Gateway to Greatness: Merchant Payment Gateway Explained

The Digital Revolution in Payment Processing

A merchant payment gateway is a secure technology service that enables businesses to accept online credit card payments by encrypting sensitive information and transmitting it between the customer, merchant, and payment processor.

What is a merchant payment gateway?

- A secure online service that authorizes electronic payments for e-commerce and brick-and-mortar businesses

- Acts as the digital equivalent of a physical point-of-sale terminal

- Encrypts sensitive card data to ensure secure transmission

- Connects merchants with payment processors and acquiring banks

- Typically settles funds into merchant accounts within 1-3 business days

In today's digital economy, accepting online payments isn't just a convenience—it's essential for business survival. With 82% of US customers using digital payment methods in 2021, businesses of all sizes need reliable systems to process these transactions securely and efficiently.

The days of cash being king are long gone. Modern consumers expect seamless checkout experiences whether they're shopping online, in-store, or through a mobile app. A merchant payment gateway serves as the crucial bridge that makes these transactions possible.

Think of a merchant payment gateway as the digital equivalent of a physical card terminal. It securely captures payment information, encrypts it, transmits it to the appropriate financial institutions for authorization, and then communicates the approval or decline back to you and your customer. All of this happens within seconds, creating the smooth payment experience your customers expect.

I'm Lydia Valberg, co-owner at Merchant Payment Services where I've spent years helping businesses implement merchant payment gateway solutions that eliminate unnecessary fees while maintaining the highest security standards. My experience has shown that the right payment gateway can transform a business's efficiency and customer satisfaction.

Merchant Payment Gateway 101: Definitions & Core Components

Let's break down the payment ecosystem into bite-sized pieces that make sense. I remember when I first encountered these terms, they seemed like alphabet soup! But once you understand the key players, everything clicks into place.

The world of digital payments is booming – with noncash retail payment transactions growing at a compound annual rate of 13% between 2018 and 2021. In some markets, that growth has skyrocketed to 25%! This explosion explains why having a reliable merchant payment gateway isn't just nice to have anymore – it's essential for business survival.

| Component | Primary Role | Relationship to Gateway |

|---|---|---|

| Payment Gateway | Encrypts and transmits transaction data | The front door of the payment process |

| Payment Processor | Routes authorization requests and prepares settlement files | Works with the gateway to move transactions forward |

| Merchant Account | Holds funds before transfer to business bank account | Receives approved funds after gateway transmission |

| Acquiring Bank | Maintains merchant account and facilitates settlement | Receives encrypted data from gateway |

| Card Networks | Sets interchange rates and connects all parties | Receives transaction data through the gateway |

| Issuing Bank | Approves/declines transactions and bills cardholders | Receives authorization requests via the gateway |

What is a merchant payment gateway?

A merchant payment gateway is like a secure digital tunnel for your customers' payment information. When someone enters their credit card details on your website or taps their card on your terminal, the gateway springs into action.

At its heart, the gateway does five critical things: it encrypts sensitive payment data (turning card numbers into unreadable code), creates tokens (unique identifiers that replace actual card numbers), authenticates the customer (making sure they're authorized to use the payment method), obtains authorization from the bank, and securely transmits all this information between the parties involved.

Think of it as your business's financial bodyguard – it protects sensitive information at every step, reducing your liability while keeping your customers' data safe. With 82% of US customers now using digital payment methods according to McKinsey research, this protection isn't optional – it's mandatory.

Payment gateway vs. processor vs. merchant account

These three payment players often get mixed up, but they each have their own distinct job in getting money from your customer to your bank account:

Your merchant payment gateway is all about information security – it moves data, not money. It's the customer-facing part of the equation, providing that smooth checkout experience whether online or in-store. The gateway collects payment details and wraps them in layers of encryption before sending them on their journey.

The payment processor takes the baton next, handling the actual authorization request and preparing settlement files. Think of processors as the traffic controllers of the payment world – they route information between banks and card networks to get transactions approved.

Your merchant account is a specialized bank account that temporarily holds your funds after a sale but before they reach your regular business bank account. It's like a financial waiting room where money sits for 1-3 business days before landing in your main account.

Here in Ohio, we at Merchant Payment Services have helped countless businesses in Dayton, Cincinnati, and Columbus streamline this entire process. We've seen how understanding these components helps business owners make better decisions about their payment systems.

The beauty of modern payment solutions is that many of these functions can be bundled together, making the whole process simpler for you. You don't need to understand every technical detail – that's what we're here for – but knowing the basics helps you choose the right solution for your business needs.

How a Merchant Payment Gateway Works & How to Integrate It

Ever wonder what happens in those few seconds between clicking "Buy Now" and seeing "Payment Approved"? Let's peek behind the digital curtain to see how a merchant payment gateway makes the magic happen.

