Android Card Payment Apps That Make Your Wallet Jealous

Why Android Card Payment Apps Are Taking Over

An android card payment app has revolutionized how we pay and get paid. Whether you're tapping your phone at checkout or turning your device into a payment terminal, these apps offer speed, security, and convenience that traditional wallets simply can't match.

Popular Android Card Payment App Types for 2024:

- Built-in Android wallet that ships with most phones, boasting hundreds of millions of users

- A device-manufacturer wallet that works with both NFC and legacy magnetic-stripe terminals

- Hardware-free merchant “tap-to-pay” apps that charge a flat 1.6 – 2.0 % per transaction

- Full POS suites designed for mobile businesses and side-hustles, often with offline capability

The numbers tell the story: the default wallet on most Android devices has processed billions of transactions, while hardware-free merchant apps report zero activation fees and near real-time funding. As one Midwest merchant told us: "Customers tell me it's magic!" when describing tap-to-pay transactions.

These apps fall into two main categories: consumer wallets for everyday purchases and merchant solutions that turn any Android device into a payment terminal. Both use the same core technology – NFC communication and tokenization – to keep your financial data secure.

I'm Lydia Valberg, and I've spent years helping small businesses steer payment technology transitions, including the shift toward android card payment app solutions that reduce costs and improve customer experience. At Merchant Payment Services, we've seen how these apps can transform a business's payment processing efficiency.

What Is an Android Card Payment App?

An android card payment app is essentially a digital wallet that stores your payment cards, loyalty cards, and passes on your Android device. But it's more than just storage – these apps transform your smartphone into either a payment method or a payment terminal, depending on which type you're using.

At its core, every android card payment app uses Near Field Communication (NFC) technology to securely transmit payment data. When you tap your phone at a checkout terminal, you're not actually sharing your real card number. Instead, the app generates a unique, encrypted token that represents your card for that specific transaction.

The built-in wallet that comes pre-installed on most Android phones, for example, uses encrypted payment codes rather than your real credit card number during tap-to-pay transactions. This tokenization process happens instantly and creates a virtual card number that merchants never see.

The technology works on any Android phone running Lollipop 5.0 or higher, which covers virtually all modern Android devices. The app communicates with payment terminals displaying the contactless symbol, making acceptance widespread across retailers, transit systems, and restaurants.

How an Android Card Payment App Secures Your Plastic

Security in an android card payment app relies on multiple layers of protection that make it significantly safer than carrying physical cards. Here's how the security handshake works:

Device Authentication: Before any payment can process, you must open up your device using your PIN, fingerprint, or face recognition. This ensures that even if someone steals your phone, they can't make payments without your biometric data or passcode.

NFC Handshake: When you hold your phone near a payment terminal, the NFC chips communicate at a frequency of 13.56MHz, but only at extremely close range – typically within 4 centimeters. This short range prevents eavesdropping or interception of payment data.

Encrypted Tokens: The most crucial security feature is tokenization. Your real 16-digit card number never leaves your device. Instead, the app generates a unique token for each transaction that's useless to anyone who might intercept it. Even if hackers captured this token, they couldn't use it for additional purchases.

As one security expert noted, "The Android wallet does not share the real credit card number with merchants when tapping to pay." This means your actual account information stays protected even during the transaction process.

Best Android Card Payment Apps in 2024

Finding the right android card payment app can feel overwhelming with so many options available. The good news? We've done the heavy lifting for you. After testing and researching the top solutions, we've found apps that work brilliantly whether you're buying your morning coffee or running a busy business.

The android card payment app world splits into two main camps: apps for everyday shoppers and apps for business owners who want to accept payments. Both serve important purposes, and many people actually use apps from both categories.

Native Android Card Payment App Essentials

The default digital wallet that ships with most Android phones dominates the consumer space for good reason. With hundreds of millions of downloads and a solid user rating, it has become the go-to digital wallet for many Android users. But calling it just a payment app sells it short – it's more like having a smart assistant in your pocket.

The magic happens in how the wallet anticipates what you need. Your boarding pass appears automatically when you arrive at the airport. Your loyalty cards pop up when you walk into your favorite store. The secure tap-to-pay feature works at any terminal showing the contactless symbol, which covers most retailers across the U.S.

What makes this built-in wallet special is its smartwatch sync capabilities and biometric lock protection. You can tap to pay right from your Wear OS watch, and everything stays locked behind your fingerprint or face recognition. The app even imports boarding passes from your email and updates transit card balances through Maps integrations.

