Going Cashless in Schools Made Easy (and Why Parents Love It)

The Digital Revolution in School Payments

Remember when your child came home with an empty lunch account because the cash you gave them somehow vanished between your front door and the school cafeteria? Those days are quickly becoming a thing of the past.

Cashless payments for schools are changing how money moves through our education system. From lunch purchases to yearbook sales, the digital revolution is making life easier for everyone involved.

"The days of students carrying cash to pay for meals, school trips, or other activities are quickly fading." - Education Technology Report

What Are Cashless Payments for Schools?

Think of a cashless payment system as your school's digital wallet. Instead of handling physical money, parents can load funds into their child's account from the comfort of home. Students then make purchases using cards, fobs, or even smartphone apps – no cash needed.

These systems do more than just process payments. They automatically track every dollar, generate detailed reports, and seamlessly connect with existing school management platforms. It's like having a mini-banking system designed specifically for educational needs.

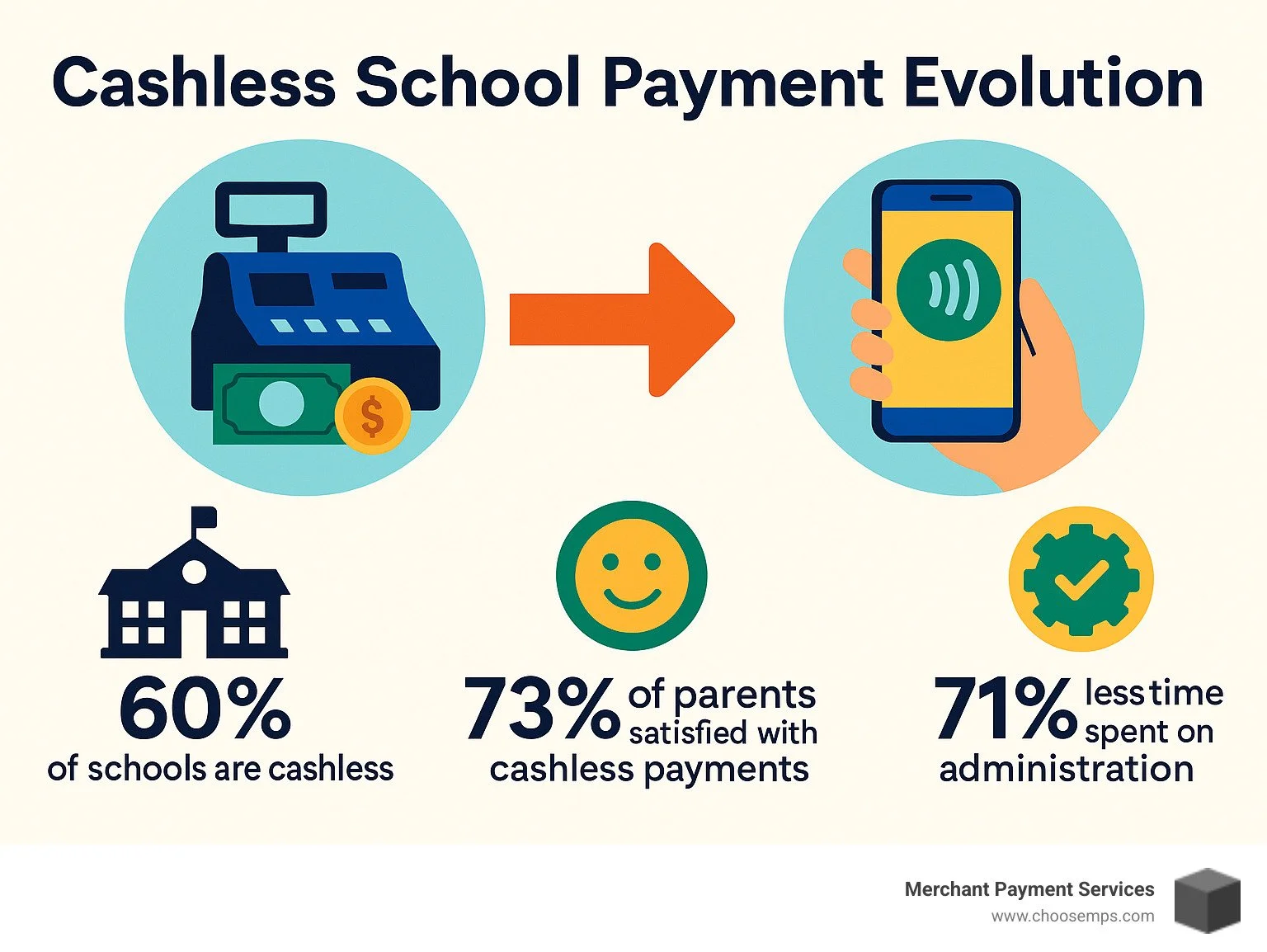

The shift toward digital is happening fast. In 2022, a whopping 86% of point-of-sale transactions across the U.S. involved either cards or digital wallets. Schools are catching this wave, with 60% already embracing cashless systems and another 23% planning to implement them within the next two years.