The merchant payment gateway in action

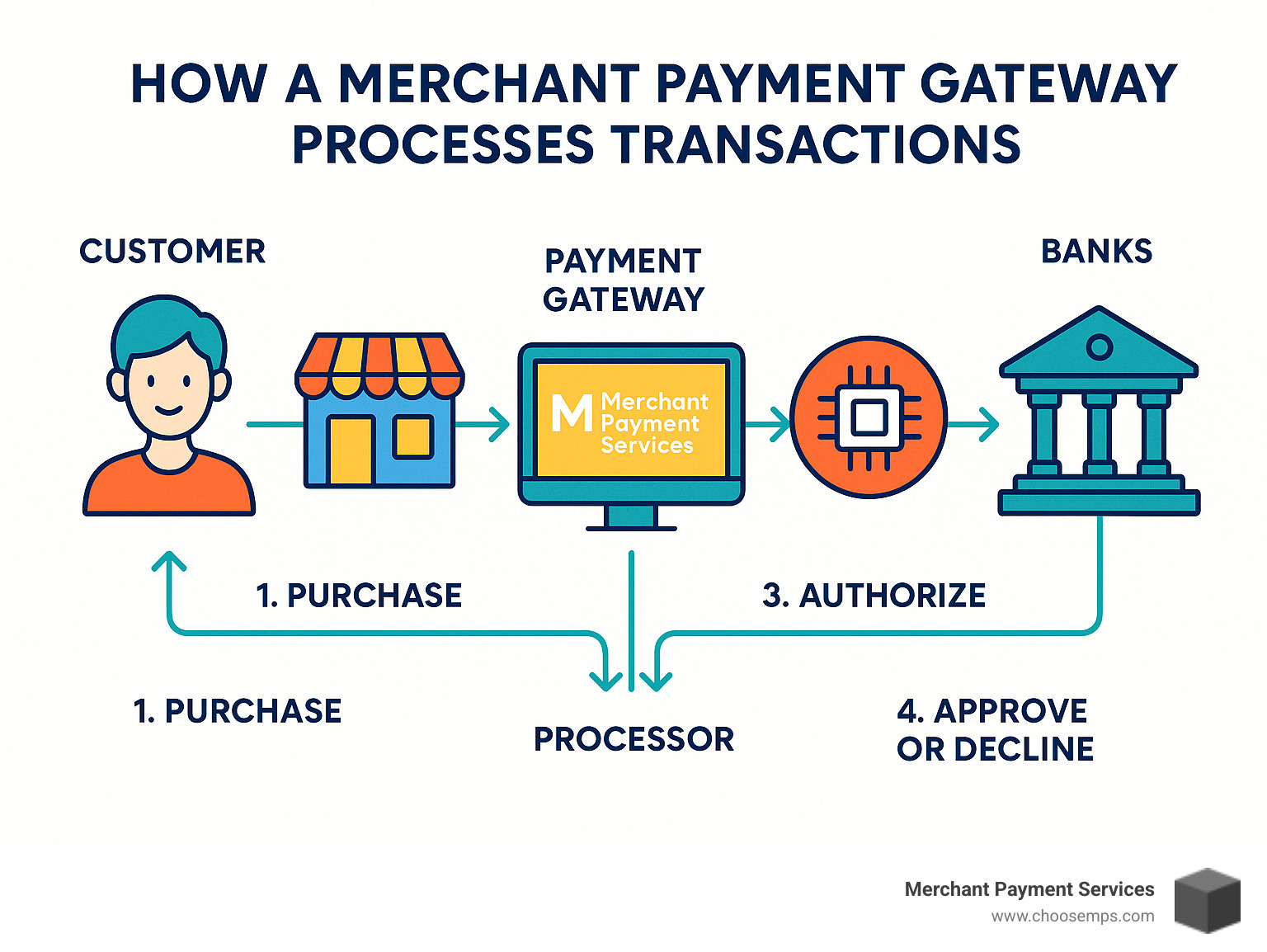

When your customer decides to make a purchase, their payment information starts on a secure journey that takes just seconds to complete:

First, your customer enters their card details on your website or taps their card at your terminal. Immediately, your merchant payment gateway springs into action, encrypting this sensitive information—changing those card numbers into secure code that's protected during its digital journey.

This encrypted data then zips off to the payment processor, which routes it through the appropriate card network like Visa or Mastercard. From there, it reaches your customer's bank, where the real decision-making happens. The bank checks available funds, looks for any red flags that might signal fraud, and sends back their verdict—approved or declined.

All this happens in mere seconds! Your customer sees the result on screen, completely unaware of the complex digital dance that just occurred.

Behind the scenes, more steps follow. At day's end, your processor bundles all successful transactions into a batch. The acquiring bank collects funds from all those customer banks and deposits them into your merchant account. Finally, those funds make their way to your business bank account, typically within 1-3 business days.