Some third-party wallets have also built strong followings by consolidating payment cards, loyalty cards, transit cards – even access badges for your office building – into one clean interface.

Android Card Payment App Picks for Merchants & Side-Hustles

Business owners face a different challenge. They need an android card payment app that turns their phone into a professional payment terminal without breaking the bank. The hardware-free revolution has made this possible, and the results are pretty amazing.

Today’s top "tap-to-pay on Android" apps require no card readers, no dongles, and no complicated setup – just download the right app and start accepting payments. Typical transaction fees hover around 1.6 – 2.0 %, with no activation fees or monthly charges hiding in the fine print.

Setting up usually takes about five minutes. You sign up online, download the app on any Android device running version 8 or higher, flip on "Tap to Pay on Android" in settings, and you're ready to go. One food-truck owner told us: "I type in the amount, show it to my customers, and they tap their phone on mine. Customers think it's magic!"

Most systems handle physical card taps up to $100 per transaction, while digital wallet payments have no limits. Next-day funding means you get your money fast, which matters when you're running a small business.

For businesses that operate in areas with unreliable internet (think farmers markets, outdoor events, or rural service calls), look for solutions with offline transaction capabilities and optional hardware that can be added later if needed.

At Merchant Payment Services, we help businesses choose and integrate these mobile payment solutions into their operations. Our Mobile Payment Processing Apps guide walks you through the setup process and shares best practices we've learned from helping hundreds of businesses make the switch.

The beauty of modern android card payment app solutions is how they level the playing field. A solo entrepreneur can now accept payments as professionally as a major retailer, often with better customer service and a more personal touch.

How Tap-to-Pay Works on Android

The magic behind your android card payment app happens so quickly that it feels almost instant. But there's actually some pretty sophisticated technology working behind the scenes to make those two-second transactions possible.

When you hold your phone near a payment terminal, your device's NFC antenna springs into action. This tiny component communicates at a frequency of 13.56 MHz, but only when you're practically touching the reader – we're talking about a range of just a few centimeters. This ultra-short range isn't a limitation; it's a security feature that prevents anyone from intercepting your payment data from across the room.

Your phone needs to meet a few basic requirements to work with tap-to-pay. Android Lollipop 5.0 or higher covers virtually every device made after 2014, so unless you're holding onto a really vintage phone, you're probably good to go. You'll also need Google Play Services running in the background, which handles the secure communication between your app and the payment networks.

The payment terminal needs to display the contactless symbol (those four curved lines that look like Wi-Fi waves). Most major retailers, restaurants, and transit systems across the U.S. now support these payments, making acceptance widespread.

Here's where security gets interesting: your device must have a screen lock requirement enabled. Whether that's a PIN, pattern, fingerprint, or face open up doesn't matter – what matters is that barrier exists. For smaller purchases under $25-50 (depending on your bank), you might not even need to open up your phone, which keeps checkout lines moving quickly.

The actual transaction flow is beautifully simple. You wake and open up your phone, hold the back of your device against the payment reader, and wait for that satisfying blue checkmark. If you're making a larger purchase, you might need to enter your PIN or provide a signature, but that's becoming less common as security systems improve.

When things don't go smoothly (and let's be honest, technology isn't perfect), the fixes are usually straightforward. Check that NFC is enabled in your phone settings first – it's the most common culprit. If that's not it, try moving your phone closer to the reader or switching to your default card if you have multiple options loaded. Sometimes a simple device restart clears up any app glitches, and if cards appear disabled, a quick call to your bank usually sorts things out.

For businesses looking to accept these payments, our Contactless Mobile Payment Solutions guide covers everything from setup to troubleshooting, helping you create a seamless payment experience for your customers.