Parents love knowing exactly where their money goes, while also eliminating the risk of cash being lost or stolen. For schools, the benefits are equally compelling – less time counting money, better financial oversight, and significantly improved security.

I'm Lydia Valberg, and in my years with Merchant Payment Services, I've guided countless schools through this digital change. The smile on an administrator's face when they realize they'll never have to count lunch money again? That never gets old.

What Is a Cashless Payment System for Schools?

Picture this: no more counting quarters for lunch, no more forgotten field trip money, and no more "Mom, I lost my cafeteria cash!" A cashless payment system for schools transforms these everyday headaches into smooth digital transactions.

At its heart, a cashless system is your school's financial command center—a digital hub where parents add funds to student accounts, track spending, and receive instant updates when balances run low.

"A cashless payment system allows payments to be made without the use of physical cash or coins, using electronic methods like cards or digital wallets and often prepayment onto a card or fob," as the folks at Access Education (who develop this kind of software) explain it.

These systems handle practically everything money-related at school:

Your child's morning bagel in the cafeteria, the upcoming science museum field trip, drama club dues, that new school hoodie, fundraiser donations, those overdue library books (we've all been there!), yearbooks, and even tickets to Friday's big game.

The difference between old-school cash and modern cashless payments for schools is night and day:

AspectCash SystemCashless SystemDaily handling time1-2 hours10-15 minutesRisk of theftHighMinimalReconciliation errorsCommonRareParent visibilityLimitedCompleteAdministrative cost$15,000-20,000/year$5,000-8,000/yearReceipt managementPaper-basedAutomatic digital

Schools that make the switch typically save hundreds of administrative hours each year. Plus, those nerve-wracking "wait, the money doesn't add up" moments? Almost entirely eliminated.

How Cashless Platforms Operate Day-to-Day

The beauty of modern cashless payments for schools lies in their simplicity. Here's what the typical school day looks like with these systems:

Parents start by creating accounts linked to their children. They can add funds whenever convenient—midnight pajama banking is totally acceptable!—using credit cards, debit cards, bank transfers, or sometimes even cash at designated locations for families who prefer that option.

At lunchtime, students simply identify themselves at the register. This might be with an ID card, a PIN number, a quick fingerprint scan, or even a mobile app. The system automatically deducts the purchase amount from their account balance. No fumbling for change, no lost dollars.

Parents receive real-time updates about purchases and get low-balance alerts before their child faces the dreaded "insufficient funds" message in the lunch line. Plus, they can see detailed reports on what their kids are actually eating (goodbye mystery cafeteria spending!).

Behind the scenes, the system handles all the accounting work—matching transactions with bank deposits and eliminating those Friday afternoon reconciliation headaches for school staff.

As Sarb Singh from Brentwood School shares: "Parents can top up their child's account, and the funds appear within 30 minutes, eliminating the frustration of insufficient balances experienced with the old system."

These platforms don't exist in isolation, either. They integrate seamlessly with existing school systems through Digital Payment Systems that ensure information flows smoothly between all your school's digital platforms.

Cashless Payments for Schools: 9 Major Benefits

Remember when school payments meant sending your child with an envelope of cash and hoping it actually made it to the office? Those days are quickly becoming history as cashless payments for schools transform how education finances work. Let's explore the nine game-changing benefits that are making digital payments the smart choice for schools nationwide.

1. Improved Security

When cash disappears from school hallways, so do many security headaches. No more worrying about money vanishing from backpacks or lockers!

"Cash on hand presents student safety risks such as theft and bullying," explains a recent educational technology report. With digital systems, these concerns practically vanish overnight, creating a safer environment for everyone.

2. Administrative Efficiency

School staff have better things to do than count quarters and reconcile cash boxes. Cashless payments for schools free up valuable administrative time that can be redirected to activities that actually support education.

As Gillian Harrison from Manley Village School puts it: "It has reduced the time spent counting money and freed my time for other work." Who wouldn't want their talented staff focusing on students instead of stacks of bills?