The process works a bit differently depending on whether your customer is standing in front of you or shopping from their couch:

For in-store purchases (card-present), your customer physically presents their card, which means lower fraud risk and lower processing fees. The EMV chip in modern cards adds an extra layer of security, and your terminal acts as the physical gateway.

For online or phone orders (card-not-present), your customer enters their details remotely. This comes with higher fraud risk and fees, which is why additional security measures like address verification and CVV codes are so important. Here, your online merchant payment gateway handles the critical encryption steps.

Integration options & timelines

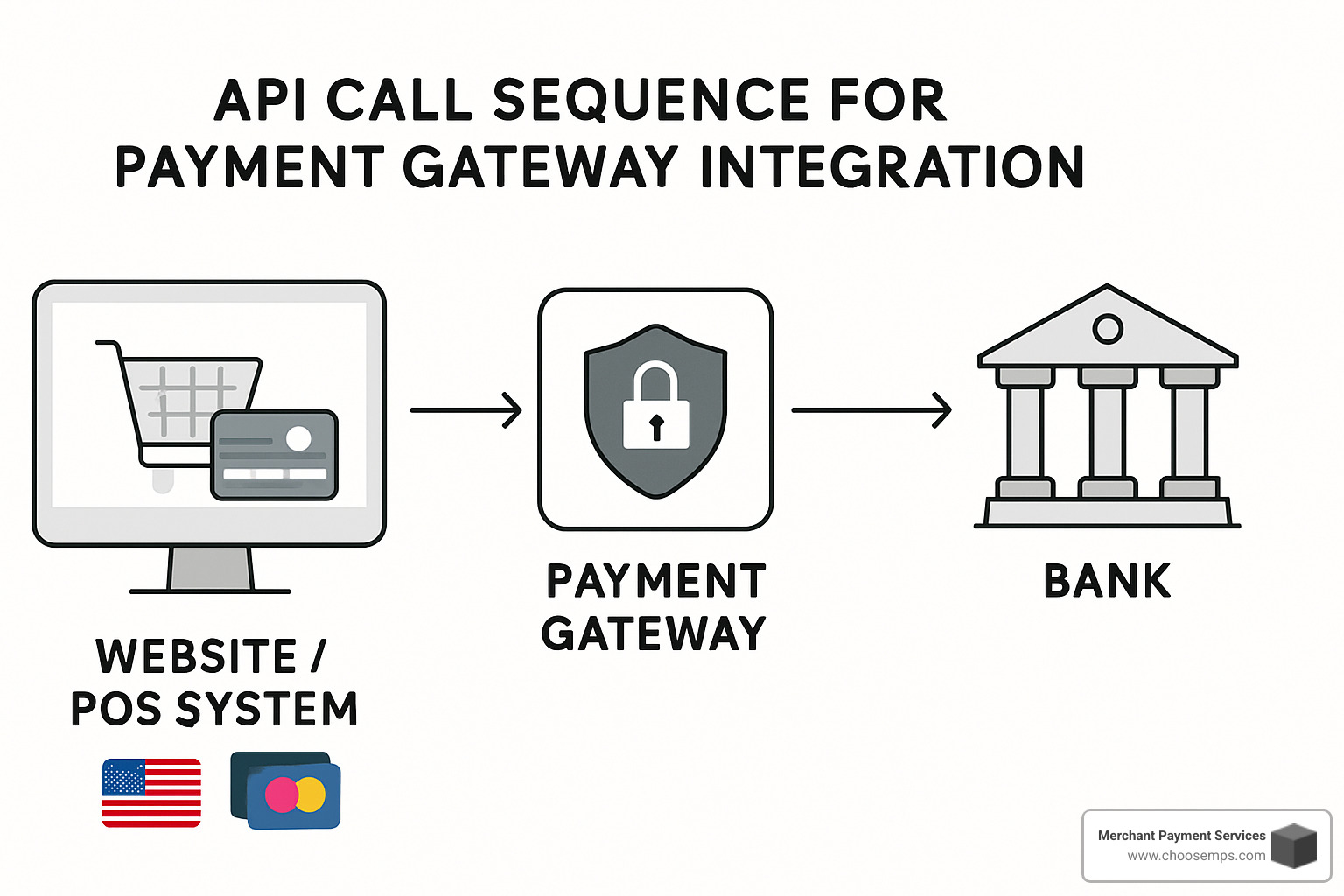

Getting a merchant payment gateway up and running with your business systems is easier than you might think. Here are your main options:

Hosted Checkout Pages provide the simplest path forward. Your customer gets redirected to a secure payment page hosted by the gateway provider. While this means minimal PCI compliance headaches for you, it still allows for customization with your branding. Most businesses can be up and running in just 1-3 days.

If you want more control, API Integration offers the most flexibility. Your customers never leave your website to complete payment, creating a seamless experience. This requires some developer resources and comes with higher PCI compliance requirements, but the payoff is a fully customized payment flow. Depending on complexity, this typically takes 3-14 days to implement.