Android Card Payment App Setup Checklist

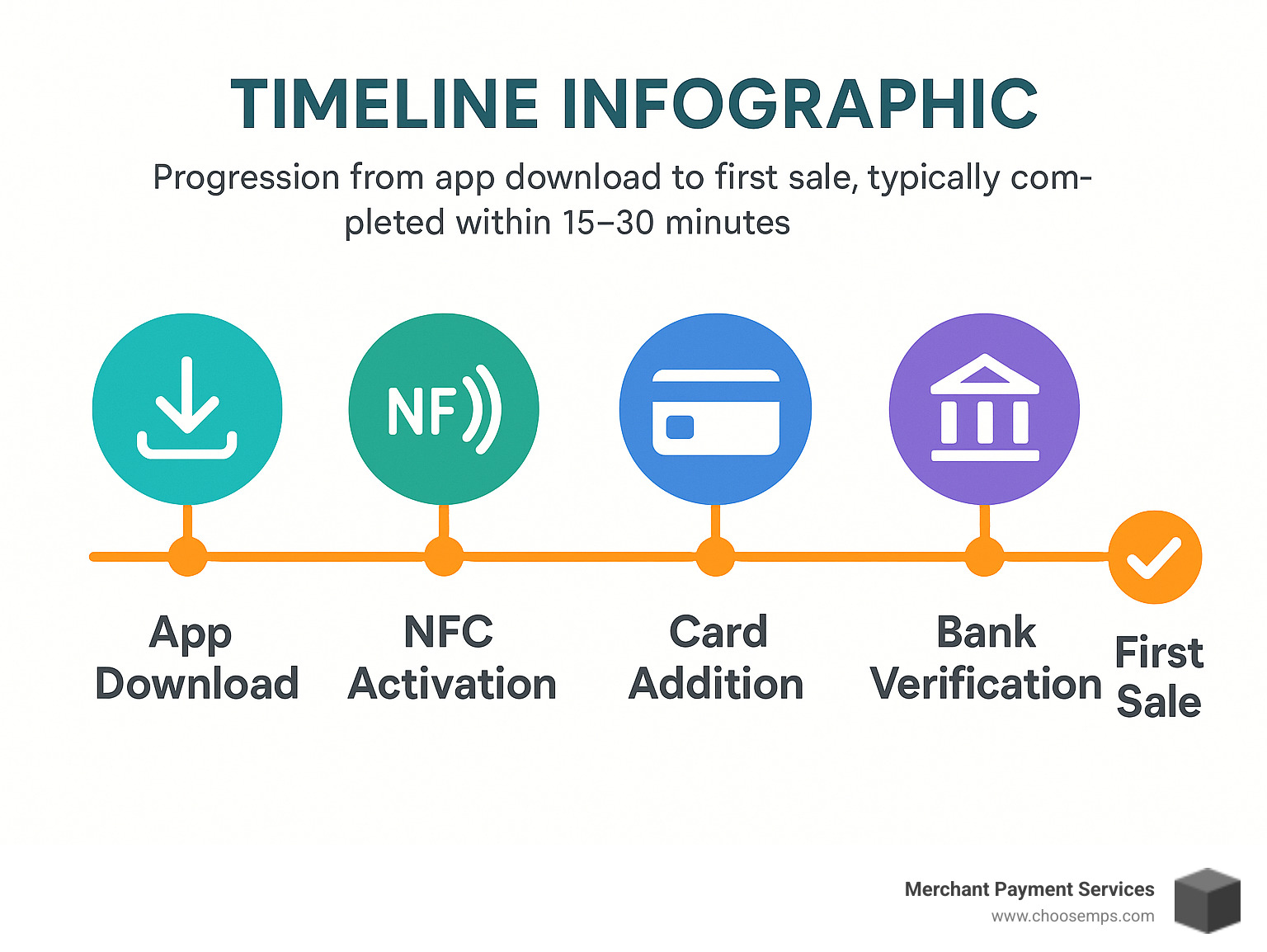

Setting up your android card payment app is surprisingly quick when you know the right steps. Most people can get everything running in under five minutes.

Turn on NFC first by navigating to Settings, then Connected devices, then Connection preferences, and finally NFC. Some Android devices organize this differently – you might find NFC settings under "Wireless & networks" in the main Settings menu. Toggle it on and you're ready for the next step.

Adding your card is where the real convenience shows up. Open your wallet app and tap "Add to Wallet," then "Payment card," then "New credit or debit card." You can use your camera to scan the card (which works surprisingly well even in mediocre lighting) or enter the details manually if you prefer. Accept your bank's terms when prompted – this is standard security protocol.

Bank verification happens next, and it's usually painless. Most cards require a quick verification through your banking app or a text message with a code. This step proves you're the legitimate cardholder and activates the card for mobile payments. Some banks handle this instantly, while others might take a few minutes.

Setting your default payment method matters more than you might think. If you're loading multiple cards, choose which one should be your go-to option. This card gets used automatically unless you manually select a different one during checkout, which saves time when you're in a hurry.

