Card Payments for Retailers Made Simple

Understanding Card Payment Solutions for Retailers

Card payments for retailers are electronic transactions that allow customers to pay using credit or debit cards through point-of-sale terminals, online gateways, or mobile devices. For retail businesses, implementing the right card payment solution is essential for growth and customer satisfaction.

Quick Guide to Card Payments for Retailers:

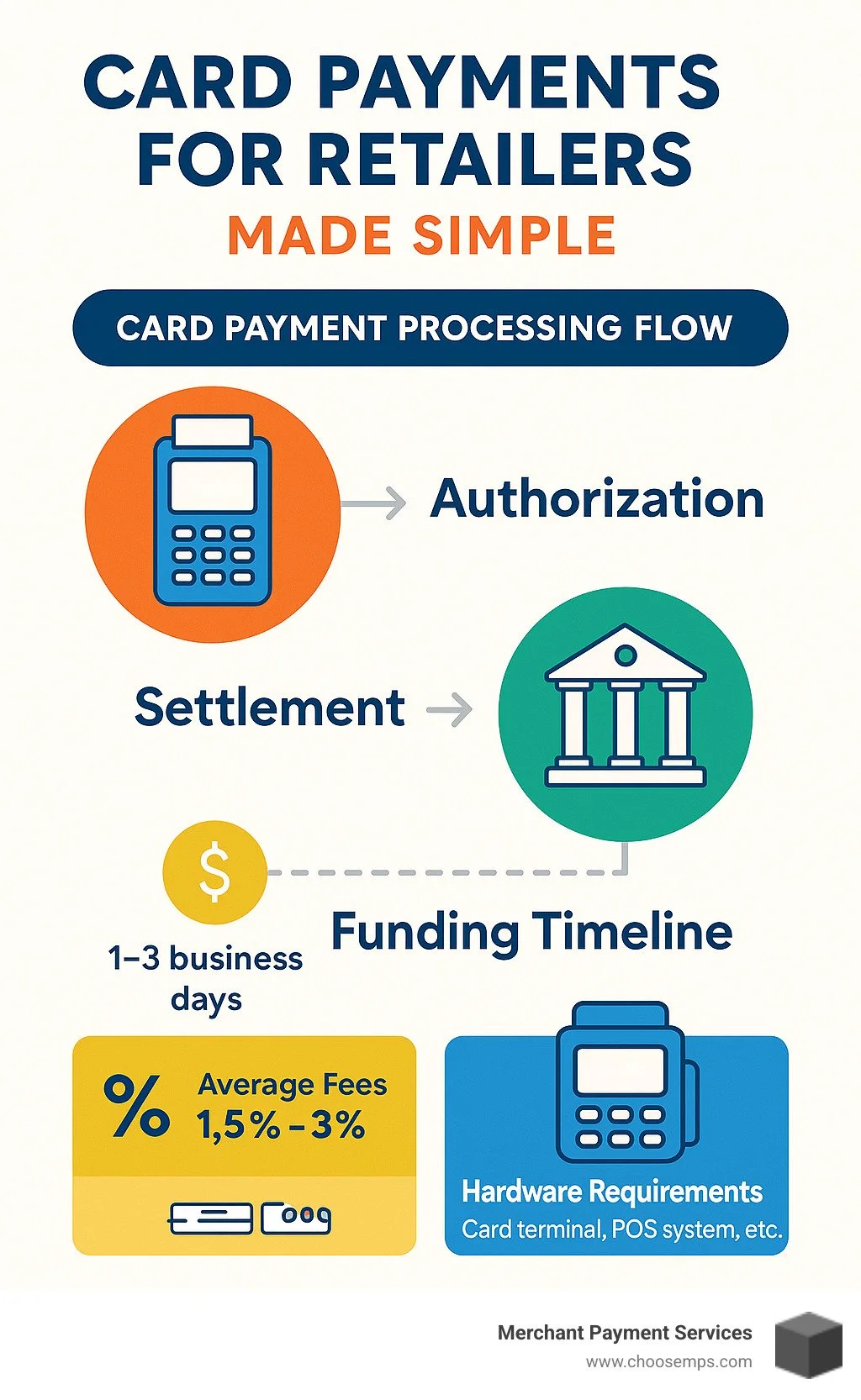

Key Component What It Means for Retailers Processing Fees Typically 1.5-3% of transaction value + per-transaction fee (10-30¢) Hardware Needed Card terminals, POS systems, or mobile readers ($50-500 one-time cost) Settlement Time 1-3 business days standard; same-day options available Security Requirements PCI DSS compliance, encryption, and tokenization Payment Types Credit, debit, contactless (NFC), digital wallets, buy now pay later

The retail landscape has shifted dramatically in recent years, with cash transactions dropping to just 16% of in-store payments in 2023. Today's consumers expect seamless payment experiences whether they're shopping in-store or online.