For e-commerce businesses, Shopping Cart Plugins offer a happy medium. These pre-built integrations for platforms like Shopify or WooCommerce can be installed with minimal technical knowledge in just a day or two.

If your business revolves around a mobile app, Mobile SDK Integration provides a native payment experience for your users. This requires mobile development expertise and usually takes 5-14 days to implement properly.

Need something right away? A Virtual Terminal gives you a web-based interface for manually entering payments—perfect for phone orders. There's no technical integration required, so you can start processing payments immediately.

At Merchant Payment Services, we pride ourselves on quick setup—typically within three business days, sometimes even same-day. Our team stays with you through the entire process, ensuring a smooth transition whether you're a small shop in Cincinnati or a growing business in Columbus.

Most modern merchant payment gateways include sandbox environments where you can test everything before going live. This lets you verify that your integration works flawlessly without processing actual transactions—giving you peace of mind before your first real customer checks out.

Ready to learn more about integrating a payment gateway with your e-commerce site? Check out our detailed Payment Gateway Integration for Ecommerce Site: Step by Step guide.

Features, Security & Fraud Protection

Security is paramount when it comes to payment processing. A robust merchant payment gateway should offer comprehensive security features and fraud protection tools to safeguard both your business and your customers.

Compliance checklist for a merchant payment gateway

Let's face it – payment security can seem like alphabet soup with all those acronyms! But don't worry, I'll break it down in simple terms.

Your merchant payment gateway needs to tick several important security boxes. First and foremost is PCI DSS compliance – that's the Payment Card Industry Data Security Standard. Think of it as the security gold standard that all companies handling credit card information must follow. Your gateway provider should be PCI Level 1 compliant (the highest level) and help reduce your compliance burden through tools like hosted payment pages.

Encryption and tokenization are your next lines of defense. Good encryption is like sending your customers' payment data through an armored car instead of on the back of a postcard – it protects information while it's moving between systems. Tokenization takes this a step further by replacing actual card numbers with meaningless "token" values that would be useless to hackers. Point-to-Point Encryption (P2PE) ensures card data never actually touches your systems, which dramatically reduces your liability.

For brick-and-mortar transactions, EMV chip card technology is essential. Those little chips on modern cards have virtually eliminated certain types of fraud and, importantly, shift liability away from you as the merchant.

At Merchant Payment Services, we take security seriously. All our payment solutions are PCI-validated and include the latest encryption technologies. We don't just set you up and walk away – we provide ongoing guidance to help you maintain compliance and reduce both risk and liability.

Fraud-fighting toolkit

Modern merchant payment gateway solutions come equipped with sophisticated fraud prevention tools that act like a security team working 24/7 to protect your business.

Address Verification Service (AVS) is your first line of defense for online transactions. It compares the billing address provided by the customer with the address on file at their bank. A mismatch could be a red flag. Similarly, requiring the CVV (that 3 or 4-digit security code) verifies that the customer actually has the physical card in hand.

Velocity checks monitor how frequently transactions come from the same card or IP address. It's like having a security guard who notices if someone tries to use the same card ten times in an hour – that's probably not normal behavior!

The most advanced merchant payment gateways now employ machine learning fraud detection that analyzes transaction patterns across millions of data points. These systems get smarter over time, automatically flagging or blocking suspicious transactions before they can harm your business.

Chargebacks can be a major headache for any business. Good gateway providers offer early warning systems for potential disputes and automated tools to contest illegitimate chargebacks. They'll also help you identify patterns so you can prevent future problems.

For B2B merchants, Level II/III data capabilities provide improved transaction details that not only reduce fraud risk but can also lower your interchange rates – a win-win!

Here in Ohio, businesses face the same fraud challenges as anywhere else in the country. At Merchant Payment Services, we've helped countless local businesses from Cincinnati to Columbus implement effective fraud prevention strategies. The best part? We include comprehensive fraud monitoring and prevention features as standard – not as expensive add-ons that nickel-and-dime you after the fact.

Want to learn more about creating a secure payment environment? Check out our guide to Secure Online Credit Card Payment Services or review the latest research on gateway security to stay ahead of emerging threats.

Pricing, Contracts & Choosing the Right Gateway

Understanding what you'll actually pay for a merchant payment gateway can feel like deciphering a secret code sometimes. Let's break down these costs in plain English so you can make a choice that works for your business and keeps your budget intact.

Cost components you'll face

When you're evaluating payment gateway providers, you'll encounter several types of fees that can add up quickly if you're not careful.