Practice a test tap before you head to the store – trust me on this one. Hold the back of your device flat against a table or counter to get comfortable with the positioning and timing. It sounds silly, but knowing exactly where your phone's NFC antenna is located prevents those awkward moments at checkout where you're waving your phone around looking for the sweet spot.

Security & Privacy Measures You Can Trust

When you're considering making the switch to an android card payment app, security worries probably top your list of concerns. I get it - trusting your phone with your financial information feels like a big leap. But here's what might surprise you: these apps actually use multiple layers of protection that often make them safer than the plastic cards sitting in your wallet right now.

Every time you make a payment, you're using two-factor authentication without even thinking about it. You need something you have (your phone) plus something you know or are (your PIN, fingerprint, or face recognition). It's like having a double-locked door - even if someone gets past the first barrier, they still can't get in.

Your payment data gets device encryption treatment both when it's stored on your phone and when it travels to payment terminals. Think of it as putting your financial information in an unbreakable code that only authorized systems can read. Even if someone somehow accessed your phone's memory, they'd find gibberish instead of useful payment details.

Lost your phone at the coffee shop? No panic needed. Remote wipe capability lets you erase all payment data through your Google account, even if your phone is turned off or the SIM card has been removed. It's like having a self-destruct button for your financial data - but only the good kind.

Zero-liability policies from major card networks and banks extend their fraud protection to mobile payments. According to research on zero-liability policies, you'll face maximum liability of $50 for credit card fraud, and many banks offer complete zero-liability protection that covers you entirely.

The fraud alerts system works like having a personal financial bodyguard. Advanced algorithms learn your spending patterns and instantly alert you when something looks fishy. Since mobile payments create detailed transaction logs with location data, spotting unusual activity becomes much easier than with physical card use.

Why an Android Card Payment App Is Often Safer Than the Physical Card

Here's where things get really interesting. Your android card payment app actually beats physical cards in the security department by a pretty wide margin.

No real PAN shared means your Primary Account Number (that 16-digit number on your card) never leaves its secure vault. Merchants only get a temporary token that's completely useless for future transactions. Meanwhile, your physical card broadcasts its real account number every single time you swipe or insert it.

Think about the security code on the back of your physical card - it's the same three digits forever. But mobile payments use a dynamic CVV that generates a brand new cryptographic code for each transaction. It's like having a security code that changes every time you use it, making stolen payment data worthless.

Even your receipts show only the last four digits of a masked account number, not your real card details. This protects you from receipt-based fraud and makes it much harder for dishonest employees to steal your information. Your physical card, on the other hand, exposes its full number during every transaction.

At Merchant Payment Services, we've seen how these security features give both businesses and customers greater peace of mind during transactions. The combination of tokenization, biometric authentication, and encrypted communication creates a security system that's genuinely more robust than traditional card payments.

Frequently Asked Questions about the Android Card Payment App Scene

When you're getting started with an android card payment app, you probably have questions about what works, what costs money, and what to do when things go wrong. Let's tackle the most common concerns we hear from both consumers and business owners.

What cards and passes can I store?

Your android card payment app is like having a super-powered wallet that can hold way more than just your credit cards. The variety might surprise you.

All your payment cards work seamlessly – credit cards, debit cards, and prepaid cards from major networks like Visa, Mastercard, and American Express. Most U.S. banks have partnerships with the major wallet apps, so setup is usually painless.

But here's where it gets interesting. You can ditch that overstuffed physical wallet entirely. Transit cards for buses, subways, and trains work in many U.S. cities. Some wallets even update your transit card balance automatically and show departure times when you're near a station.

Loyalty cards are a game-changer. Store your grocery store cards, coffee shop punch cards, and membership cards digitally. The app knows when you're near your favorite store and surfaces the right card automatically. No more digging through your wallet while the line behind you grows impatient.

Event tickets live happily in your digital wallet too. Concert tickets, sports passes, movie tickets – they all show up exactly when you need them. The app uses your location and calendar to surface tickets on event day.

Are there fees when I pay or get paid?

The fee situation depends entirely on whether you're buying something or selling something with your android card payment app.

As a consumer, you're in luck – paying with your digital wallet costs nothing extra. When you tap to pay at the grocery store or coffee shop, you pay exactly the same price as you would with a physical card. The merchant handles the processing fees behind the scenes.

