An Essential Guide to Payment Solutions for Small Businesses

Finding the Right Payment Solution for Your Small Business

Payment solutions for small businesses are essential tools that allow you to accept customer payments across multiple channels while managing transactions efficiently. Here's a quick overview of what you need to know:

Top Payment Solutions Best For All-in-One Solutions Brick-and-mortar with simple flat-rate pricing Developer-Friendly Platforms Online businesses with international customers Universal Payment Systems Businesses needing quick setup and versatility Integrated POS Systems Retail needing robust POS hardware options Volume-Based Processors Volume discounts for growing businesses

US businesses paid a record $160.7 billion in processing fees in 2022 to accept over $10 trillion in card payments from credit, debit, and prepaid cards. With only 16% of in-store payments made in cash during 2023, having the right digital payment solution isn't just convenient—it's critical for survival.

Today's small business owners face an increasingly complex payment landscape. Your customers expect seamless checkout experiences whether they're shopping in-store, online, or through mobile apps. They want to pay using credit cards, digital wallets, contactless options, and even buy-now-pay-later services.

The good news? The right payment solution can do more than just process transactions. It can:

Improve cash flow with faster access to funds

Boost sales conversion rates by up to 46% (according to industry data)

Streamline operations by integrating with your accounting and inventory systems

Provide valuable customer insights through transaction data

But choosing the wrong solution can mean dealing with hidden fees, poor customer support, and systems that don't grow with your business.

I'm Lydia Valberg, co-owner of Merchant Payment Services, where I've spent years helping small businesses steer payment solutions for small businesses to find transparent, reliable systems that truly serve their needs. My experience has shown that the right payment technology can transform not just how you get paid, but your entire business operation.

Why Modern Payment Solutions Matter

Remember those "cash only" signs hanging in shop windows? They're practically antiques now. Today's shoppers reach for cards and phones instead of bills and coins – and businesses need to keep up. Recent studies show digital payments cost 57% less to process than handling cash and checks. It's not just convenient; it's smart business.

The numbers tell an amazing story. Over half of all retail payments in April 2023 happened with smartphones, and experts predict digital payments will reach a mind-boggling $12 trillion by 2028. This isn't just some passing trend – it's a complete change in how we buy and sell.

For small business owners, this shift comes with significant costs (those record $160.7 billion in processing fees didn't pay themselves). But payment solutions for small businesses aren't just another expense – they're investments that can revolutionize how your entire operation runs.

Core benefits

Accelerated Cash Flow

Remember waiting days or weeks to access your hard-earned money? Modern payment solutions have changed the game. Instead of that frustrating wait, you can access your funds same-day or next-day. At Merchant Payment Services, we even offer instant deposits every single day of the year – yes, including weekends and holidays. When you need cash to restock inventory, make payroll, or jump on a growth opportunity, that speed makes all the difference.

Improved Customer Trust

Today's shoppers are savvier about security than ever before. When your payment system offers robust encryption, tokenization, and EMV compliance, it silently communicates to customers that their data is safe with you. That peace of mind translates directly into completed purchases rather than abandoned carts.

Higher Average Order Value (AOV)

When customers have flexible ways to pay, they typically spend more. Those buy-now-pay-later options aren't just convenient – they've been proven to boost average order values significantly. Industry data shows businesses see a 30% increase in average order value when customers can use their preferred payment option.

Valuable Business Intelligence

Your payment system isn't just processing transactions – it's collecting gold-mine data about your business. This information helps you understand customer buying patterns, identify your bestsellers, fine-tune your pricing, and make smarter decisions based on real evidence rather than guesswork.

Competitive Advantage

In today's crowded marketplace, offering smooth, hassle-free payment experiences can truly set your business apart. The easier you make it for customers to pay, the more likely they'll choose you over competitors who offer fewer options or clunky checkout processes.

According to latest research on processing fees, businesses that offer diverse payment methods for small businesses see higher customer satisfaction and retention rates. The investment pays for itself through increased sales and operational efficiency.

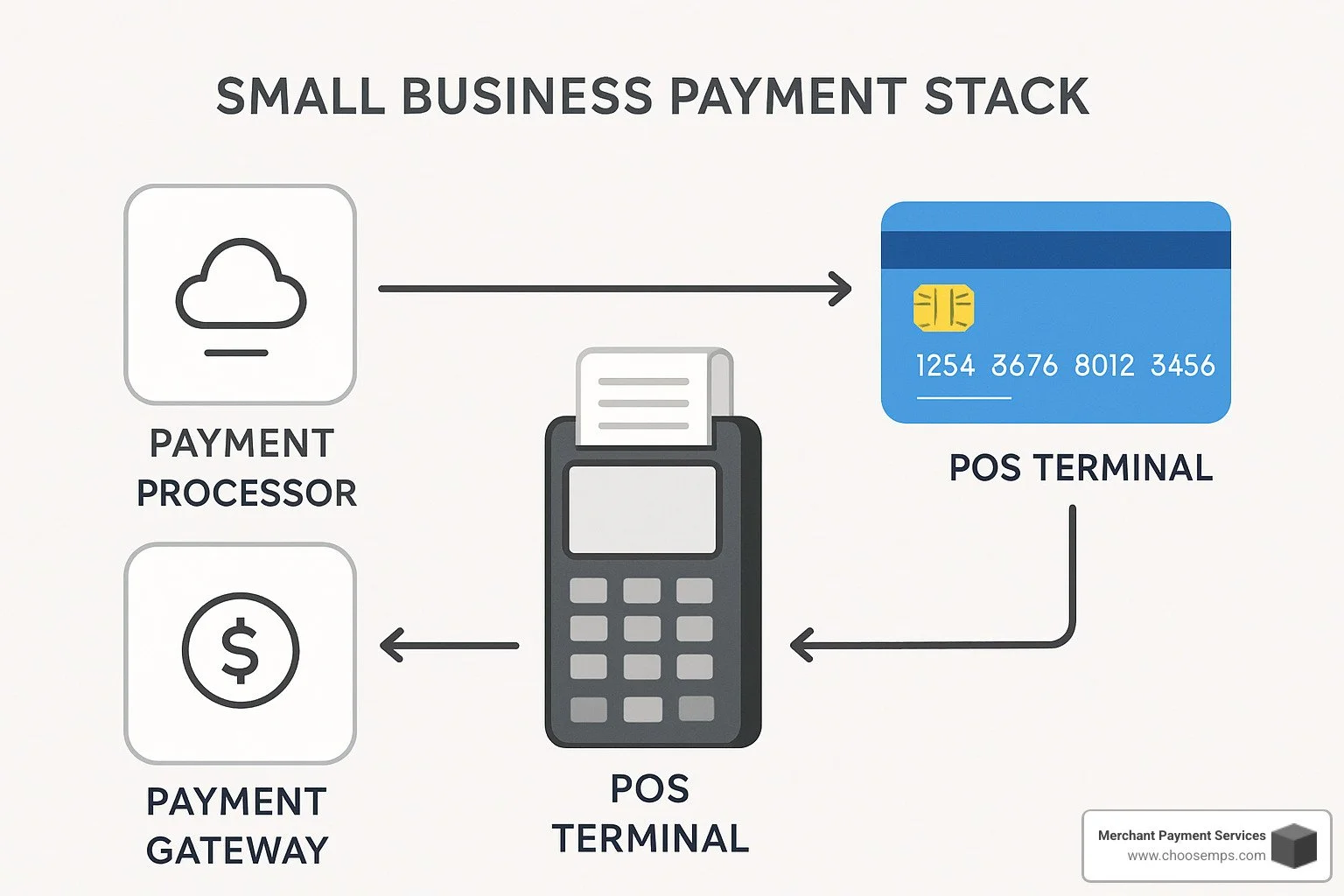

Key Components of a Small-Business Payment Stack

Understanding the building blocks of payment processing can help you make more informed decisions about which solution is right for your business. Here are the essential components of a complete payment solution for small businesses:

Payment Gateway

Think of the payment gateway as your digital cashier. It's the friendly technology that securely captures and encrypts your customers' payment information whether they're shopping on your website, standing in your store, or using their phone. Just like a trusted employee handling cash, your gateway carefully packages this sensitive information and sends it off to the payment processor for approval.