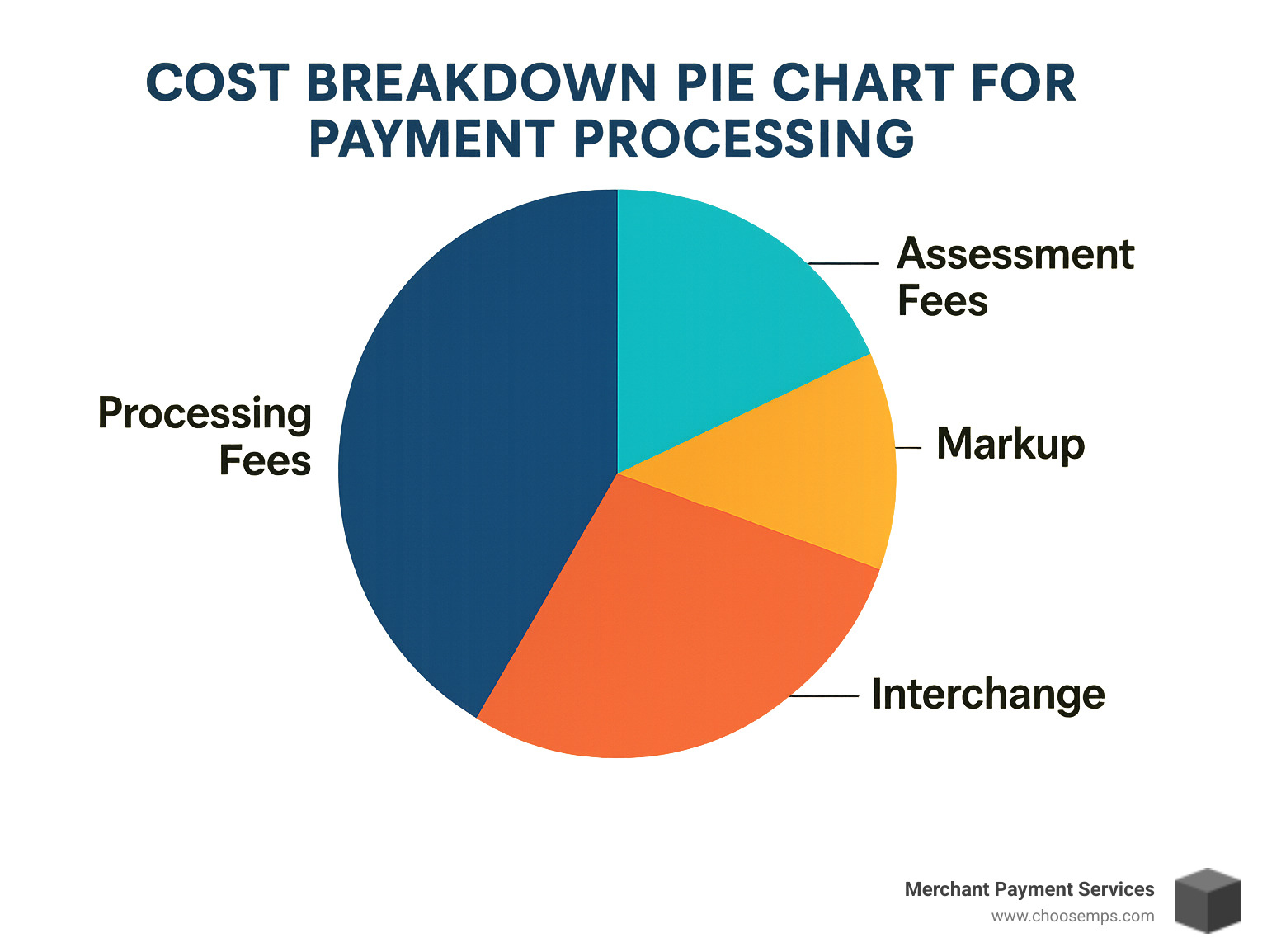

The most obvious cost is the transaction fee, which typically ranges from $0.10-$0.30 per transaction. Many providers also charge a percentage-based fee (usually 2.5%-3.5% for online transactions), and some will hit you with both. It's like paying rent and utilities—they're separate costs for the same service.

Then there's the monthly gateway fee, typically $10-$50 just for the privilege of using the service. Some providers will waive this if your business processes enough volume, which is a nice perk for growing businesses.

Don't forget about those one-time setup and integration costs. These can range from absolutely nothing to $500 depending on the provider. If you need technical help getting everything connected, that might cost extra too.

The interchange fees are set by card networks like Visa and Mastercard, not by your gateway provider. These vary based on the type of card your customer uses and how the transaction happens. Think of these as the wholesale cost of accepting cards—they're passed on to you in most pricing models.

At Merchant Payment Services, we've eliminated the headaches with our transparent, risk-free, month-to-month agreement. No startup fees, no hidden costs, and no long-term commitments for our Ohio merchants from Dayton to Cincinnati and beyond.

Many businesses are now implementing surcharging programs to offset their processing costs. This is completely legal in most states and allows you to pass along a small fee to customers who choose to pay with credit cards. It's a simple way to significantly reduce your payment expenses without affecting your bottom line.

