrase "month-to-month" gets thrown around a lot in the payment processing world, but not all agreements are created equal. A truly contract-free arrangement should mean:

You can cancel anytime without early termination fees

No long-term commitment locking you in

Freedom to switch providers whenever you need

Unfortunately, some card processing companies advertise "month-to-month" services while hiding restrictive terms in the fine print. Before signing anything, ask specific questions about cancellation policies, equipment return requirements, and notice periods.

"I learned this lesson the hard way," admits Tom, a landscaper from Columbus. "My previous processor claimed to be month-to-month, but when I tried to cancel, they hit me with a $495 'early cancellation fee' that was buried on page 12 of the contract."

Our approach at Merchant Payment Services is simple: genuine freedom. Our month-to-month agreement means exactly what it says – no sneaky termination fees, no long-term commitments, and we'll even help you transition to another provider if your needs change. That's how confident we are in our service quality.

How fast will I see deposits after each batch?

Nothing impacts your daily operations quite like your cash flow. When you're making sales today but need to pay suppliers tomorrow, the timing of your deposits matters tremendously.

Funding timeframes vary widely between card processing companies:

Standard funding typically takes 1-3 business days after you batch out. This is the most common arrangement and usually comes with no additional fees.

Next-day funding puts money in your account the following business day – a popular option for businesses that need quicker access to their funds.

Same-day funding deposits your sales within hours on the same business day, though this premium service often comes with additional fees.

Instant funding provides immediate access to your money, but it's typically the most expensive option and not offered by all processors.

Most standard processing agreements don't include weekend or holiday deposits. If Saturday is your busiest day, you might not see that money until Tuesday with standard funding.

"Cash flow is everything in our business," explains Janet, who runs a hardware store in Dayton. "Having next-day funding means we can restock quickly during busy seasons without relying on credit lines. It's made a huge difference in how we manage our inventory."

When evaluating your options, consider your typical cash flow needs and whether faster funding justifies any additional fees. Also pay attention to the daily cut-off times – submit your batch after the deadline, and you'll add another day to your waiting period.

At Merchant Payment Services, we offer flexible funding options to match your business needs, with competitive rates even for our expedited services. Because we believe your money should work for you, not sit in processing limbo.

Conclusion

Choosing the right card processing company isn't as complicated as it might seem at first glance. With the knowledge you've gained from this guide, you're now equipped to make a decision that truly serves your business needs without breaking the bank or causing unnecessary headaches.

Throughout our journey together, we've covered the essential elements that matter most when selecting a payment processor. Let's take a moment to reflect on what truly matters:

Transparency should be at the heart of your relationship with any payment processor. If you can't clearly understand what you're paying and why, that's a red flag worth noticing. The days of accepting confusing statements and hidden fees are over – you deserve better.

Security isn't just a fancy feature – it's the foundation of trust between you and your customers. Your card processing company should make compliance straightforward while providing robust protection for sensitive data. One breach can damage customer trust that took years to build.

Your business is unique, and your payment solution should reflect that. Whether you're running a busy restaurant, a mobile service business, or an online store, the right processor will offer solutions custom to your specific needs rather than forcing you into a one-size-fits-all package.

When technology hiccups (and it will), knowing you have responsive, knowledgeable support can make all the difference. The quality of customer service often separates good processors from great ones.

A true partnership means your card processing company is invested in your success. They should grow with you, adapting their solutions as your business evolves and celebrating your victories alongside you.

At Merchant Payment Services, these principles form the backbone of everything we do. Our risk-free, month-to-month agreement with no startup fees or hidden charges isn't just a selling point – it's a reflection of how we believe business should be done. We're proud to provide free terminals, POS systems, and mobile payment options customized to your specific needs, all backed by service that treats you like a partner, not just an account number.

Whether you're accepting cards for the first time or looking to escape the frustration of your current processor, we're here to help. Our team of payment experts serves businesses throughout Ohio and Kentucky, including Dayton, Cincinnati, Columbus, and all surrounding areas, with the personal touch that only a family-owned business can provide.

Ready to experience payment processing that actually makes your life easier instead of more complicated? Contact us today to learn more about how we can help your business thrive in today's increasingly cashless economy.