For your online shop, this gateway lives inside your website or e-commerce platform. In your physical store, it's built right into your point-of-sale system – those sleek terminals where customers tap, dip, or swipe their cards.

Merchant Account

A merchant account isn't your typical business checking account – it's more like a secure holding area where money from card transactions rests briefly before making its way to your business bank account. It's the financial equivalent of a waiting room.

You have two main options here: you can get a dedicated merchant account established directly with a bank (like having your own private waiting room), or use an aggregated merchant account through a Payment Service Provider who pools multiple merchants together (like a shared waiting area that's quicker to set up).

Payment Processor

The payment processor is your behind-the-scenes financial courier. When a customer hands over their card information, the processor springs into action, carrying that information between your business, the customer's bank, and your bank. They're responsible for getting approvals, preventing fraud, and making sure the money actually moves from point A to point B.

POS Hardware

For face-to-face sales, you'll need some physical tools to accept payments. This might be as simple as a mobile card reader that plugs into your phone, or as comprehensive as a full system with a touchscreen, cash drawer, and receipt printer. Modern terminals now accept contactless payments too, so customers can tap cards or phones without handing them over.

Software Integrations

The best payment solutions for small businesses play nice with your other business tools. Your payment system should connect seamlessly with your accounting software (like QuickBooks), inventory tracking, customer databases, online store, and appointment systems. These connections save you countless hours of manual data entry and help prevent costly mistakes.

Security Features

Today's payment landscape requires serious security measures. Your payment solution should include strong encryption (like a secret code that protects data in transit), tokenization (replacing sensitive card data with non-sensitive placeholders), fraud detection tools, and PCI DSS compliance features. These protections safeguard both your customers and your business from costly data breaches.

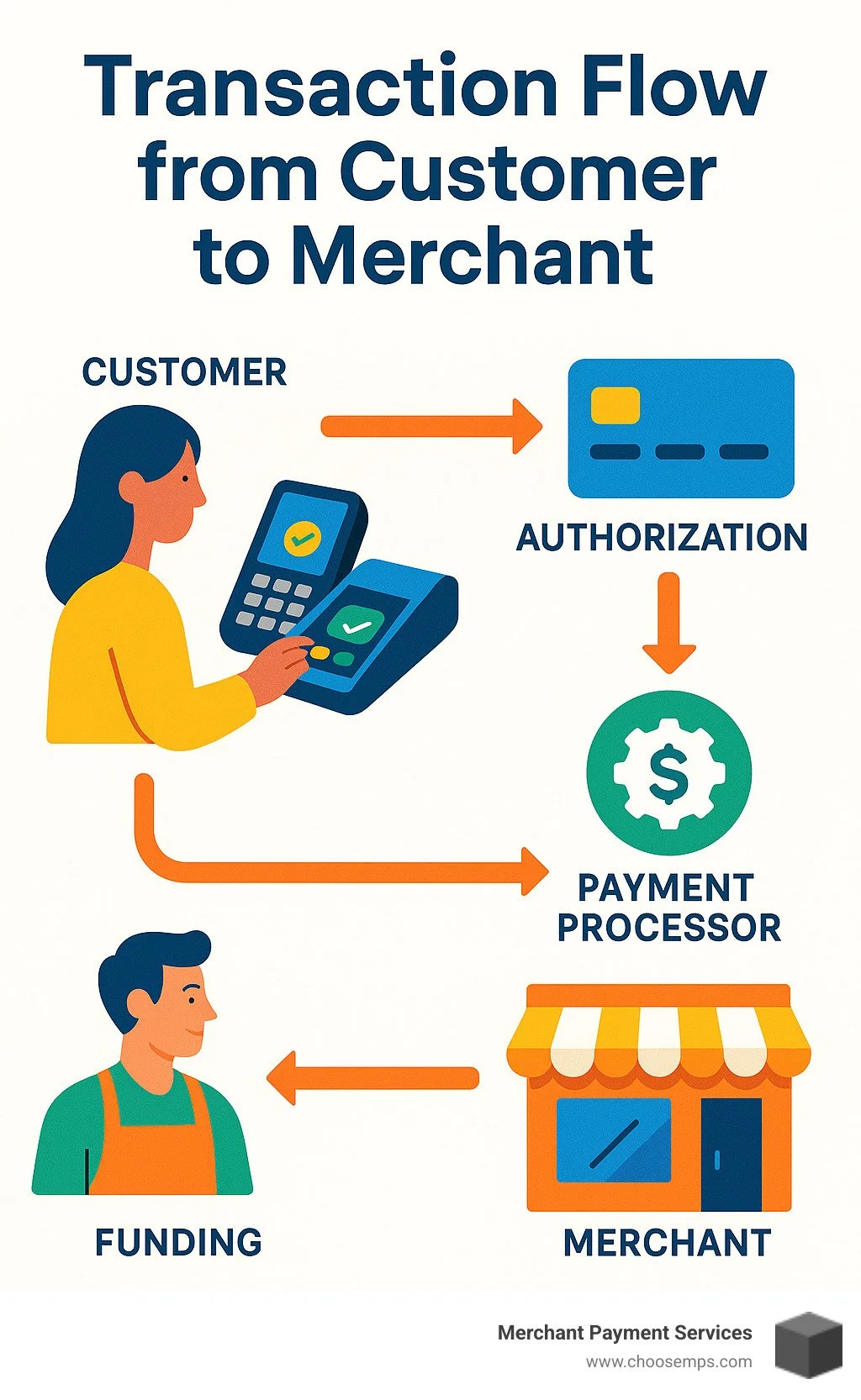

How payment processing works

When a customer hands over their card or clicks "buy now," a complex but lightning-fast process begins:

Authorization: Your payment gateway securely packages the card details and sends them to your processor, who passes them along to card networks like Visa or Mastercard and ultimately to the customer's bank. The bank quickly checks if funds are available and the card is legitimate.

Batching: Rather than sending each transaction individually (which would be inefficient and costly), your system collects authorized transactions throughout the day into batches – like bundling several letters to mail at once instead of making separate trips.

Settlement: At day's end, your processor sends these batched approvals to the card networks, which direct the appropriate funds from customers' banks to your merchant account.

Funding: Finally, the money lands in your business bank account, minus the processing fees. Depending on your provider, this might happen within 1-3 business days, or even same-day with expedited options from services like Merchant Payment Services.