Decision framework

Choosing the right merchant payment gateway isn't just about finding the lowest price—it's about finding the right fit for your specific business needs.

Start by considering your business type and needs. Do you sell exclusively online, only in a physical store, or both? How many transactions do you process monthly, and what's your average sale amount? If you sell internationally, you'll need a gateway that handles multiple currencies seamlessly.

Next, think about the features you actually need. What payment methods do your customers use? Does the gateway integrate with your existing systems like your shopping cart or accounting software? If you offer subscriptions or recurring services, you'll need a gateway that supports automated billing.

Security and compliance should be non-negotiable. Your gateway should help with PCI DSS compliance, offer robust fraud prevention tools, and provide protection in case of data breaches. This isn't just about avoiding fines—it's about protecting your customers and your reputation.

The quality of support and reliability can make or break your experience. Is help available when you need it—including nights and weekends when most shopping happens? Can you reach a real human being when problems arise? What's their track record for uptime and reliability?

Pay close attention to contract terms. Some providers lock you into multi-year contracts with hefty early termination fees. Others offer more flexibility but might charge higher rates. Transparency in pricing is crucial—hidden fees have a way of appearing on your statement when you least expect them.

Finally, consider funding speed. How quickly will money reach your bank account after a sale? Standard funding typically takes 1-3 business days, but some gateways offer next-day or even same-day options. This can be crucial for cash flow, especially for smaller businesses.

At Merchant Payment Services, we believe in keeping things simple. Our risk-free, month-to-month agreements mean you're never trapped in a bad relationship. Our US-based support team is available 24/7/365—because payment issues don't just happen during business hours. When you call us, you'll talk to a real person who can actually solve your problem, not a chatbot or an overseas call center reading from a script.

Looking for more detailed information? Check out our guide on the Best Payment Gateway for Online Business to help you make an informed decision.

Future-Proof Payments: Multicurrency, Digital Wallets & Crypto

The payment landscape is evolving faster than ever. To stay competitive, your merchant payment gateway needs to support not just today's payment methods, but tomorrow's as well. Let's explore how you can future-proof your payment strategy.

Expanding payment options through your merchant payment gateway

Today's consumers expect options when they pay. They want convenience, security, and flexibility—all delivered through a seamless experience.

Digital wallets have transformed how we pay. With Apple Pay, Google Pay, and Samsung Pay gaining massive adoption, customers increasingly expect to simply tap their phones to complete a purchase. These solutions use advanced tokenization technology that actually makes them more secure than traditional card swipes or chip insertions.

ACH and eCheck payments offer a compelling alternative to credit cards, especially for recurring billing. They typically come with lower processing fees (often 1% or less compared to 2-3% for credit cards) and significantly reduced chargeback risk. For subscription-based businesses or those with regular customers, adding this option through your merchant payment gateway can substantially improve your bottom line.

The Buy Now, Pay Later revolution is reshaping retail financing. Services like Affirm, Klarna, and Afterpay are particularly popular with younger shoppers who may not have traditional credit cards. Merchants offering BNPL options through their merchant payment gateway often see cart sizes increase by 30-50% because customers feel more comfortable making larger purchases when they can spread payments over time.

Contactless payments surged during the pandemic but are here to stay. The speed and convenience of tap-to-pay have made it the preferred checkout method for many consumers. If your merchant payment gateway doesn't support contactless transactions, you're likely creating friction at checkout.