For retail business owners, offering card payments isn't just convenient—it's a competitive necessity. Studies show that customers spend more when using cards versus cash, with credit card purchases averaging higher ticket values than cash transactions.

Modern card payment solutions do more than just process transactions. They provide valuable business intelligence through reporting tools, help manage inventory, and create a unified view of your customers across all sales channels.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've helped thousands of retailers implement cost-effective card payments for retailers over my 15+ years in the payment processing industry. My approach focuses on transparent pricing and solutions custom to each retailer's unique needs.

Card Payments for Retailers: The Essentials

Remember those "cash only" signs hanging in shop windows? They're quickly becoming as outdated as rotary phones. With 77% of consumers now reaching for their cards instead of cash, retailers who haven't accepted card payments for retailers are essentially watching potential sales walk out the door. Let's explore why card payments have become the lifeblood of modern retail.

Why card payments for retailers matter

The shift from cash to cards isn't just about convenience—it's changing how retail businesses operate and grow. When customers aren't limited by the cash in their wallet, they naturally spend more. Credit card purchases consistently ring up higher ticket values than cash transactions. One of our boutique clothing clients in Dayton saw their average transaction value jump by 24% after implementing our card payment solution.

Have you ever watched a customer reach the checkout only to find they don't have enough cash? That dreaded "I'll come back later" usually translates to "goodbye forever." Card payments eliminate this friction entirely, keeping your sales flowing smoothly.

Mike, who owns a specialty food store in Cincinnati, shared his experience with me: "Before we started accepting card payments, we'd lose at least 3-4 sales a day when customers realized they didn't have enough cash. Now those lost sales are ancient history, and our monthly revenue has climbed nearly 15%."

There's also the trust factor. Professional payment systems signal to customers that your business is established and legitimate. In today's fraud-conscious world, consumers feel safer with electronic payments that offer protection against disputes and unauthorized charges.

Modern retail isn't confined to physical storefronts anymore. A robust card payment system creates an omnichannel experience that lets you sell seamlessly across multiple touchpoints—your brick-and-mortar store, online shop, pop-up events, and even social media—while maintaining a unified view of your inventory and customer relationships.

More info about Accepting Card Payments

Key players & terms

The card payment ecosystem might seem complex at first glance, but understanding the key players helps explain the process:

Your customer (the cardholder) presents their card to you (the merchant). Behind the scenes, the issuer (the bank that gave your customer their card) and the acquirer (the financial institution processing payments on your behalf) work together to move money securely.

The payment processor—that's where we come in at Merchant Payment Services—acts as the technical bridge between merchants, card networks like Visa and Mastercard, and financial institutions.

Your payment gateway is the technology that securely transmits payment data from your point of sale to the processor, while your merchant account is the specialized business account that allows you to accept and process card payments, separate from your regular business checking.

Understanding these relationships helps clarify why certain fees exist and who's responsible for ensuring your customers' payments reach your bank account safely and efficiently. When you know how all the pieces fit together, you can make smarter decisions about your payment processing setup.

The debit-credit differences matter too. While they might look similar to customers, debit transactions pull funds directly from checking accounts while credit cards extend a line of credit. This distinction affects both the fees you pay and how quickly funds reach your account.

How Card Transactions Work: Swipe to Settlement

Ever wonder what happens in those few seconds between a customer tapping their card and the approval message appearing on your terminal? Let's explain the journey of a card payment from the moment of purchase to the money landing in your account.

Step 1 – Authorization to capture

When your customer pulls out their card to pay for that new sweater or dining table, a fascinating digital process begins behind the scenes.

For card-present transactions, your customer might swipe their card's magnetic stripe (though this is becoming less common), dip their EMV chip, or simply tap their card or phone for a contactless payment. In card-not-present scenarios – like your online store or when taking phone orders – they'll type their card details into a checkout page or give them to you verbally.

Once that card information enters your system, your payment terminal or gateway bundles it up with the transaction amount and your merchant details, then sends this package securely to your payment processor.

For online purchases, additional safety measures activate. The Address Verification Service (AVS) checks if the billing address matches what the card issuer has on file, while the Card Verification Value (CVV) – that little 3-digit code on the back of the card – helps verify the customer actually has the physical card in hand. Many online retailers also use 3D Secure technology (like Verified by Visa or Mastercard SecureCode) for an extra layer of protection.