Interchange: Throughout this journey, various fees are collected – the largest typically being the interchange fee paid to the customer's bank. Other smaller fees go to the card network and your payment processor.

Looking for more details about how these systems work together? Check out our comprehensive guide to Payment Systems for Small Business for a deeper dive into finding the right configuration for your specific needs.

Choosing the Best Payment Solution for Small Businesses

Looking for the right payment solution for small businesses can feel like navigating a maze. With countless options vying for your attention, how do you know which one truly fits your business? Let's break this down into something manageable.

Core criteria for payment solutions for small businesses

1. Fee Structure and Total Cost

Money matters – especially for small businesses where every dollar counts. When evaluating payment solutions, look beyond the advertised rate and dig into the complete fee picture:

What you'll want to understand includes transaction fees, monthly subscriptions, equipment costs, PCI compliance fees, and those pesky chargeback fees. And watch out for early termination fees – they can sting!

I've seen too many business owners get excited about a seemingly low rate, only to find hidden costs later. The lowest advertised rate rarely tells the whole story. Take your typical sales volume and average transaction size into account to calculate what you'll actually pay.

2. Contract Terms and Flexibility

At Merchant Payment Services, we're big believers in giving businesses room to breathe. That's why we offer month-to-month agreements without the handcuffs of long-term commitments.

Be cautious about lengthy contracts with early termination penalties – they can cost thousands if your business needs change. Equipment leases often end up costing more than buying outright, and those automatic renewal clauses? They can trap you in a service that's no longer serving you.

3. Security and Compliance

Your customers trust you with their payment information – that's a responsibility worth taking seriously. Look for solutions that offer:

PCI DSS compliance isn't optional – it's essential protection for your business. End-to-end encryption and tokenization keep sensitive data safe, while solid fraud prevention tools can save you from costly chargebacks. The right security features protect both your customers and your bottom line.

4. Omnichannel Capabilities

Today's customers shop everywhere – and they expect to pay everywhere too. Modern payment solutions for small businesses need to cover all the bases:

Whether you're selling in-store, online, over the phone, or sending invoices, your payment system should create a seamless experience. Customers who can pay their way are happier customers – and happy customers come back.

5. Integration Capabilities

Your payment solution shouldn't exist in isolation – it should play nicely with your other business tools. Look for solutions that connect easily with your accounting software, inventory management, e-commerce platform, CRM system, and any scheduling tools you use.

When your payment system talks to your other software, you'll save hours of manual data entry and reduce costly errors. That's time you can spend growing your business instead of reconciling payments.

6. Customer Support

Payment issues never happen at convenient times – they tend to pop up during your busiest hours or on holiday weekends. That's why support matters so much.

Look for 24/7 availability through multiple channels (phone, email, chat). A dedicated account representative who knows your business can be worth their weight in gold. And don't overlook implementation assistance and training resources – they can make or break your experience.

7. Scalability

The payment solution that works for you today should still work when you've doubled in size. Consider whether the system can handle multiple locations, offers volume-based discounts as you grow, provides more sophisticated reporting for larger operations, and can process international payments if that's in your future.

8. Speed of Funding

Cash flow is the lifeblood of small businesses. How quickly can you access your money after a sale? Standard funding times vary widely, but many providers now offer same-day or next-day options. Some, like us at Merchant Payment Services, even provide instant deposit capabilities – including weekends and holidays.

How transaction fees impact payment solutions for small businesses

The pricing model your provider uses dramatically affects what you'll pay. Let's break down the main options:

Flat-Rate Pricing keeps things simple with a fixed percentage plus a per-transaction fee (like 2.9% + $0.30). It's predictable and easy to understand, with no monthly fees. This works best for businesses with lower sales volumes or seasonal operations.

Interchange-Plus Pricing shows you exactly what you're paying: the interchange fee (set by card networks) plus a markup (interchange + 0.3% + $0.10, for example). It's more transparent and typically cheaper for higher volumes, though it may include monthly fees. Higher-volume merchants often save substantially with this model.

Tiered Pricing sorts your transactions into qualified, mid-qualified, and non-qualified categories – each with different rates. The lack of transparency here can hide costs, as processors decide which category your transactions fall into. We generally don't recommend this approach.

Subscription Pricing charges a monthly fee plus a small per-transaction fee, often eliminating percentage-based costs. This can be incredibly cost-effective for businesses with high average ticket sizes.

Here's a real-world comparison for a typical small business:

Pricing Model Example Rate Monthly Fee Cost per $100 Transaction Monthly Cost (100 transactions @ $100) Flat Rate 2.9% + $0.30 $0 $3.20 $320 Interchange Plus Interchange + 0.3% + $0.10 $20 ~$2.50 $270 Tiered 1.7% - 3.5% + $0.25 $15 $2.70 - $3.75 $285 - $390 Subscription $0.10 per transaction $99 $0.10 $109

Your actual costs will depend on your business type, sales volume, and average transaction amount. This is why it's so important to evaluate options based on your specific situation, not just advertised rates.

Finding the right payment solution for small businesses doesn't have to be overwhelming. Take your time, ask plenty of questions, and remember that the best solution is one that grows with you while keeping costs transparent and reasonable.

In-Person POS & Card Terminals

For businesses that interact with customers face-to-face, having the right point-of-sale (POS) system and card terminals is essential. Modern POS systems do far more than just process payments—they can help you manage inventory, track sales, analyze customer behavior, and streamline operations.

Key Features to Look For

1. Payment Flexibility

Today's customers expect options when they pay. Your POS system should welcome every payment method with open arms. Whether your customer prefers tapping their phone, inserting their chip card, or (occasionally) swiping the old-fashioned way, your terminals need to handle it all smoothly.

I've seen businesses lose sales simply because they couldn't accept contactless payments or mobile wallets. Where many shoppers don't even carry physical cards anymore, this flexibility isn't just nice to have—it's essential.

2. Hardware Options

The right hardware depends on how and where you serve your customers. Let me walk you through the main options:

Countertop Terminals sit reliably at your checkout counter, ready for high-volume action. They're the workhorses of the retail world—sturdy, secure, and built to handle hundreds of transactions daily. Many include built-in receipt printers and connect via ethernet or Wi-Fi for stable connectivity.

Mobile Card Readers bring freedom to your fingertips. If you're a food truck owner, service provider making house calls, or a vendor at weekend markets, these smartphone-connected devices let you take payments wherever your customers are. They're affordable entry points into card acceptance, though they trade some features for portability.

Full POS Systems offer the complete package—touchscreen displays, cash drawers, receipt printers, and powerful software that ties it all together. They're command centers for your business, tracking inventory levels, managing employee shifts, and even running loyalty programs. For retailers and restaurants managing complex operations, these systems provide invaluable insights beyond just processing payments.

3. Integration Capabilities

Your payment solutions for small businesses shouldn't create more work—they should eliminate it. The best systems connect seamlessly with your existing business tools. When your in-store POS talks to your online store, your accounting software, and your inventory system, you save hours of manual data entry and reduce costly errors.

I recently worked with a small boutique owner who was spending Sunday evenings manually reconciling her in-store and online sales. After setting up proper integrations, she got her Sundays back—and finded her inventory counts were finally accurate.