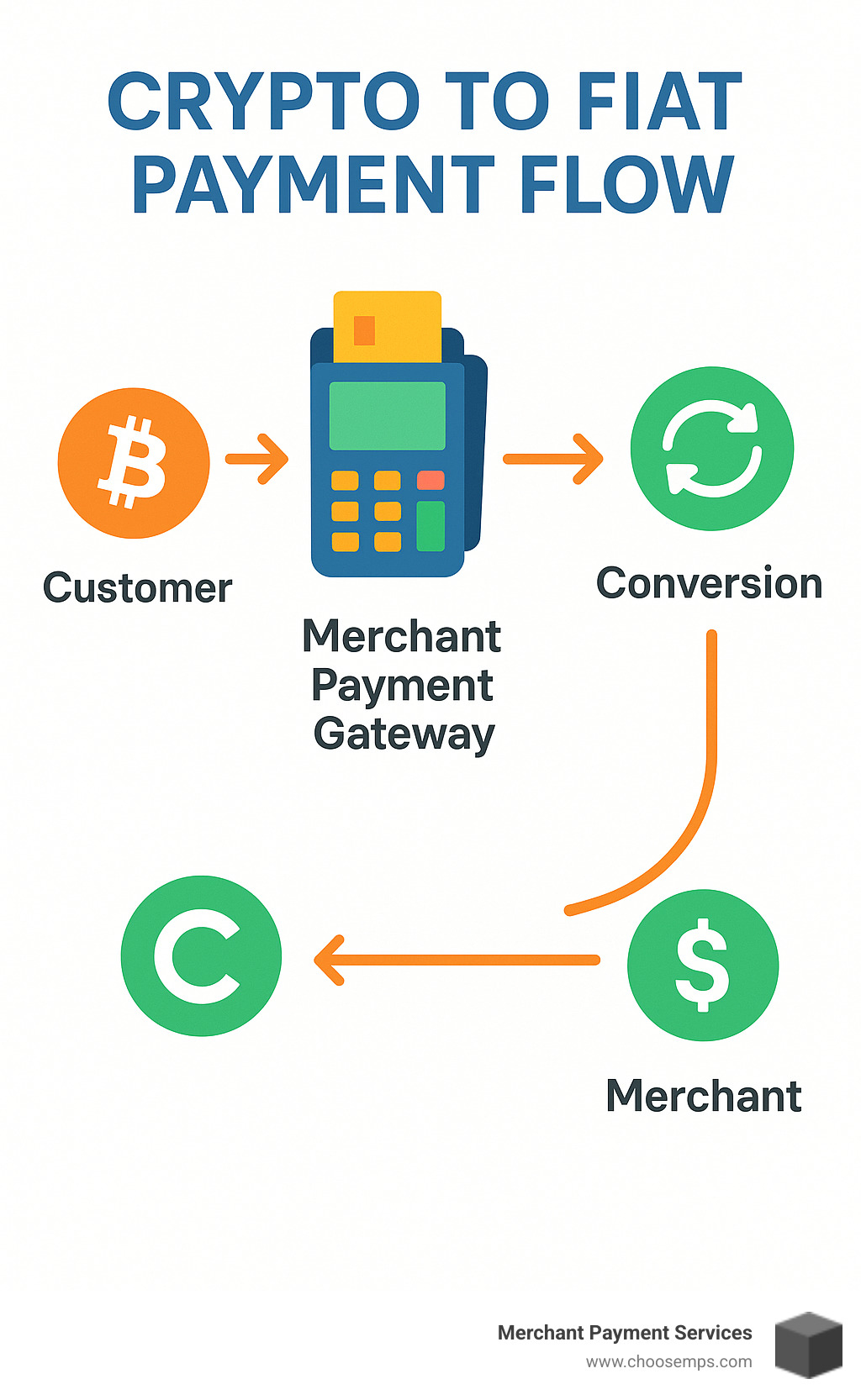

Cryptocurrency payments represent the cutting edge of payment technology. While still emerging, merchants who integrate crypto payment options can attract tech-savvy customers and potentially reduce cross-border transaction fees. Most modern solutions automatically convert crypto to dollars, eliminating volatility risk for merchants. Whether it's Bitcoin, Ethereum, or stablecoins, the right merchant payment gateway can handle these transactions with surprising simplicity.

QR code payments have found new life in recent years. They're especially valuable for restaurants and retailers looking to integrate loyalty programs with payments. A simple scan creates a contactless, app-free way for customers to pay that works on virtually any smartphone.

At Merchant Payment Services, we're committed to keeping Ohio businesses ahead of payment trends. Our solutions support both traditional and emerging payment methods through a single, integrated platform that grows with your business.

All-in-One vs Independent Gateways—pros & cons

When selecting a merchant payment gateway, one of your biggest decisions will be whether to choose an all-in-one solution or an independent gateway paired with separate processing services.

All-in-one solutions bundle everything together—gateway, processing, merchant account—into a single package. They shine in their simplicity. With one vendor relationship, one support number, and one integrated reporting system, they minimize complexity for busy business owners. Setup is typically quick, and the flat-rate pricing models (like 2.9% + $0.30 per transaction) make budgeting straightforward.

However, this convenience often comes at a cost. As your business grows, those flat rates can become expensive compared to interchange-plus pricing models. You're also locked into using that provider's features and tools, which might not be ideal for your specific industry. And if you ever want to change providers, you'll need to replace your entire payment infrastructure.

Independent gateways offer more flexibility. You can select a best-in-class gateway while negotiating separately for processing rates, giving you more leverage to secure better terms. This approach allows you to switch processors without disrupting your customer experience or integration points. For high-volume merchants, the savings can be substantial.

The downside? Managing multiple vendor relationships requires more time and expertise. Integration can be more complex, and you'll need to reconcile reporting across different systems. It's generally better suited for businesses with dedicated financial or technical staff.

Which approach is right for you? At Merchant Payment Services, we believe in flexibility. We offer customized solutions that adapt to your specific needs, whether you prefer an all-in-one approach or want to leverage an independent gateway with our processing services. Our team helps businesses throughout Ohio—from Cincinnati to Columbus and beyond—evaluate the best approach based on their unique requirements.