3. Financial Transparency

Remember the days of wondering exactly where your child's lunch money went? Digital payment systems shine a bright light on school finances. Parents can see every purchase their child makes, while administrators get crystal-clear reporting at their fingertips.

This transparency isn't just convenient—according to McKinsey research on digital payments, it's a major factor driving adoption across many sectors, education included.

4. Accelerated Fundraising

School fundraisers get a serious boost when going cashless. Anita Donnelly from Our Lady of Compassion Catholic Primary School shares an impressive result: "We have increased our fundraising income by over 180%. Collecting online has made fundraising much easier."

When contributing becomes as simple as a few clicks, more parents participate, and schools raise more money for important programs.

5. Reduced Bullying

It's an unfortunate reality that cash can make students targets. When lunch money and field trip fees go digital, we remove one potential trigger for bullying. Recent studies on school safety confirm that "schools reported reduced incidents of bullying as pupils no longer carry physical cash to campus."

6. Healthier Food Choices

Here's a benefit many don't consider: cashless payments for schools can actually promote better nutrition. Many systems allow parents to set purchasing guidelines or review what their children buy.

Anne Bull, former LACA National Chair, notes: "It reduces the chances of sweets and junk food being purchased on the way to and from school – something which parents flagged as a concern in our research." That afternoon candy splurge becomes much harder when the system is designed to support healthy choices!

7. Detailed Audit Trails

School finances require accountability. Digital systems create comprehensive records of every transaction, making audits and financial reviews infinitely easier. No more hunting through paper receipts or trying to decipher handwritten records!

8. Environmental Sustainability

Every paper receipt avoided is a small win for our planet. By eliminating paper-based payment processes, schools reduce their environmental footprint while teaching students about modern, sustainable practices.

9. Improved Inclusivity

Perhaps most importantly, modern cashless systems include features that protect student privacy, particularly for those receiving free or reduced-price meals. When all students use the same payment method regardless of their financial status, we create a more inclusive, dignified experience for everyone.

Student & Parent Advantages of Cashless Payments for Schools

For families, the benefits of going cashless are practical and immediate. Students no longer face the embarrassment of forgotten lunch money or the risk of cash disappearing from backpacks. Cafeteria lines move faster, giving kids more time to actually eat their lunch. And for students on free or reduced meal programs, the stigma disappears completely—everyone uses the same payment method, regardless of their financial situation.

Parents gain peace of mind along with convenience. "I love being able to see exactly what my child is eating for lunch and getting notifications when their balance is low," shares one parent. "It's one less thing to worry about in our busy mornings."

With 24/7 account access, parents can add funds anytime—even at 11 PM when they suddenly remember tomorrow's field trip! They can review purchases, set spending limits, and receive alerts when balances run low. The days of the "Mom, I need $10 for lunch—right now!" morning scramble are finally over.

Staff & District Advantages of Cashless Payments for Schools

School staff might be the biggest fans of cashless payments for schools. The hours previously spent counting cash, preparing bank deposits, and reconciling accounts can now be directed toward more meaningful work.

Cafeteria lines move faster, giving staff more time to interact with students instead of handling money. Financial reporting becomes automated, and refund processing happens with a few clicks rather than paperwork and trips to the office.

At the district level, the benefits multiply. Centralized financial management provides better oversight and simplifies compliance. Karl Rogerson from Billesley Primary School confirms what many administrators find: "ParentPay is efficient and has enabled us to monitor spend more closely."

The detailed reporting available through Payment Solutions for Education helps districts make more informed budgeting decisions while reducing the risk of financial irregularities.

Built-In Security and Compliance Benefits

When it comes to handling money in schools, security isn't optional—it's essential. Modern cashless payments for schools incorporate robust protections that far exceed what's possible with cash.

PCI DSS compliance ensures systems meet rigorous payment industry standards. End-to-end encryption and tokenization protect sensitive data at every step of the transaction process. Comprehensive audit logs track every penny, and sophisticated fraud detection algorithms identify suspicious patterns before they become problems.

At Merchant Payment Services, we understand that school finances demand the highest level of protection. Our Secure Payment Solutions are built from the ground up to safeguard both financial assets and sensitive information, giving schools and families complete confidence in their payment systems.

The result? A safer, more efficient financial environment where schools can focus on their real mission: education.

7-Step Roadmap to Cashless Success

Making the switch to cashless payments for schools isn't something that happens overnight. Based on our hands-on experience helping schools across Chicago, Fresno, and Providence, we've developed a practical roadmap that takes the guesswork out of this transition. Let me walk you through the journey.