4. Offline Mode

Internet outages happen at the worst possible times—like during your busiest sales day. Look for systems that can process transactions even when your connection drops. The best solutions will store transaction data securely and sync everything once you're back online, ensuring you never have to turn away a sale due to technical difficulties.

5. User-Friendly Interface

Your staff needs to focus on customers, not on fighting with complicated technology. The best interfaces are intuitive enough that new employees can learn them quickly, with customizable layouts that put your most-used functions front and center. Clear visuals that work in various lighting conditions (from bright sunlight to dimmed evening settings) ensure smooth operations throughout your business day.

At Merchant Payment Services, we understand that equipment costs can be a major barrier for small businesses. That's why we offer free terminals with no leasing requirements. You get modern, capable hardware without long-term commitments or the hidden costs that often come with equipment leases from other providers. Our POS Systems for Small Businesses are designed to grow with you, providing the flexibility and features you need at every stage of your business journey.

Online Payment Gateways & E-commerce Checkout

Let's face it—even if you run a traditional brick-and-mortar shop, having a solid online payment solution isn't optional anymore. E-commerce continues to grow year after year, and your customers have come to expect checkout experiences that are quick, easy, and secure.

When I talk with small business owners about their online payment needs, I often hear the same concerns: "Will it be complicated to set up?" "How do I keep customer information safe?" "Why are people abandoning their carts?" Let's address these questions and more as we explore the essential components of payment solutions for small businesses in the online world.

Key Components of Online Payment Solutions

1. Payment Gateway Integration

Think of your payment gateway as the digital version of your cash register—it's what securely carries payment information from your website to the payment processor. A good gateway isn't just functional; it's invisible to your customers while providing you with powerful tools behind the scenes.

When evaluating gateways, look for one that plays nicely with your e-commerce platform, whether that's Shopify, WooCommerce, or something else. The best gateways support multiple payment methods (not just credit cards but also digital wallets and alternative payment options), provide robust security, and let you customize the checkout experience to match your brand.

Many of our clients at Merchant Payment Services have found that the ability to securely store customer payment information for repeat purchases has dramatically improved their repeat business rates.

2. Checkout Optimization

The checkout process is where the magic happens—or where sales disappear. Research shows that the average cart abandonment rate is nearly 70%, which means most potential sales never materialize. But there's good news: small tweaks to your checkout can make a big difference.

Start with offering guest checkout. Nothing kills a sale faster than forcing someone to create an account when they just want to make a quick purchase. Make sure your checkout is mobile-friendly (pinching and zooming is so 2010), keep form fields to a minimum (do you really need their fax number?), and clearly show customers where they are in the process with progress indicators.

Other conversion boosters include address auto-complete (because nobody enjoys typing their full address on a tiny phone screen) and storing payment methods for returning customers. Every extra click or field is another opportunity for your customer to change their mind.

3. Fraud Prevention Tools

Online transactions come with unique security challenges. The trick is finding the sweet spot between security and convenience—too much security friction and customers bounce, too little and you're vulnerable to fraud.

A balanced approach includes Address Verification Service (AVS) to confirm billing addresses match what's on file with the card issuer, requiring the Card Verification Value (CVV), and implementing 3D Secure authentication for higher-risk transactions. More sophisticated solutions add IP address monitoring and machine learning fraud detection that adapts to emerging threats.

At Merchant Payment Services, we help our clients set up customizable risk rules that flag suspicious orders for review while letting legitimate orders sail through.

4. Subscription and Recurring Payment Capabilities

If your business involves subscriptions or recurring services—whether that's a monthly box of goodies or ongoing professional services—you need tools designed specifically for this purpose.

Look for features like automated recurring billing that handles the entire payment cycle, secure card storage that meets PCI compliance standards, and intelligent retry logic that automatically attempts to process failed payments before giving up. Your customers will appreciate self-service portals where they can update their payment information or pause subscriptions without having to contact you.

5. Global Payment Support

Even small local businesses can find themselves serving customers around the world. If international sales are part of your strategy, your payment solution needs to accommodate different currencies, payment preferences, and regulations.

Multi-currency processing lets customers pay in their local currency, reducing friction and surprise fees. Different regions have different preferred payment methods—credit cards dominate in the US, but in Germany, direct bank transfers are popular, while in China, mobile payments rule. A flexible gateway can adapt to these preferences.

Don't forget about tax calculation and compliance—getting this wrong can lead to headaches down the road.

6. Mobile Checkout Optimization

More than half of online shopping now happens on mobile devices, yet many checkouts still feel designed for desktop first. Your mobile checkout experience should be thoughtfully crafted for thumbs and small screens.

This means responsive design that automatically adapts to different screen sizes, touch-friendly buttons (no tiny checkboxes, please), and forms simplified for mobile input. Integration with digital wallets like Apple Pay and Google Pay can reduce checkout time from minutes to seconds by eliminating the need to type card information.

QR code payment options are also gaining traction, allowing customers to quickly complete a purchase by scanning a code with their phone's camera.

At Merchant Payment Services, we help businesses implement secure, user-friendly online payment solutions for small businesses that seamlessly integrate with your website and operations. Our solutions include guest checkout options that have been shown to significantly boost conversion rates by removing unnecessary friction from the buying process. After all, the easier you make it for customers to pay you, the more likely they are to complete their purchase—and come back for more.

Mobile & Contactless Payments

Remember when contactless payments felt like futuristic technology? Today, they're not just normal—they're expected. The pandemic didn't create this shift; it just pressed fast-forward on a change that was already happening. Now your customers assume they'll be able to pay without touching anything, whether they're in your store or receiving services at home.

Types of Contactless Payment Options

Tap-to-Pay Cards have become incredibly common. These credit and debit cards with embedded NFC chips let customers simply hover their card near your terminal rather than the traditional insert or swipe. It's quick, convenient, and customers love the simplicity.

Mobile Wallets have transformed smartphones and smartwatches into payment devices. Apple Pay, Google Pay, and Samsung Pay let your customers leave their physical cards at home. These solutions aren't just convenient—they're actually more secure thanks to tokenization and biometric authentication. Plus, many integrate with loyalty programs, giving customers another reason to use them.

QR Code Payments offer a wonderfully accessible option that doesn't require specialized hardware. You can display a QR code on a screen, print it on receipts, or add it to invoices. Your customer simply scans it with their smartphone camera and completes the payment. This method is particularly popular with younger customers who appreciate its simplicity.

Text-to-Pay Solutions have been a game-changer for service businesses. Imagine finishing a job at a customer's home and sending a payment link via text message before you even leave. These solutions get impressive response rates because they meet customers where they already are—on their phones.

Mobile Payment Acceptance for Businesses

Small businesses need flexible ways to accept payments, and mobile solutions deliver exactly that. Mobile card readers connect to smartphones or tablets, turning them into portable payment systems. They're perfect if you're a food truck operator, farmer's market vendor, or home service provider who needs to take payments on location.

The newest innovation is Tap-to-Phone Technology, which allows NFC-enabled smartphones to accept contactless payments directly—no additional hardware needed. It's a zero-equipment-cost solution that works with devices you already own. For businesses that only occasionally need to accept payments, this can be a perfect fit.

Curbside and On-Location Payments became essential during the pandemic, but customers still love the convenience. Mobile payment solutions let you accept payments wherever you meet your customers—at curbside pickup locations, in customers' homes for service calls, or at community events and pop-up shops.