Your processor then routes this information to the appropriate card network – Visa, Mastercard, American Express, or Find – which forwards it to the customer's bank. The bank quickly checks available funds, confirms the card is valid and not reported stolen, and sends back their verdict.

All of this happens in just 2-3 seconds! According to Visa's scientific research on payment network speed, their VisaNet system can process more than 76,000 transaction messages per second. That's the difference between a smooth, pleasant checkout experience and a line of impatient customers.

When approved, your terminal displays the good news, and your customer walks away with their purchase. But here's the thing – while their available credit or bank balance has been reduced, the money isn't actually in your account yet.

Step 2 – Clearing & settlement timeline

After the customer leaves happy with their purchase, the behind-the-scenes financial machinery keeps working to get those funds to you.

Throughout your business day, your payment system quietly collects all authorized transactions into what we call a "batch." Most systems automatically close these batches at the end of each business day around midnight.

Here's a pro tip I share with all our retail clients: always ensure your system is set to batch daily. Delayed batching can trigger higher interchange rates, costing you unnecessary money.

Once your batch is submitted, your acquirer sends it through the card networks to each customer's issuing bank for clearing. The issuing banks transfer the transaction amounts minus interchange fees to your acquirer. This process is called clearing.

Next comes settlement, where your acquirer deposits the funds into your merchant account. This typically happens within 1-3 business days after batching, though the exact timing varies.

The final step is funding – when the money moves from your merchant account to your actual business bank account. The timing here depends on your payment processor:

Standard funding takes 1-3 business days and is most common. Next-day funding makes funds available the next business day, while same-day funding options (often available for an additional fee) can get you your money even faster.

At Merchant Payment Services, we know that cash flow is the lifeblood of retail businesses. That's why we prioritize next-day funding options for our clients throughout Ohio and Kentucky. As Sarah, who owns a home décor boutique in Centerville, told me recently, "Having funds available the next morning means I can restock popular items immediately rather than waiting days for the money to clear."

Want to learn more about the nuts and bolts of processing? Check out our detailed guide to Credit Card Payment Processing for an even deeper dive.

Choosing Solutions & Controlling Costs

Let's talk about finding the perfect card payment solution for your retail business without breaking the bank. After all, accepting cards is essential, but it shouldn't eat up all your profits!

Hardware options for card payments for retailers

The equipment you choose really depends on how and where you sell. Think of it as picking the right tool for your specific retail environment:

Countertop terminals are those reliable workhorses that sit at your checkout counter. Today's models handle it all – chip cards, traditional swipes, and tap-to-pay options. They're perfect if you have a fixed checkout area with steady customer flow.

Smart terminals take things up a notch with touchscreens and the ability to run apps. They're like mini-computers that process payments while also helping manage inventory and customer information. They cost more but do a whole lot more too.

Mobile card readers are the game-changers for retailers on the move. These small devices connect to your smartphone or tablet, making them ideal for pop-up shops or outdoor markets. I remember chatting with a jewelry vendor from Xenia who told me, "My mobile reader paid for itself in the first weekend by capturing sales from customers who 'never carry cash.'" That's the reality of today's shoppers!

POS systems are the comprehensive solution – they handle payments while also managing inventory, customer relationships, employees, and detailed reporting. They're the biggest investment but offer the most complete retail management package.

Here at Merchant Payment Services, we actually provide free terminals to our retail clients. Why? Because we know that upfront hardware costs can be a real barrier for small businesses. Plus, our equipment always includes the latest security features and payment technologies.

Software & integration checklist

Great hardware needs great software to match. Here's what matters:

Virtual terminal access gives you the flexibility to process card payments from any computer with internet. It's a lifesaver for phone orders or when your physical terminal decides to take an unexpected break.

Payment gateway is essential if you sell online. Look for one that plays nicely with your e-commerce platform and supports multiple payment methods – from traditional cards to digital wallets and "buy now, pay later" options. Good gateways also offer tokenization for secure card storage and tools to spot potential fraud.

Inventory synchronization prevents the nightmare scenario of selling products you don't actually have. If you sell both online and in-store, make sure your systems talk to each other.

CRM integration connects payment data with your customer database, opening doors to personalized marketing that really works.

Accounting software connection saves you from mind-numbing data entry. Direct links to QuickBooks or Xero mean fewer headaches and fewer errors.