Step 1: Secure Stakeholder Buy-In

First things first—you need everyone on board. This means bringing together administrators, teachers, staff, parents, and yes, even students. We've found that holding casual information sessions where people can ask questions works wonders.

I remember one principal telling me, "If no one has any comments, good or bad, your team doesn't care. Criticism from staff is actually positive—it shows they're engaged!" She was absolutely right. Form a small committee with representatives from each group to champion the change.

Step 2: Conduct a Fee Inventory

Time to roll up your sleeves and make a list of every single payment your school handles. From lunch money to yearbook sales, field trip fees to library fines—you want to capture everything. This inventory becomes your checklist when evaluating payment systems.

One school administrator in Providence finded they were handling 14 different payment types—far more than they initially realized. This comprehensive view helped them choose a system that could handle their complete needs.

Step 3: Select the Right Vendor

Not all payment processors understand the unique needs of schools. As you evaluate potential partners, focus on:

School-specific experience is non-negotiable. A vendor who's worked with educational institutions understands the unique challenges you face.

Integration capabilities with your existing student information system will save countless headaches down the road.

Security features must meet the highest standards—student data deserves nothing less.

At Merchant Payment Services, we specifically designed our educational payment solutions with these needs in mind. And unlike many vendors who lock schools into long contracts, we offer month-to-month agreements with no startup fees. It's a risk-free way to test the waters.

Step 4: Launch a Pilot Program

Start small to win big. Instead of flipping the switch for the entire school, begin with just cafeteria payments or a single grade level. This controlled environment lets you work out any kinks before going school-wide.

A middle school in Fresno started with just their 6th grade class and cafeteria. The students became mini-ambassadors for the system, showing their parents how it worked and building excitement for the full rollout.

Step 5: Provide Comprehensive Training

Even the best system falls flat without proper training. We've learned that different stakeholders need different approaches:

Administrative staff need in-depth backend training. Cafeteria workers need quick, practical instruction focused on their daily tasks. Parents and students benefit from simple visual guides and short video tutorials.

One school created a "Tech Tuesday" lunch hour where staff could drop in with questions as they got comfortable with the new system—a simple idea that dramatically improved adoption.

Step 6: Promote Adoption

Communication is key to successful adoption. Use every channel at your disposal—school newsletters, morning announcements, social media, parent-teacher conferences—to spread the word.

I still smile thinking about the elementary school that created a "Cash-Free Countdown" bulletin board in their lobby. Students added paper links to a chain as more families signed up, creating a visual representation of their progress toward becoming cashless.

Step 7: Scale District-Wide

Once your pilot proves successful, it's time to expand. Roll out to additional payment types, grade levels, or schools across your district. Continue gathering feedback and making refinements—this isn't a "set it and forget it" process.

Many schools find it helpful to create a simple dashboard tracking adoption rates and transaction volumes. Celebrating milestones keeps the momentum going and reinforces the benefits of Online Payment Processing.

Ensuring Inclusivity During the Transition

When implementing cashless payments for schools, ensuring that every family can participate is crucial—regardless of their access to technology or banking services.

Texas A&M University's experience offers valuable lessons. They reduced cash payments from $1.4 million to just $2,000 in the first year, eventually reaching zero. This remarkable success came through thoughtful inclusion strategies, not forcing technology on those who weren't ready.

For families without reliable internet access, schools can provide dedicated computer terminals in school offices. For those without bank accounts, cash-loading kiosks in accessible locations solve the problem. Some schools partner with local retailers for cash top-up services, similar to how PayPoint offers 28,000+ locations for cash payments.

Multi-language materials and hands-on workshops help bridge communication gaps. As one thoughtful principal told me, "We identified families who might struggle with the transition and reached out personally. No one gets left behind on our watch."

Our Mobile Payment Solutions are designed with these realities in mind, offering multiple access points so every family can participate comfortably.

Budgeting & ROI for Cashless Payments for Schools

Let's talk dollars and cents. Yes, implementing a cashless system requires some upfront investment, but the return typically comes quickly and substantially.

On the cost side, you'll need to budget for initial setup, possible hardware, ongoing transaction fees, and training. But here's where it gets interesting—the returns are both immediate and long-lasting.

Administrative time savings typically amount to 15-20 hours per week. One school secretary told me, "I used to spend every Monday morning counting and reconciling cash. Now I use that time to actually help students."

Cash handling errors virtually disappear. No more missing $20 bills or miscounted change.

Theft risk is eliminated when there's no cash on premises.

Collection rates for fees and payments increase dramatically. Schools regularly report 15-30% improvements in collection rates after going cashless.