Benefits of Offering Contactless Payments

The advantages of contactless payments go far beyond just keeping up with trends. Faster transactions mean shorter lines and happier customers. A tap payment typically completes in seconds, allowing you to serve more customers during busy periods.

Reduced physical contact remains important to many consumers even as pandemic concerns fade. By offering contactless options, you're showing customers you care about their comfort and preferences. No handling cash, no touching keypads—just a simple, hygienic transaction.

Improved security is a major benefit that customers may not see but definitely appreciate. Contactless methods often use advanced security features like tokenization and biometric authentication, protecting both you and your customers from fraud.

Perhaps most importantly, contactless payments are simply what customers prefer. Recent data shows that 77% of users prefer credit and debit card payments, over 50% of retail payments are now made with smartphones, and only 16% of in-store payments were made in cash in 2023. Offering the payment methods your customers want to use is just good business.

At Merchant Payment Services, we understand that different businesses have different needs. That's why we offer a range of mobile and contactless payment solutions for small businesses that can be custom to your specific situation, whether you're running a retail store, restaurant, service business, or e-commerce site. Our solutions make it easy to meet your customers' expectations for convenient, secure, and touch-free payments.

Recurring & Subscription Billing

If your business relies on recurring revenue—whether you're running a SaaS company, membership site, service business, or subscription box—you need more than just a way to charge cards repeatedly. You need a complete system that manages the entire customer lifecycle from sign-up to renewal to (hopefully not!) cancellation.

Think about it: your recurring billing solution is essentially the engine that keeps your revenue flowing month after month. When it works well, it's almost invisible. When it doesn't... well, that's when customers get frustrated and your cash flow takes a hit.

Key Features of Effective Recurring Billing Solutions

Flexible billing schedules are the foundation of any good subscription system. Your business isn't one-size-fits-all, and your billing shouldn't be either. Look for solutions that let you charge monthly, quarterly, or annually—or even create custom intervals that match your unique business model. Need to offer trial periods that automatically convert? Want to charge setup fees? Need to handle usage-based billing? Your system should make all of this simple.

The best systems also include robust customer management tools that empower your subscribers. A self-service portal where customers can upgrade, downgrade, pause, or (if they must) cancel their subscription creates transparency and trust. It also saves your team countless hours of manual account adjustments.

Let's face it—failed payments happen. Credit cards expire, get replaced, or hit limits. That's why smart payment retry logic is absolutely crucial. Good systems will automatically attempt to recharge failed payments on an intelligent schedule, use card updater services to refresh expired card details, and implement dunning management to reduce that dreaded "involuntary churn" where customers drop off simply because their payment method failed.

Beyond basic retries, effective revenue recovery features can make a huge difference to your bottom line. Pre-expiration card notifications, account updater services, and the ability to store backup payment methods can all help maintain that steady revenue stream. Some of our clients at Merchant Payment Services have reduced involuntary churn by over 30% just by implementing these features.

To grow your subscription business, you need visibility. Robust reporting and analytics should track your Monthly Recurring Revenue (MRR), analyze churn patterns, calculate Lifetime Value (LTV), and show retention rates across different customer cohorts. These metrics aren't just numbers—they're the vital signs of your subscription business.

Finally, your billing system can't exist in isolation. Strong integration capabilities ensure it works seamlessly with your CRM, accounting software, tax calculation services, email marketing platforms, and customer service tools. This creates a unified ecosystem where data flows freely, giving you a complete picture of your business.

Benefits of Automated Subscription Billing

The most immediate benefit of a good subscription system is improved cash flow. There's something magical about waking up on the first of the month knowing that revenue is automatically flowing in. This predictability makes planning easier, impresses investors, and dramatically reduces the accounts receivable workload on your team.

Speaking of workload, the reduced administrative overhead is another major advantage. No more manually creating invoices, chasing payments, or reconciling accounts. The system handles it all automatically, freeing your team to focus on growing the business rather than managing payments.

Your customers benefit too. A well-designed subscription system creates an improved customer experience with convenient automatic payments, self-service options, and transparent billing history. Today's consumers expect this level of control and convenience—especially for services they pay for month after month.

Perhaps most importantly, automated systems help prevent revenue leakage. No more missed invoices or forgotten charges. The system ensures you capture every dollar you've earned, with automatic retries for failed payments and proactive management of expiring cards. For many businesses, this alone can increase revenue by 3-5% with zero additional sales effort.

At Merchant Payment Services, we understand that subscription billing is more than just a convenience—it's the lifeblood of your recurring revenue business. Our payment solutions for small businesses include subscription management tools that integrate seamlessly with your existing systems, providing the reliability and flexibility you need to nurture long-term customer relationships. We'll help you set up the right recurring billing approach that matches your specific business model while minimizing fees and maximizing successful payments.

ACH & Bank Transfer Solutions

When it comes to handling larger transactions or B2B payments, ACH (Automated Clearing House) and bank transfer solutions can be a game-changer for your small business. Unlike credit card processing, these methods move money directly between bank accounts—often with significantly lower fees and different benefits that make sense for certain business models.

I've seen many of our clients save thousands of dollars annually by incorporating ACH payments into their payment solutions for small businesses strategy, especially for recurring or high-ticket transactions.

Understanding ACH Payments

Think of ACH as the digital equivalent of writing a check, but faster and more secure. This electronic network processes millions of financial transactions daily across the United States, handling everything from direct deposits of your paycheck to automatic bill payments and B2B transactions.

What makes ACH different is that it moves money directly from one bank account to another without the credit card networks acting as middlemen. This direct approach translates to substantial cost savings, particularly for larger transactions.

Benefits of ACH & Bank Transfer Solutions

Lower Processing Costs make ACH particularly attractive for small businesses watching their bottom line. Instead of paying percentage-based fees (which can be painful on large transactions), ACH typically charges a small fixed fee—usually between $0.20 and $1.50 per transaction regardless of the amount. For a $1,000 transaction, this could mean paying $1 instead of $30 with a typical credit card processor. That's up to 80% in savings going straight back into your business.

Reduced Chargeback Headaches give business owners more peace of mind. ACH transactions have stricter dispute rules with shorter windows for customers to file claims. This means you're less likely to face the frustrating situation of delivering a product or service only to have the payment clawed back months later.

Recurring Revenue Reliability makes ACH ideal if your business model involves subscriptions or regular billing. Since ACH payments aren't affected by expired cards or replaced plastic, you'll experience fewer failed payments and less need to chase customers for updated information. This translates to steadier cash flow and fewer awkward collection conversations.

High-Value Transaction Efficiency becomes apparent when you're processing larger payments. Since fees don't increase with transaction size, you can process a $10,000 payment for the same flat fee as a $100 payment. This predictable cost structure makes budgeting easier and protects your margins on your biggest sales.

ACH Implementation Options

Same-Day ACH has transformed what was once a slow process into something much more efficient. While traditional ACH processing typically took 1-3 business days, Same-Day ACH offers multiple settlement windows throughout the business day, making funds available much faster. There's usually a slightly higher fee for this expedited service, but for time-sensitive transactions, the speed can be well worth it.