We've seen many businesses start with an all-in-one solution for simplicity, then gradually transition to an independent gateway as they grow and their needs become more sophisticated. Our month-to-month agreements make this evolution painless, with no long-term contracts locking you into a solution you've outgrown.

Frequently Asked Questions & Conclusion

As we wrap up our deep dive into merchant payment gateways, I'd like to address some questions I hear almost daily from business owners across Ohio who are navigating the payment processing landscape.

What security standards are required?

When it comes to handling credit card data, security isn't optional—it's mandatory. Every business that accepts card payments must comply with the Payment Card Industry Data Security Standard (PCI DSS).

Think of PCI compliance as your business's security shield. The specific requirements vary based on your transaction volume and how you process payments, but they all serve the same purpose: protecting your customers and your business from data breaches.

Key security elements you'll need include:

The foundation starts with PCI DSS Compliance—a set of standards that protects cardholder data. For in-store transactions, EMV Compliance (those chip card readers) shifts fraud liability away from you. Behind the scenes, encryption works like a secret code that protects data while it travels, while tokenization replaces sensitive card numbers with non-sensitive substitutes for safer storage.

At Merchant Payment Services, we don't just provide PCI-compliant solutions—we walk alongside you through the compliance process. We've simplified what can be a complex journey, helping businesses from Cincinnati to Columbus meet these requirements without headaches.

How fast will I get my money?

Cash flow is the lifeblood of any business, so this question is crucial. The timing of when funds hit your bank account depends on several factors:

Most businesses see funds deposited within 1-3 business days with standard processing. If waiting isn't an option, next-day funding gets you yesterday's sales today, while premium same-day funding options can accelerate access even further.

One often overlooked detail is weekend and holiday processing. Traditional banks don't process on weekends or holidays, creating funding gaps that can strain small businesses. Some providers offer continuous processing to bridge these gaps.

We understand that waiting for your money can be frustrating. That's why at Merchant Payment Services, we offer flexible funding options including next-day funding for qualified merchants. We want Ohio businesses to have quick access to their hard-earned revenue.

What are typical startup costs?

Starting to accept payments shouldn't require a small fortune, but many providers front-load their fees. Here's what you might encounter elsewhere:

When setting up a merchant payment gateway, you might face setup fees ranging from $0-$500 depending on the provider. If you need physical equipment for in-person payments, terminals typically cost $200-$600, while more comprehensive POS systems can range from $500-$2,000. Then there are ongoing costs like monthly gateway fees (typically $10-$50) and potential integration costs if you need developer assistance.

At Merchant Payment Services, we've taken a different approach. We believe in removing barriers to better payment processing, which is why we offer a risk-free, month-to-month agreement with no startup fees. We even provide free terminals to qualified merchants.

Our philosophy is simple: we succeed when you succeed. That means eliminating unnecessary costs and hidden fees that burden businesses across Dayton, Cincinnati, Columbus, and throughout Ohio. We'd rather earn your loyalty through exceptional service than lock you into long-term contracts with upfront costs.

Ready to explore how a merchant payment gateway can work for your business without breaking the bank? Our team at Merchant Payment Services is just a call away, ready to provide a customized solution that fits your specific needs. Check out more info about online processing to get started.

Conclusion: Your Gateway to Payment Success

Choosing the right merchant payment gateway isn't just a technical decision—it's a strategic one that directly impacts your bottom line, customer satisfaction, and business growth potential. After helping hundreds of Ohio businesses streamline their payment systems, I've seen how the right gateway can transform operations almost overnight.

Think of your payment gateway as the digital front door to your business. It needs to be welcoming, secure, and efficient—just like you'd want your physical storefront to be. When customers encounter a smooth, reliable checkout experience, they're more likely to return and recommend your business to others.

At Merchant Payment Services, we take a different approach than the industry norm. We believe Ohio businesses deserve better than long-term contracts and surprise fees. That's why we offer:

- Risk-free, month-to-month agreements that put you in control

- A refreshing no-startup-fee policy (yes, really!)

- Free terminals and POS systems for qualified merchants

- 24/7/365 support from real humans based right here in the US

- Comprehensive security that keeps you and your customers protected

- Flexible integration options that work with your existing systems

The payments world never stands still—from contactless payments to cryptocurrency, the landscape keeps evolving. Having a partner who stays ahead of these changes while keeping your business compliant isn't just convenient—it's essential for long-term success.

Whether you run a cozy café in Dayton, a busy retail shop in Cincinnati, or an expanding e-commerce business in Columbus, we're committed to providing payment solutions that grow with you. Our team takes the time to understand your specific needs rather than pushing one-size-fits-all packages.

Ready to transform your payment experience? Contact Merchant Payment Services today to learn more about our merchant payment gateway solutions and how we can help your business thrive. We're proud to serve Ohio businesses with the integrity and personalized service you deserve.