Most schools recover their costs within 12-18 months, with ongoing savings thereafter. If budget is a concern, consider a phased implementation to spread costs across budget cycles, or explore technology grants and modernization funds.

Following PCI Compliance Guidelines also helps schools avoid potential fines and penalties associated with inadequate payment security—an often overlooked benefit of modern systems.

The journey to cashless might seem daunting at first, but with this roadmap, you'll find it's more manageable than you expected. And we're here to help every step of the way.

Frequently Asked Questions about Cashless School Payments

What school payments can be handled digitally?

When schools switch to cashless payments for schools, parents are often surprised by just how many different payments can be handled through one simple system.

Almost everything your child needs throughout the school year can be paid for digitally. This includes daily cafeteria purchases like meals and snacks, as well as those permission slips for field trips that used to require exact change in an envelope. Athletic fees, club dues, and those special activities that enrich your child's education? All covered.

Even those once-a-year purchases like yearbooks and school spirit merchandise can be handled through the same system. Library fines, textbook fees, and fundraising contributions become simple digital transactions instead of hunting for cash.

"The convenience factor is huge for parents," says one school administrator. "Whether it's buying tickets to the school play or paying for summer programs, everything is in one place."

Modern systems are incredibly flexible, handling both recurring payments (like monthly meal plans) and one-time expenses. For bigger costs like overnight trips, many systems even offer installment plans to make budgeting easier for families.

How do cashless systems protect student data?

With data breaches making headlines, parents naturally worry about their children's information. Fortunately, quality cashless payments for schools systems take security extremely seriously.

These systems use multiple layers of protection, starting with strong encryption that scrambles all personal and financial information both when it's being transmitted and when it's stored. Card details are never actually stored in their original form – instead, they're converted to secure tokens that would be useless to potential thieves.

Access to information is strictly controlled based on who needs to see what. A cafeteria worker might only see names and meal eligibility, while financial administrators have broader access to payment records.

"We understand parents are trusting us with both their children's data and their financial information," explains a payment security expert. "That's why we maintain rigorous compliance with both PCI DSS standards for payments and FERPA requirements for educational records."

Behind the scenes, the data is housed in secure, closely monitored data centers with multiple backups and protections. Regular security audits help identify and address any potential weaknesses before they become problems.

At Merchant Payment Services, protecting your family's information is our top priority across all our payment solutions.

What if families don't have reliable internet access?

Making sure every family can participate is essential for successful cashless payments for schools systems. We've worked with schools across diverse communities and have developed practical solutions for families with limited internet access.

Quality systems offer multiple ways to add funds to student accounts. While online payments are convenient for many, schools can also provide payment kiosks or computers in the front office where parents can make payments in person. Administrative staff can help process payments over the phone, and many systems partner with local retailers where parents can add cash directly to their accounts.

"We worried about excluding families without good internet," shares one school principal. "But by offering multiple options and some extra support, we actually found those families appreciated the new system just as much as everyone else."

Schools can further support these families by extending hours when payment terminals are available, helping set up auto-payments during periods when internet is accessible, or creating community support networks where tech-savvy parents help others steer the system.

One middle school found a creative solution: "We identified about 8% of our families who lacked reliable internet. By setting up a dedicated computer in our front office and training our staff to assist, we ensured these families could still participate fully in our cashless system."

With thoughtful implementation, cashless systems can actually increase participation and reduce barriers for all families in your school community.

Conclusion

The transition to cashless payments for schools represents a significant step forward in educational administration, offering benefits that extend to every member of the school community. From improved security and administrative efficiency to improved parental engagement and student experience, the advantages are clear and compelling.

As we've seen through real-world examples and statistics, schools that implement cashless systems report remarkable improvements:

180% increases in fundraising income

90% parent activation rates

Significant reductions in administrative workload

Improved financial transparency and reporting

Improved student experiences with faster service and reduced stigma

At Merchant Payment Services, we're committed to making this transition as smooth and beneficial as possible for schools across Chicago, Fresno, Providence, and nationwide. Our approach emphasizes:

Transparent, month-to-month agreements with no hidden fees

Comprehensive support throughout implementation and beyond

Flexible solutions that integrate with existing school systems

Inclusive options for all families regardless of technical resources

Industry-leading security and compliance standards

The future of school payments is undoubtedly digital, and the schools that accept this change now will be better positioned to serve their communities efficiently and effectively.

Ready to explore how your school can benefit from cashless payment solutions? Contact Merchant Payment Services today to learn more about our specialized online processing solutions for educational institutions. Our team of experts is ready to guide you through every step of your journey toward a cashless campus.