ACH for Invoice Payments can revolutionize your accounts receivable process. By including ACH payment options on your invoices, you can reduce days sales outstanding (DSO) and improve cash flow predictability. Many of our clients offer small discounts for customers who set up automatic ACH payments, creating a win-win that reduces administrative work while ensuring timely payments.

ACH for E-commerce is becoming increasingly popular, especially for businesses selling higher-priced items. While it requires a bit more setup than credit card processing, it appeals to customers concerned about card security and can significantly reduce your processing costs on larger online purchases.

ACH API Integration offers the most flexibility for businesses with custom payment needs. These direct integrations with your existing systems allow for automated reconciliation, custom payment flows, and detailed reporting capabilities that can streamline your financial operations.

According to recent research on ACH growth, ACH transaction volume continues to climb year over year, with businesses increasingly recognizing its value for certain payment scenarios. The research shows that ACH payments are growing at a rate of 7.1% annually, reflecting their increasing importance in the payment ecosystem.

At Merchant Payment Services, we help small businesses integrate ACH processing solutions that work alongside your existing payment methods, giving your customers options while protecting your profit margins. Our ACH solutions are designed to complement rather than replace your current payment solutions for small businesses, creating a more versatile and cost-effective payment strategy.

Accounting & AR Automation Platforms

Modern payment solutions do much more than just process transactions these days. They can become your accounting department's best friend by seamlessly connecting with your financial systems and taking the drudgery out of accounts receivable management. This kind of integration is like having an extra team member who never takes breaks, makes mistakes, or complains about data entry.

Key Features of Integrated Accounting & Payment Solutions

1. Two-Way Synchronization

Remember the days of manually entering payment data into your accounting software? Those can be behind you. Today's best payment solutions for small businesses create a conversation between your systems, not just a one-way shout.

When a customer makes a payment, that information flows automatically into your accounting records. When you update customer details in your CRM, those changes reflect across your payment platform too. It's like your business systems are finally talking to each other after years of awkward silence.

Automated Invoice Management

Nothing slows down cash flow like invoice delays. Modern systems can transform your billing process from a monthly headache into a smooth background operation.

Imagine invoices that create themselves based on your sales or schedules, then zip off to customers with payment links already embedded. When customers pay, the system automatically marks those invoices as settled and sends thank-you notes. Meanwhile, for those who haven't paid, gentle reminders go out without you lifting a finger.

One of our clients, a service business with over 200 monthly invoices, reduced their billing process from two full days to just 30 minutes after implementing our automated solution.

Bill Capture & Payment Automation

The accounts payable side gets love too. Modern systems can scan incoming bills, extract the important details, and route them through your approval workflow automatically.

Instead of processing each vendor payment individually, you can review and approve them in batches, scheduling payments to optimize your cash flow. The system remembers each vendor's payment preferences, whether they want checks, ACH transfers, or credit card payments.

As one small business owner told us, "It's like having an AP department without having to hire one."

Reconciliation Tools

Bank reconciliation used to be accounting's most dreaded task—matching hundreds of transactions to bank statements line by line. Integrated systems now handle the heavy lifting.

The software automatically pairs transactions with bank records, flagging only the exceptions that need human attention. What used to take days now takes minutes, and month-end closing happens on time instead of weeks late.

Financial Reporting & Analytics

With your payment and accounting data living harmoniously together, you gain insights that were previously impossible. Cash flow forecasting becomes more accurate. You can spot payment trends across customer segments. You'll know exactly which products generate the most revenue with the least hassle.

One of our clients finded through integrated reporting that their highest-volume customers were also their slowest payers—knowledge that led to a simple policy change that improved their cash position by over $50,000.

Benefits of Accounting & Payment Integration

The advantages go beyond just saving time (though that's certainly nice). When your payment solutions for small businesses talk directly to your accounting systems, you're building a financial ecosystem that works while you sleep.

Reduced Manual Data Entry means your team can focus on growth instead of grunt work. One retailer we work with estimates they save 15 hours every week—that's nearly two full workdays—by eliminating double entry between systems.

Accelerated Cash Flow happens naturally when invoices go out promptly and include one-click payment options. The average business using integrated systems gets paid 7-10 days faster than those using separate platforms.

Improved Accuracy might be the biggest benefit of all. When humans manually transfer data between systems, errors inevitably creep in. Integrated systems eliminate that risk, ensuring your financial reports reflect what's actually happening in your business.

Better Decision Making comes from having reliable, real-time information at your fingertips. Should you order more inventory? Can you afford that new hire? Are your payment terms working? With integrated systems, you'll have the data to decide confidently.

At Merchant Payment Services, we've seen how the right integration between payment systems and accounting software can transform a business. Our solutions work with QuickBooks, Xero, and other popular platforms to create a financial ecosystem that's greater than the sum of its parts.

Security & Compliance Essentials

Let's face it—payment security isn't just some technical checkbox to tick off. For small businesses, it's absolutely vital to your survival and success. When customers hand over their payment information, they're placing their trust in you. A single data breach or fraud incident can shatter that trust, drain your finances, and potentially close your doors for good.

I've worked with hundreds of small business owners who initially viewed security as "something for the big companies to worry about." But in today's digital landscape, businesses of all sizes need strong protection.

PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) might sound like intimidating jargon, but it's simply a set of security rules that protect card data. If you accept credit cards, compliance isn't optional—it's mandatory.

Think of PCI compliance as having a good security system for your digital storefront. The requirements include securing your networks with firewalls, protecting stored cardholder data, regularly updating your security systems, restricting access to sensitive information, monitoring your networks, and maintaining clear security policies.

Many small business owners tell me, "This sounds overwhelming!" The good news is that working with a reputable payment processor like Merchant Payment Services can significantly simplify compliance. We handle much of the technical heavy lifting while providing clear guidance for the parts that remain your responsibility.

Key Security Technologies

Encryption is like sending your customers' payment data in an unbreakable secret code. Strong encryption should protect data from the moment it's captured all the way through processing. Without the proper decryption key, this information is useless to hackers—even if they somehow manage to intercept it.

Tokenization takes security a step further by replacing sensitive card information with a meaningless string of characters called a token. This is particularly valuable for businesses with repeat customers. You can store these tokens safely to enable one-click purchases without ever keeping the actual card details on your systems.

EMV chip technology has dramatically reduced in-person fraud since its introduction. Those little metallic squares on credit cards generate unique codes for each transaction, making them virtually impossible to counterfeit. As a bonus, merchants using EMV-compliant terminals shift liability for certain types of fraud back to the card issuers.

Fraud Prevention Strategies

Smart fraud prevention combines multiple layers of protection. Address Verification Service (AVS) checks whether the billing address provided matches what's on file with the card issuer—a simple but effective way to spot potential fraud, especially for online sales.

Requiring the Card Verification Value (CVV)—that little 3 or 4-digit code on the back of cards—helps verify that the customer actually has the physical card in hand. Since merchants aren't allowed to store these codes (per PCI requirements), they provide an additional security layer for each new transaction.

Velocity checks monitor how frequently transactions come from a single source. Imagine someone attempting dozens of small purchases in quick succession using different card numbers—that's exactly the kind of suspicious pattern these checks can flag.

For businesses facing sophisticated fraud attempts, machine learning fraud detection systems can identify subtle patterns that might escape human notice. These systems continuously learn and adapt to new fraud techniques, providing real-time risk assessment with fewer false alarms.