Feature Stand-alone Terminal Integrated POS System Payment Processing ✓ ✓ Inventory Management ✗ ✓ Customer Database ✗ ✓ Employee Management ✗ ✓ Sales Reporting Basic Advanced E-commerce Integration ✗ ✓ Initial Cost $0-$300 $500-$2,000+ Monthly Software Fees $0-$20 $50-$200+

Understanding pricing models

Controlling costs starts with understanding how you're charged. It's like knowing what's on your restaurant bill before you pay it:

Interchange-plus pricing breaks everything down transparently. You pay the interchange fees (set by card networks and paid to banks), assessment fees (paid to card networks), and the processor markup (the only part you can negotiate). This model typically works best for retailers processing over $10,000 monthly because you're only paying the actual costs plus a clear markup.

Flat-rate pricing is simpler – you pay the same rate no matter what card your customer uses (like 2.6% + 10¢ per transaction). It's predictable but often costs more overall. Good for smaller retailers who value simplicity.

Tiered pricing groups transactions into qualified, mid-qualified, and non-qualified tiers with different rates. It's common but often hides costs in the fine print. I generally steer my clients away from this model.

Subscription pricing charges a monthly membership fee plus interchange costs and a small per-transaction fee. This can work well for high-volume retailers.

At Merchant Payment Services, we believe you deserve complete transparency. We'll look at your specific transaction patterns and recommend the pricing model that will save you the most money, not the one that maximizes our profit. That's just how we do business.

For more detailed information about retail point-of-sale systems that integrate with card payments, check out our More info about POS Systems for Retail guide.

Security, Compliance & FAQs

Let's face it – talking about security isn't the most exciting part of running a retail business, but it might be the most important. Think of good security practices as the silent guardian of your reputation and bottom line.

Must-have security measures

When customers hand over their cards, they're trusting you with their financial information. Here's how to honor that trust:

EMV chip technology has revolutionized in-store payments. Those little metallic squares create a unique code for every transaction, making it nearly impossible for fraudsters to create fake cards from stolen data. Plus, having EMV-enabled terminals shifts fraud liability away from your business – a win-win for security and your peace of mind.

End-to-end encryption (E2EE) works like an invisible shield. From the moment a card is swiped, dipped, or tapped, the data is scrambled into unreadable code until it safely reaches the processor. Even if someone managed to intercept it along the way, they'd get nothing but gibberish.

"When I explain encryption to my retail clients, I tell them it's like putting their customers' card information in an unbreakable lockbox that only the bank has the key to," says Tom, our security specialist at Merchant Payment Services.

Tokenization is your best friend for stored cards. Instead of keeping actual card numbers, your system stores meaningless stand-in values. One boutique owner told me, "It's a relief knowing that even if someone hacked our system, they'd just get a bunch of useless tokens instead of my customers' actual card details."

Point-to-Point Encryption (P2PE) takes security a step further by creating a complete fortress around transaction data from the exact moment of capture until it reaches its secure destination.

For online retailers, 3D Secure adds that extra layer of protection by having customers verify purchases through their bank. It's like having a bouncer who checks ID at the door – dramatically reducing fraudulent transactions and those dreaded chargebacks.

Compliance roadmap

PCI DSS compliance sounds intimidating, but it's really just a standardized set of security practices that protect card data. Every business that accepts cards must comply, but requirements vary based on your size:

Most small retailers fall into Level 4 Merchant category, which means you'll need to:

Complete a yearly Self-Assessment Questionnaire (SAQ) – essentially a security checklist

Run quarterly network scans if you accept online payments

Submit an Attestation of Compliance form

Don't forget about staff training – your team is your first line of defense. Make sure everyone knows:

Never to write down complete card numbers

Never to store security codes (those 3-4 digits on the back)

How to spot suspicious behavior or unusual purchase patterns

The proper procedures for verifying cards

One of our bookstore clients in Kettering put it perfectly: "The Merchant Payment Services team turned what seemed like an overwhelming compliance process into something actually manageable. They walked us through each step and were always available when we had questions."

Frequently Asked Questions about card payments for retailers

How quickly do retailers receive funds?

Cash flow is the lifeblood of retail, so this is a question I hear daily. Most retailers see funds hit their accounts within 1-3 business days after transactions are batched. If you batch your terminal at closing each night, funds typically arrive in your account within 48 hours.

Next-day funding has become increasingly common and is our standard offering at Merchant Payment Services. Submit your batch by the cutoff time (usually around 7-8 PM) and you'll have those funds available the next business morning – perfect for restocking hot items quickly.

Some processors offer same-day or instant funding options for an additional fee (typically around 1% of the transaction amount). While this might seem appealing, we've found that next-day funding meets the needs of most retailers without the extra cost.