For business owners, the story is different but still reasonable. If you're accepting payments through mobile apps, expect to pay somewhere between 1.6 % and 2.9 % per transaction, depending on the provider and your monthly volume.

The beauty of these mobile solutions is no monthly minimums or hidden fees. Unlike traditional merchant accounts that might require you to process a certain amount each month, mobile payment apps only charge when you actually make money. Perfect for side hustles, seasonal businesses, or anyone just starting out.

At Merchant Payment Services, we help businesses understand these fee structures and often provide better rates than standard app-based processing, especially as your business grows.

What if my payment fails at the terminal?

Don't panic when your android card payment app doesn't work at checkout. Payment failures happen, but they're usually quick fixes that get you back to paying in seconds.

Start with the basics. Check that NFC is enabled in your phone settings – some devices turn it off automatically to save battery. Then move your phone closer to the payment terminal. We're talking 1-2 inches max. The NFC range is intentionally short for security, so don't be shy about getting close.

If you have multiple cards stored, try your default payment method. Sometimes terminals are picky about which cards they accept, and switching to a different card often solves the problem instantly.

Restart your device if the app seems frozen or unresponsive. This clears temporary glitches that can mess with NFC communication. While you're at it, make sure your wallet app is updated to the latest version – outdated apps sometimes have trouble with newer payment terminals.

Most payment failures resolve with basic troubleshooting. If problems persist, contact your bank or the app's customer support team. They can verify your account settings and troubleshoot specific issues with your cards.

Conclusion

The android card payment app revolution has arrived, and it's changing how Americans pay and get paid every single day. Whether you're tired of digging through your wallet at checkout or you're a business owner watching customers walk away because you can't accept their preferred payment method, mobile payment apps offer a solution that's both neat and practical.

Future-Proof Your Payment Experience: The default Android wallet – with hundreds of millions of downloads – represents a fundamental shift in consumer behavior. When so many people choose to store their cards digitally, that's not a trend, it's the new reality. Businesses across Ohio and beyond are finding that customers increasingly expect the convenience of tap-to-pay options.

Speed That Actually Matters: There's something almost magical about completing a purchase in two seconds. No fumbling for exact change, no waiting for chip readers to process, no signing receipts. Just tap and go. For busy coffee shops in Columbus or food trucks in Cincinnati, this speed translates directly into serving more customers and reducing those frustrating lunch-hour lines.

Security You Can Actually Trust: Here's the surprising truth – your android card payment app is probably safer than the credit cards in your physical wallet. With tokenization protecting your real account numbers and biometric locks preventing unauthorized use, mobile payments have lower fraud rates than traditional card transactions. It's like having a personal bodyguard for every purchase.

Business Growth Made Simple: The most exciting part? You don't need expensive equipment or complicated setups anymore. A small business owner in Dayton can start accepting contactless payments this afternoon using nothing but their Android phone. From farmers market vendors to home repair contractors, entrepreneurs are finding new revenue opportunities simply because they can accept payments anywhere.

At Merchant Payment Services, we've watched this change unfold across countless businesses throughout Ohio. The handyman who increased his payment collection rate by 40% because customers could pay on the spot. The bakery that doubled their lunch rush efficiency by eliminating cash transactions. These aren't just statistics – they're real people whose businesses improved because they adopted mobile payment technology.

The timing couldn't be better. Mobile payment infrastructure is mature, secure, and widely accepted. Setup takes minutes, not hours. Costs are transparent, with no hidden fees or long-term contracts trapping you into outdated systems.

We understand that adopting new payment technology can feel overwhelming, especially when you're focused on running your business. That's exactly why we offer risk-free, month-to-month agreements and comprehensive support to help you integrate these solutions seamlessly into your operations. No startup fees, no hidden costs, just straightforward payment processing that works.

The android card payment app ecosystem offers something for everyone. Consumers get convenience and security. Merchants get faster transactions and happier customers. Small businesses get enterprise-level payment capabilities without enterprise-level costs.

For comprehensive guidance on implementing mobile payment solutions that fit your specific business needs, explore our detailed Mobile Payments resource center. We cover everything from choosing the right app to optimizing your mobile payment strategy for maximum results.

The future of payments isn't actually in the future – it's in your pocket right now. Your Android device is ready to replace your old wallet, streamline your purchases, and potentially transform your business. The technology works, the security is solid, and the convenience is undeniable.

The only question left is: are you ready to make the switch?