Chargeback Prevention and Management

Chargebacks—when customers dispute charges directly with their bank instead of contacting you first—can be a real headache for small businesses. Beyond the reversed payment, you'll typically face chargeback fees, lost merchandise, and administrative time dealing with the dispute.

The best defense starts with clear merchant identification. Make sure your business name appears recognizably on credit card statements—I've seen countless chargebacks initiated simply because customers didn't recognize the charge on their statement.

Maintain thorough documentation of all transactions, including shipping confirmations and customer communications. When disputes do arise, respond quickly with this evidence. Many payment solutions for small businesses now include tools that help streamline the chargeback response process.

Creating a hassle-free refund policy often prevents chargebacks in the first place. When customers know they can easily resolve issues directly with you, they're less likely to go straight to their bank with complaints.

At Merchant Payment Services, we understand that security can seem daunting for small businesses. That's why we provide comprehensive PCI Compliance for Small Businesses assistance and fraud protection tools as part of our standard service. We believe your focus should be on growing your business, not worrying about payment security—we've got you covered there.

Cost & Fee Structures Explained

Let's face it – understanding payment processing costs can feel like deciphering a secret code. But knowing what you're really paying (beyond those flashy advertised rates) is crucial for your bottom line. Let's break down these costs in plain English so you can make smarter decisions for your business.

Common Pricing Models

Flat-Rate Pricing is like the "one-size-fits-all" t-shirt of payment processing. You'll pay the same predictable rate for every transaction – typically something like 2.9% plus 30 cents per transaction. It's refreshingly simple: no monthly fees, no surprises on your statement. Perfect if you're just starting out or process lower volumes. The downside? You might be overpaying once your business grows, especially since you don't benefit from the lower costs of debit card transactions.

Interchange-Plus Pricing separates what the card networks charge (interchange) from what your processor adds (the markup). It looks something like "interchange + 0.3% + $0.10" on paper. This model is like buying wholesale – you pay the base cost plus a transparent markup. While monthly statements require a bit more brain power to decipher, businesses with higher transaction volumes often save significantly. You'll also benefit when customers use lower-cost cards like debit cards or basic credit cards.

Tiered Pricing groups your transactions into categories – qualified (lowest rates), mid-qualified, and non-qualified (highest rates). The catch? Processors control which transactions land in which tier. It's like a restaurant advertising their appetizer prices but hiding the cost of entrees. Many processors advertise only the qualified rate, so that attractive 1.7% might actually be 3.5% for many of your transactions. Unless you enjoy surprises on your monthly statement, approach this model with caution.

Subscription Pricing is the Netflix approach to payment processing – pay a monthly subscription ($50-$100+) plus a small per-transaction fee (10-15 cents) without percentage-based markups. If you process large transactions, this can be a game-changer. A $1,000 sale might cost just 10 cents to process (plus interchange) instead of $29 with flat-rate pricing. But if you mainly process small transactions, the monthly fee might outweigh the benefits.

Additional Fees to Watch For

Beyond basic transaction costs, payment solutions for small businesses often include various additional fees that can significantly impact your total cost:

Those monthly fees can add up fast – statement fees, PCI compliance fees, gateway fees, minimum processing requirements, and general service fees. Some providers bundle these together, while others itemize each one.

Then there are those surprise incidental fees that pop up occasionally – $15-$100 for each chargeback, fees for batching transactions, address verification charges, retrieval requests, and voice authorizations. These are like those mysterious hotel "resort fees" that appear at checkout.

Equipment and setup costs are another consideration. Will you need to purchase or lease terminals? Is there a setup fee? What about that fancy POS system? And always check for early termination penalties if you decide to switch providers.

Watch out for those sneaky surcharges too – introductory rates that increase after a few months, extra fees for "non-qualified" transactions, foreign transaction fees, cross-border charges, and seasonal inactivity fees. These hidden costs are often buried in the fine print of lengthy contracts.

Calculating Your Total Cost

The best way to compare providers is to calculate your effective rate – divide your total processing costs by your total processing volume. For example, if you processed $10,000 in a month and paid $300 in total fees (including all transaction fees, monthly fees, and incidental charges), your effective rate would be 3%.

This simple calculation cuts through the marketing jargon and reveals what you're actually paying.

At Merchant Payment Services, we believe you deserve to know exactly what you're paying for. That's why we offer transparent pricing with no hidden fees and month-to-month agreements instead of long-term contracts. We've seen too many small businesses locked into expensive, confusing payment arrangements – and we're committed to doing things differently.

When you're evaluating payment solutions for small businesses, the lowest advertised rate rarely tells the whole story. Ask detailed questions about all potential fees, calculate your effective rate, and choose a provider who values transparency as much as you value your hard-earned money.

How to Set Up Your Payment Solution

Getting your new payment solution for small businesses up and running doesn't have to be complicated. I've helped hundreds of business owners through this process, and with the right guidance, you can be accepting payments in no time. Here's a straightforward roadmap to implementation:

1. Register Your Business

Before any payment processor will work with you, your business needs to be officially established. Think of this as building your business's financial foundation:

First, obtain a proper business license from your local government. This is your official permission to operate. Next, register for an Employer Identification Number (EIN) with the IRS – think of this as your business's social security number.

You'll also need to open a dedicated business bank account. Trust me on this one – mixing personal and business finances creates headaches come tax season. Finally, make sure you've settled on your business structure, whether that's a sole proprietorship, LLC, or corporation.

2. Choose Your Payment Solution Provider

This is where all that research you've done pays off. Look beyond flashy marketing and consider what really matters for your specific business needs:

Compare the true costs by calculating your effective rate with each provider. The lowest advertised rate isn't always the cheapest in practice. Review contract terms carefully – at Merchant Payment Services, we believe month-to-month agreements give small businesses the flexibility they need to thrive.

Don't overlook security features and PCI compliance assistance – these protect both you and your customers. Consider how easily the solution will integrate with your existing tools, from your accounting software to your inventory system. Finally, check out the customer support options – because when payment issues arise, you need help right away, not next business day.

3. Complete the Application Process

Think of this step as your payment processor getting to know your business. Be prepared with:

Your business identification (EIN and license), personal identification for owners (this is standard for fraud prevention), and your bank account details for deposits. You'll likely need to share your expected monthly volume and average transaction size. If you're an established business, be ready to provide processing history, and some higher-volume merchants might need to show financial statements.

Don't worry if this sounds intimidating – at Merchant Payment Services, we walk you through each step with clear guidance.

4. Set Up Your Hardware and Software

Now comes the exciting part – getting your actual payment tools in place:

For your physical store, you'll install and configure your POS terminals, set up receipt printers, program your product catalog, and configure employee access levels. If you're selling online, you'll integrate your payment gateway with your website, set up your products, configure shipping and tax settings, and thoroughly test the checkout flow.

Mobile businesses have their own setup process: downloading the payment app, connecting card readers to your devices, setting up your product list, and testing transactions in different environments to ensure connectivity.

5. Connect with Your Existing Systems

Your payment solution shouldn't exist in isolation. The real magic happens when it talks to your other business tools:

Connect your new system with your accounting software to eliminate manual data entry. Link it to your inventory management to keep stock levels accurate. Integrate with your CRM to build a complete picture of customer behavior. And don't forget connections to your email marketing and loyalty programs to maximize customer lifetime value.