As Jackie, who owns a garden center in Beavercreek, told me: "Having funds from weekend sales in my account Monday morning means I can place orders with my suppliers first thing in the week – that timing difference alone has improved my inventory management tremendously."

What fees should I expect?

Let's explain processing fees – they're actually pretty straightforward when broken down:

Interchange fees make up the largest portion of what you'll pay. Set by card networks, they vary based on the type of card (rewards cards cost more to process than basic cards) and how it's accepted (in-person is cheaper than online). These typically range from 1.5% to 2.5% plus a fixed amount per transaction.

Assessment fees go directly to card networks like Visa and Mastercard, usually 0.11% to 0.15% of your transaction volume.

Processor markup is what your payment processor charges for their services – this is the negotiable part of your fees.

You might also encounter monthly fees (statement fees, gateway fees, PCI compliance fees), incidental fees (chargebacks typically cost $15-25 each), and equipment costs – though at Merchant Payment Services, we provide terminals at no cost to our clients.

With the right setup, most retailers can keep their total processing costs between 2-3% of transaction volume. We believe in complete transparency – you'll always know exactly what you're paying and why.

How do I switch processors without downtime?

Changing processors doesn't have to mean disruption. Here's our smooth transition playbook:

First, we set up a parallel system alongside your existing one. This lets us thoroughly test everything before making the switch. We'll help you choose a strategic time for the transition – usually during slower hours or after closing.

We'll handle all the technical details like re-certifying terminals and making sure everything is properly programmed. We'll also train your staff on any differences they need to know about.

During the first few days, we recommend watching transactions to catch any hiccups early. But honestly, with our hands-on approach, issues are rare.

A fashion retailer in Fairborn shared: "I was worried about switching processors during our busy season, but the Merchant Payment Services team made it completely painless. They set everything up after hours and were there the next morning to make sure our first transactions went through perfectly."

Most of our transitions are completed in less than 24 hours with zero downtime. We don't just set up the equipment and disappear – we provide on-site support during the transition to ensure everything runs as smoothly as your store should.

Conclusion

Let's be honest—in a world where cash is becoming increasingly rare, card payments for retailers aren't just nice to have anymore. They're essential. With only 16% of in-store purchases made with cash in 2023, your business simply can't afford to miss out on the other 84% of potential sales.

But accepting cards does so much more for your retail business than just capturing more customers:

When shoppers pay with cards, they typically spend more than they would with cash. I've seen this with hundreds of retailers across Ohio and Kentucky—the difference can be substantial for your bottom line.

Next-day funding options mean you're not waiting around for your money. That improved cash flow lets you restock popular items faster or take advantage of supplier discounts.

Today's payment security is impressive. Modern encryption and tokenization protect both your customers' sensitive information and your business from costly data breaches.

Every card transaction gives you valuable data about what your customers buy, when they shop, and how much they spend. This business intelligence helps you make smarter decisions about inventory, staffing, and marketing.

And perhaps most importantly, unified payment processing creates a seamless experience whether your customers shop in-store, online, or through a mobile app.

At Merchant Payment Services, we've built our business around understanding what retailers really need. That's why we do things differently:

We keep our pricing crystal clear. No surprises, no hidden fees—just straightforward costs you can budget for.

We provide state-of-the-art terminals completely free. Your equipment costs? Zero.

We believe in earning your business every month, which is why we offer month-to-month agreements with no early termination penalties. If we're not delivering value, you're free to walk away.

When you call us with a question or concern, you'll talk to someone local—not an overseas call center. Our team throughout Dayton, Cincinnati, Columbus and across Ohio and Kentucky provides hands-on support when you need it.

Whether you need a simple card terminal, a complete point-of-sale system, or an online payment gateway, we've got you covered with solutions custom to your specific retail environment.

The digital payments landscape continues to evolve rapidly, with projections showing nearly 10% growth by 2028. Mobile wallet transactions alone are expected to reach an astounding $12 trillion. Having the right payment infrastructure in place now positions your retail business to adapt smoothly as these trends develop.

I recently visited one of our long-term clients, a home goods store in Miamisburg. The owner pulled me aside and said, "Working with Merchant Payment Services has transformed our business. Not only did we reduce our processing costs by nearly 20%, but their system has given us insights into customer buying patterns that have helped us optimize our inventory and marketing."

That's the kind of difference we aim to make for every retailer we work with.

Ready to simplify your retail payment processing with a partner who genuinely cares about your success? Reach out to us today for a free, no-obligation consultation and cost analysis. We'll show you exactly how much you could save while creating a better payment experience for your customers.