6. Train Your Staff

Even the best payment system falls short if your team doesn't know how to use it properly:

Take time to train everyone thoroughly on processing transactions, issuing refunds, and handling special situations like discounts or tax exemptions. Make sure they know basic troubleshooting for common issues and understand the security protocols that protect your business and customers.

Consider creating a simple reference guide for new employees or for handling rare situations that might come up only occasionally.

7. Test Your System

Before going live, put your system through its paces:

Process test transactions with every payment method you'll accept. Verify that funds deposit correctly into your account. Test your refund process from start to finish. Double-check that all your integrations are working properly. And make sure your reporting gives you the insights you need to run your business effectively.

This testing phase catches potential issues before they affect real customers and real money.

8. Go Live and Monitor Performance

Once you're up and running, keep a close eye on how things are performing:

Watch your transaction success rates and note any patterns in declines. Confirm that deposits arrive as expected. Be alert for unusual patterns that might indicate problems. Gather feedback from customers about their checkout experience. And don't hesitate to contact support if anything seems off – small issues are much easier to fix before they become big problems.

At Merchant Payment Services, we don't disappear after setup. We provide ongoing support to ensure your payment solution continues to serve your business as you grow. Our team is always just a phone call away to help with questions, troubleshooting, or adapting your system as your business evolves.

Frequently Asked Questions about Payment Solutions

What payment methods should I offer?

Today's customers expect choices when it comes to paying for your products or services. The days of "cash or check only" are long gone, and businesses that limit payment options often lose sales to more flexible competitors.

For most small businesses, I recommend offering at minimum:

Credit and debit cards from all major networks (Visa, Mastercard, American Express, and Find). These remain the backbone of payment acceptance, with 77% of consumers preferring card payments over other methods.

Mobile wallets have exploded in popularity, with over half of all retail payments now happening via smartphone. Apple Pay, Google Pay, and Samsung Pay should definitely be on your acceptance list.

Contactless payments became mainstream during the pandemic and customers now expect the convenience of "tap to pay" options. The good news is that most modern terminals automatically support this technology.

For businesses with B2B customers or those handling larger transactions, ACH/bank transfers can save significantly on processing fees while providing a secure payment method.

Online businesses should consider additional options like PayPal and other digital wallets, plus "Buy Now, Pay Later" services like Affirm, Klarna, and Afterpay, which have been shown to increase average order values.

The right mix ultimately depends on your specific customer base, but recent data shows that cash payments have dropped to just 16% of in-store transactions in 2023. The message is clear: digital payment options aren't just nice-to-have anymore—they're essential for business survival.

How do I reduce chargebacks?

Chargebacks can feel like a double whammy—you lose the sale and get hit with fees too. Fortunately, there are proven ways to minimize them.

Clear communication is your first line of defense. Make sure your business name on credit card statements is recognizable to customers (not a parent company or processing name they won't recognize). Provide detailed receipts and set crystal-clear return policies upfront so customers know what to expect.

Fraud prevention tools significantly reduce unauthorized transaction chargebacks. Use Address Verification Service to confirm billing addresses match what's on file with the card issuer. Always require the CVV code for online purchases—this simple step dramatically reduces fraud. For e-commerce, implementing 3D Secure adds an extra authentication layer that shifts liability away from your business.

Excellent customer service often prevents chargebacks before they happen. Make it incredibly easy for customers to reach you with questions or concerns. Sometimes a simple refund is much less expensive than the time and fees associated with fighting a chargeback. Keep detailed records of all customer interactions—these can be invaluable if you need to dispute a chargeback.

For shipped products, always use delivery confirmation and tracking. For high-value items, signature confirmation provides an extra layer of protection. These records can be the difference between winning and losing a chargeback dispute.

Finally, maintain proper documentation for everything. Keep signed receipts, authorization records, and evidence of service delivery organized and accessible. When a chargeback does occur, responding quickly with thorough documentation significantly improves your chances of winning the dispute.

Are month-to-month agreements really better?

At Merchant Payment Services, we're big believers in month-to-month agreements, and here's why they make sense for most small businesses.

Flexibility is perhaps the biggest advantage. Your business isn't static—it grows, evolves, and sometimes pivots entirely. A month-to-month agreement means you're never trapped with outdated technology or services that no longer fit your changing needs. If a provider's service quality slides, you're free to make a change without painful penalties.

The cost savings can be substantial, though they're not always obvious at first glance. While a long-term contract might offer slightly lower rates, they often come with early termination fees ranging from hundreds to thousands of dollars. Equipment leases are particularly problematic—many businesses end up paying several times the actual value of the equipment over the life of these contracts. With month-to-month, you avoid these hidden costs entirely.

Perhaps most importantly, month-to-month agreements typically result in better service. When a provider knows you could leave at any time, they have a powerful incentive to keep you happy. Your support calls get answered faster, your issues get resolved more thoroughly, and your account manager tends to be more attentive. You're a valued partner, not a locked-in revenue stream.

The reduced risk aspect shouldn't be overlooked either. With a month-to-month agreement, you can test a provider's actual service quality before making any long-term commitment. If your business model changes suddenly (as many did during the pandemic), you can adapt your payment solutions without penalty.

While some sales reps might push hard for long-term contracts, the slightly lower processing rates they offer rarely outweigh the flexibility, service quality, and peace of mind that comes with a month-to-month agreement. That's why at Merchant Payment Services, we've built our entire business model around no-commitment partnerships based on ongoing value rather than contractual obligations.

Conclusion

The landscape of payment solutions for small businesses continues to evolve at lightning speed. As we've explored throughout this guide, today's payment systems do far more than just process transactions—they create seamless customer experiences, streamline your operations, provide valuable business insights, and position your business for sustainable growth.

The numbers tell the story: only 16% of in-store transactions now involve cash. Your customers expect convenience, speed, and security whether they're shopping in your physical store, browsing your website, or making purchases through their mobile devices. When you deliver on these expectations, you gain a real edge over competitors who are slower to adapt.

At the same time, payment processing remains a significant expense. US merchants paid a staggering $160.7 billion in processing fees in 2022. This is why choosing a payment solution with transparent pricing and no sneaky hidden fees can dramatically impact your bottom line.

At Merchant Payment Services, we've walked alongside countless small businesses navigating this complex landscape. We've seen the challenges you face, which is why we've built our business around solving them. We offer:

Risk-free, month-to-month agreements that never lock you into long-term commitments

Free terminals with absolutely no leasing requirements

Completely transparent pricing with no hidden fees that surprise you later

Exceptional service from our friendly team based right here in Dayton, Ohio

True omnichannel solutions that work seamlessly across your in-store, online, and mobile environments

Our approach isn't complicated—it's built on integrity and a genuine desire to see small businesses thrive. We believe that by providing honest, transparent payment solutions for small businesses custom to your specific needs, we help you not just process payments, but truly optimize your entire operation.

The future of payments is omnichannel, seamless, and rich with data-driven insights. By implementing the right payment solution today, you'll be perfectly positioned to meet evolving customer expectations and flourish in tomorrow's economy.

Ready to find how Merchant Payment Services can transform your business? Reach out today to discuss your specific needs and experience the difference that transparent, customer-focused payment solutions for online businesses can make for your business.